Jacksonville is wrestling with a pension crisis decades in the making. And national media and political pressure groups are taking notice.

The venerable American Spectator magazine — a bible of movement conservatism — waded into the Jacksonville public pension debate last week, throwing sharp elbows at the Northeast Florida city’s pension crisis.

The Spectator hit on Jacksonville is part of a larger series discussing how “municipalities are also being hit with unprecedented pension debt.”

“Baby boomers are retiring. Some state and local budgets allocate more funds for pensions for retirees than they use for actual services and current worker pay. Once again, the younger generation is saddled with debt from a previous profligate era,” writes the Spectator’s William Patrick.

“Jacksonville’s unfunded pension obligations have blown a hole in the city’s finances and saddled residents of Florida’s most populous city with billions of dollars in debt and no ready way to pay it,” Patrick writes, without paying any heed to August’s County Referendum 1.

The “Yes for Jacksonville” referendum authorized the extension of Jacksonville’s half-cent sales surtax and dedicate it to funding the $2.8 billion unfunded pension liability, contingent on negotiated pension reform after collective bargaining with the city’s unions.

The Spectator article doesn’t discuss this, however. Instead, it savages the city for a lack of “accurate and transparent accounting data,” claiming “the city doesn’t have enough money to pay its bills”, that “the city is still hiding about $90 million in unfunded retiree health care benefits,” and that the city has a “debt burden … estimated at $6,100 per city taxpayer.”

“According to Jacksonville’s comprehensive annual financial statements, the city has $14 billion in assets. However, more than two-thirds are capital assets, such as roads, buildings, and land, leaving only $3.5 billion available to pay $5 billion in total obligations,” claims the Spectator.

“The 1.6 billion shortfall represents compensation and other costs incurred in prior years that should have been paid in those years. Instead these costs have been shifted to future taxpayers,” a report the Spectator cited from Truth in Accounting asserted.

Truth in Accounting CEO Sheryl Weinberg was unsparing in her critique of Jacksonville.

“If Mayor Lenny Curry and his administration want to address the city’s financial situation, the first thing they should do is publish accurate and transparent accounting data. The citizens of Jacksonville deserve an honest report on the city’s finances,” she said.

Ironically, this is something the Curry administration has sought to provide.

The city commissioned an audit from Ernst and Young shortly after Curry’s election; the audit pointed to the existential threat pension costs pose for the city.

“At 46 percent funded status, Jacksonville has the lowest pension funded status for the Police and Fire pension plan compared to other Florida cities included in the analysis. At 55 percent funded status, Jacksonville has the second-lowest total pension funded status for total consolidated pension plans,” the audit noted.

Without pension reform, the audit continued, Jacksonville would face long-term pressures on the stability of the city’s pension fund.

Without pension reform, the audit continued, Jacksonville would face long-term pressures on the stability of the city’s pension fund.

