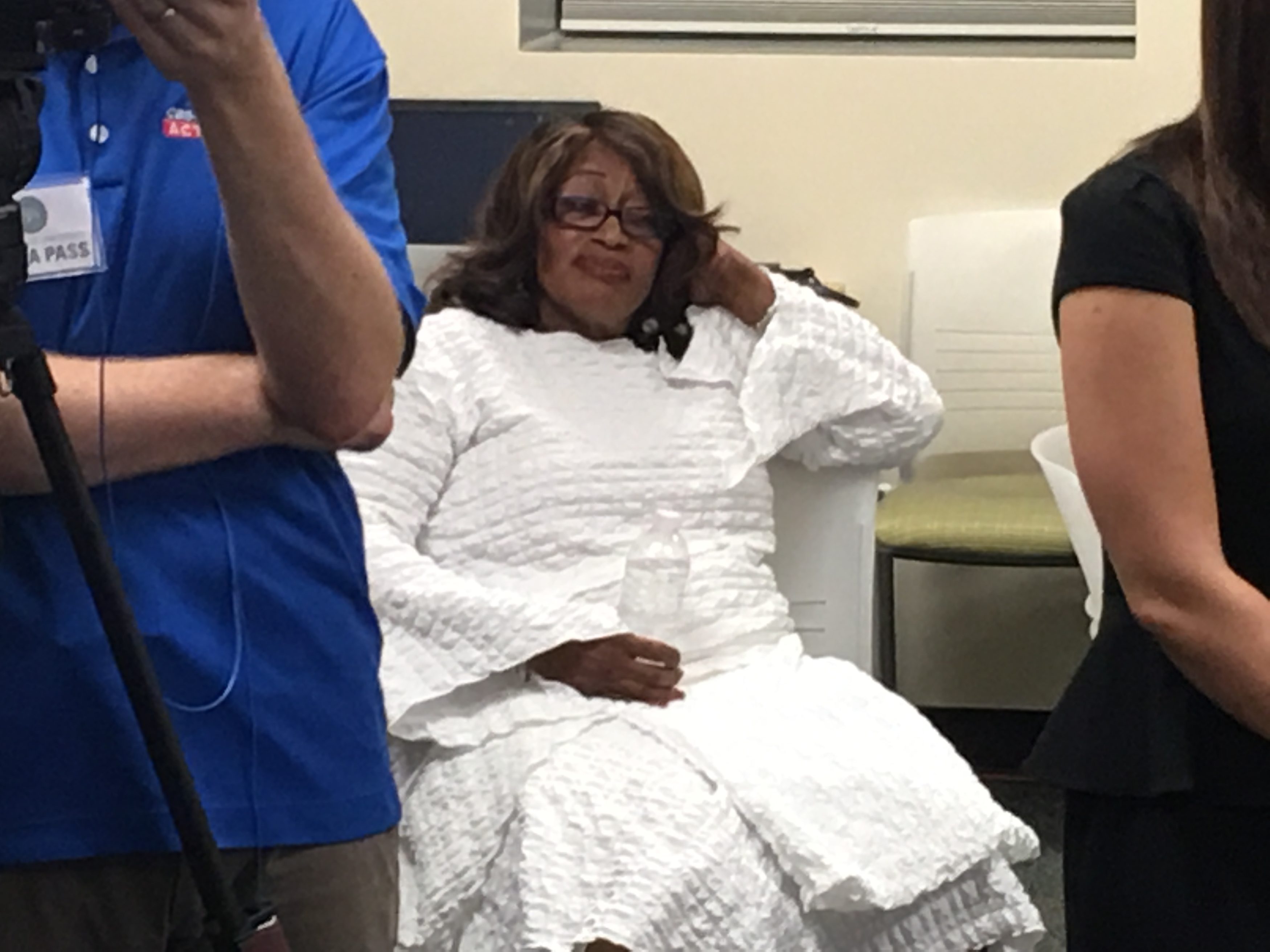

Corrine Brown recently re-affirmed motions for acquittal and for new trial, in response to federal prosecutors opposing those original motions. Her attorney wanted a chance to make oral arguments.

And he is getting that chance: Aug. 7 at 3:00 pm in Jacksonville Federal Courtroom 10-D.

