Overall, automobile insurance rates have remained the same despite a rewrite of the state’s personal injury protection laws, a new report issued by the Florida Office of Insurance Regulation shows.

The 2012 PIP law did result in a “dramatic” 54 percent decrease in the number of staged accidents, though, with just 328 fraudulent insurance scams reported in in 2013.

All Florida drivers are required to carry PIP, or personal injury protection. PIP pays 80 percent of a driver’s medical bills and 60 percent of lost wages up to $10,000 regardless of who caused the accident.

Uninsured motorist and bodily injury also can be carried by Florida drivers.

The OIR report shows that for the Top 25 carriers there was a statewide average decrease of 13.6 percent in PIP rates.

Overall rates– which includes PIP and bodily injury, uninsured motorists–didn’t decrease for Florida drivers.

State Farm Mutual Auto Insurance–the largest auto writer in the state and a proponent of HB 119–has lowered its overall rates by 4.7 percent. Its PIP rates have been lowered by just 1.6 percent since the law was passed.

The Legislature passed the PIP rewrite in 2012 with changes meant to crack down on what Florida Insurance Commissioner Kevin McCarty described as the “fraudsters and hucksters” who were exploiting the no fault system by staging accidents to secure PIP benefits.

The 2012 law changed which health care providers are allowed to provide PIP benefits by banning PIP reimbursements to chiropractors and acupuncturists. It also banned treatment unless a doctors, nurse, dentist, physician assistant or advanced registered nurse practitioner found that an “emergency medical condition” exists.

The Legislature was told to expect between 14 percent and 24.6 percent in PIP rates, a consulting group that scored the impact of the law estimated, with the caveat that, at the time, PIP rates were adequate.

The new OIR report notes that PIP rates weren’t adequate in 2012 and there were “many insurers with residual rate need in PIP.”

“While there is limited data to determine the true impact of HB 119 at this time, it is safe to say that the bill significantly impacted the personal auto market and changed the trajectory of the trends that were being seen prior to the bill.”

The report was compiled from a data call sent by the Office of Insurance Regulation.Thirty five insurers responded to the call for information. Additionally, the Office of Insurance Regulation also used data contained in annual statements and information provided by Mitchell International, Inc., which processes more than 50 million transactions from 300 insurance carriers nationwide.

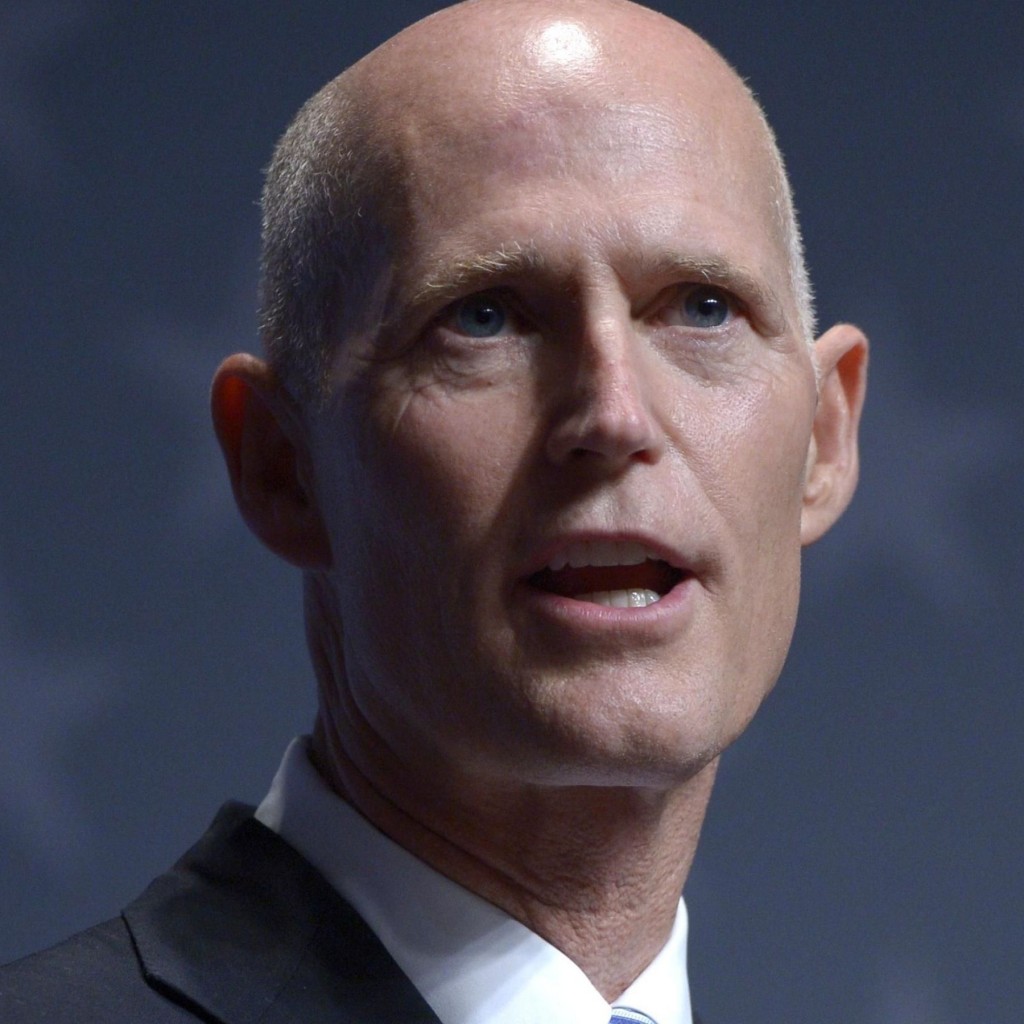

Florida Gov. Rick Scott made reforming PIP a top priority during his first legislative session mentioning it prominently in his State of the State address.

The law was challenged in in circuit court and on March 15, 2013 a temporary injunction was granted to prohibit a section of the law that precluded PIP benefits from being paid unless there was an emergency medical condition exists as well as a provision of the law that prohibits payments to massage therapists, acupuncturists, and chiropractors. The injunction was lifted by the First District Court of Appeal seven months later.

The legal challenge complicated the analysis of the law, the report notes.