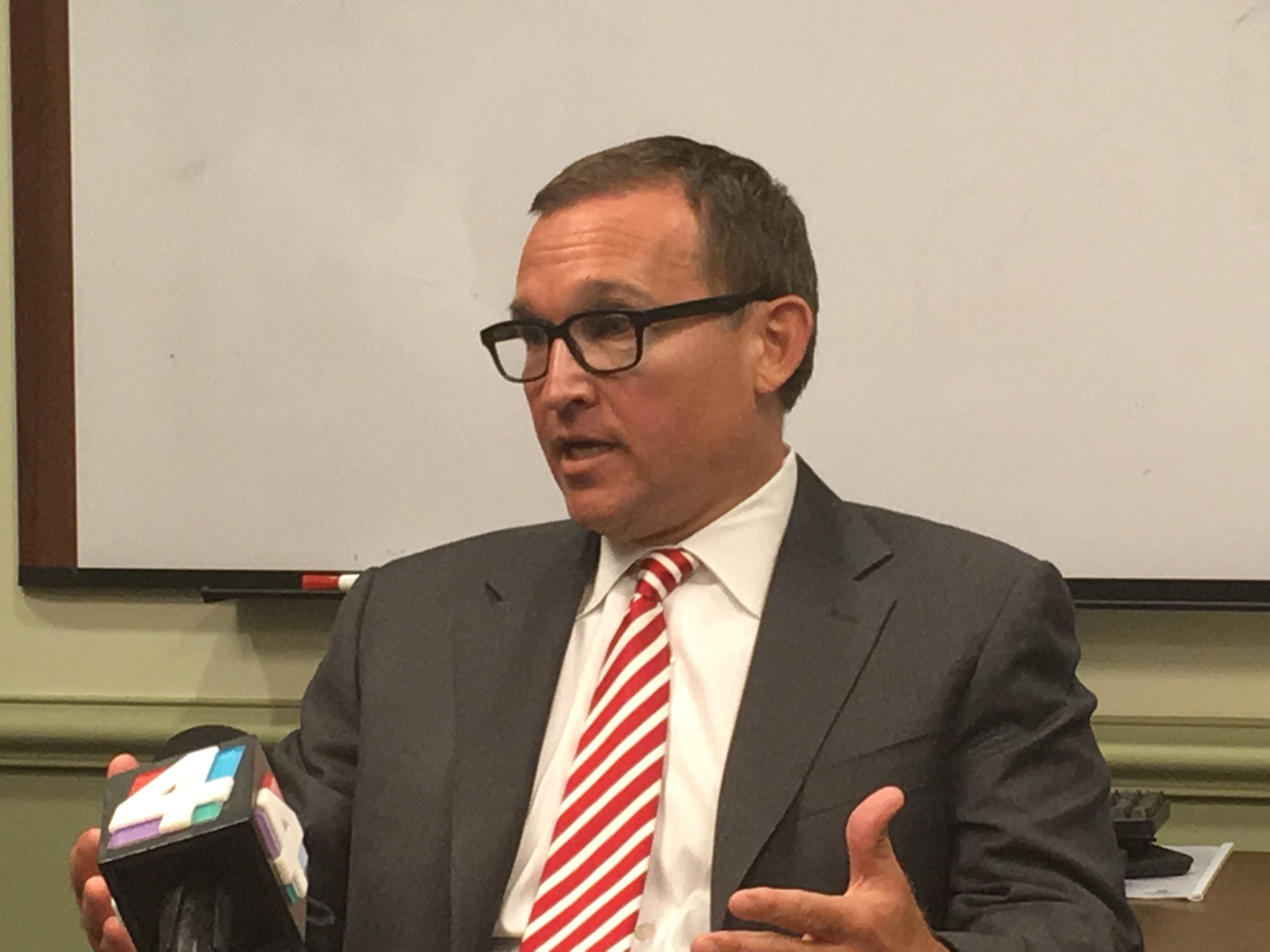

In a Monday conversation, Curry took issue with reporting from the American Spectator on this issue.

“It would appear to me they didn’t do their homework,” Curry said, noting that he’s been very vocal about the crisis created by unfunded pension liabilities for two years now, and has, with “clarity and transparency,” advanced a “solution tied to reform,” one that imposes “no additional burden” on taxpayers.

While “critics, so-called experts, and academics” pontificate, Curry is advancing “solutions grounded in principles” that he believes in.

“They wrote a story as if it’s a newsflash that Jacksonville is in a financial crisis, when I’ve been screaming at the top of my lungs that the crisis is here and must be dealt with now,” Curry added.

“We report with transparency and clarity … in accordance with [GASB] accounting rules and standards.”

Referring to the numbers used in the American Spectator report, Curry noted that they were “created and communicated” and “disclosed” by the administration … which counters the assertion from the conservative website that the city was not providing “accurate and transparent” accounting data.

The American Spectator, meanwhile, is not the only national entity taking an interest in Jacksonville’s pension negotiations.

Americans for Prosperity created a website (jaxfix.com) which allows interested parties to send form letters to members of Jacksonville’s city government, including the city council.

The website says it’s “time to fix Jacksonville” and its “broken pension system,” and includes a call to action: a form email that can be sent to elected politicians in the city.

The text exhorts site visitors to let Curry “know you appreciate him working to fix Jacksonville’s pension system problems,” and to let “the city council know that they should stand with Mayor Curry and get to work fixing the broken pension system.”

“Your city council works for you,” reads the AFP webpage, “not for Unions or special interests that are trying to keep Jacksonville broke.”

Curry said his political team has no involvement in this effort; that said, he’s “not surprised that groups would take notice” and he expects “that this will get more national attention.

Curry reiterated previous assertions that Jacksonville’s model of pension reform – which projects to be rooted in defined contribution plans for new hires, with current employee benefits guaranteed by a dedicated revenue stream after collective bargaining – could be a “model” for other cities facing similar pension issues.

One such city facing looming catastrophe: Dallas, Texas.

The New York Times reports that municipal bankruptcy may be on the horizon for Dallas, as the “city’s pension fund for its police officers and firefighters is near collapse and seeking an immense bailout.”

Risky investments and a tendency of older retirees to cash out their holdings have left Dallas seeking a $1.1 billion bailout – which does not even address the whole problem.

“As I’ve been saying for two years,” Curry added, “the crisis is here. It’s real.”

Dallas, like Jacksonville, didn’t get into its predicament instantly.

And Curry – despite the carping of the critics and their “soundbites” – is resolute in facing his city’s challenge.

“I’m facing the reality we’re in. We’re going to solve this,” Curry said.

Curry’s hope: that collective bargaining is completed in time for the next budget.

As those following Jacksonville’s situation know, renegotiated terms for new hires are a necessary prerequisite for the revenue that the ½ cent sales tax extension would allow in future decades, and – just as importantly – the guaranteed revenue source that sales tax extension provides