Brown, found guilty on 18 counts related to wire, mail, tax, and financial disclosure fraud related to a charity that led to the unjust enrichment of her and co-conspirators, continues to vigorously maintain her innocence.

___

The motion for new trial continues with the pyrotechnics revolving around Juror 13, the juror dismissed as it was ascertained that the Holy Spirit telling him Brown was innocent interfered with his impartiality.

The juror’s removal, the memo holds, violated Brown’s Constitutional rights.

Moreover, it exposed religious bias from the court.

“The Court’s decision to dismiss the juror was based on its findings: (1) that God exists; and (2) that God is an external force. As with the juror’s statements, the Court’s findings were statements of faith. They reflected the Court’s religious beliefs.”

“In fact, the juror was not dismissed because of his religious beliefs. He was dismissed because of the Court’s

religious beliefs. He was dismissed because the Court believes that God exists, and that God is an external force. But the record does not support these beliefs,” the memo contends.

“The Court’s decision, if it is not corrected, will discourage a broad section of our population from productive jury service,” the memo warns.

____

In the memo arguing again for acquittal, the defense maintains that insufficient evidence of fraud existed, with “fraudulent intent” unproven.

As well, the defense contends, albeit unsympathetically, that there is no requirement that a charity dispense any amount of money — an interesting canard.

The defense also contends that Corrine Brown was not the “primary beneficiary” of the One Door for Education “fraud,” as she got just $37,000 out of it.

As well, Brown could not have been guilty of tax fraud: “A fair reading of the evidence show [SIC] that the Defendant’s taxes and financial disclosure forms are exactly what one would expect given the lack of attention

to detail and the last minute rushed nature of their preparation.”

In other words, contends her attorney, Brown was too sloppy with forms to commit tax fraud.

____

Brown was found guilty on 18 total counts, which sets her up potentially for a prison sentence of over 300 years, and fines and restitution in the millions of dollars.

On Count 1 — conspiracy to commit mail and wire fraud — the jury ruled that Brown was found guilty of mail and wire fraud both.

Counts 2 through 17 involved mail fraud and wire fraud. Counts 2 through 8 — mail fraud — come down to shipments of checks via FedEx; counts 9 through 17 — wire fraud — involve interstate wire transfers, emails, et al.

Counts 2 through 8 saw the aforementioned co-conspirators, her former chief-of-staff Ronnie Simmons and his one-time girlfriend and CEO of the charity, Carla Wiley, at the other end of the mail solicited from donors, with the biggest pitch being for a check upward of $28,000 from a single donor.

The jury ruled that Brown was guilty on five of the seven counts.

Counts 9 through 17 saw Simmons soliciting checks from donors on some, with some “pass-through” transactions reflected in some counts, through the Alexander Agency — the agency of former Brown part-time employee Von Alexander.

The jury ruled that Brown was guilty on seven of the nine counts.

On Count 19 — scheme to conceal material facts on Congressional financial disclosure forms — the jury ruled that Brown was guilty.

Count 20 — scheme to conceal material facts — was predicated on “underreporting income” and “bogus” charitable deductions. The jury ruled that Brown was guilty.

Counts 21 to 24: four tax counts. 21 is to “obstruct and impede the due administration of Internal Revenue laws”, with false tax returns from 2012 to 2014 constituting the final three tax counts. Brown was found guilty on all.

2 comments

victor peel

July 8, 2017 at 7:08 am

If you do the crime do the time

Bruce P

July 8, 2017 at 8:17 am

The Judge issued orders demanding written response and set a deadline of July 7. Her attorney, just prior to midnight, on the deadline sent a request asking to give oral arguments instead. This is a clear delay tactic knowing that to schedule a time before a Judge will likely take months.

This is a slap in the face to the Judge. Her attorney is being used to let the Judge know Corrine still does what she wants and still controls the situation even after being convicted of multiple crimes.

The Judge needs to put there foot down. Say her attorney had their chance to do what the court order said. And that her appeal is denied. But then all this will lead to is another attorney being brought in to file an appeal against the Judge’s latest ruling as they attempt to keep her out of prison another year or so.

Comments are closed.