By a near unanimous vote, the Senate passed legislation Wednesday to repeal Florida’s no-fault auto insurance system.

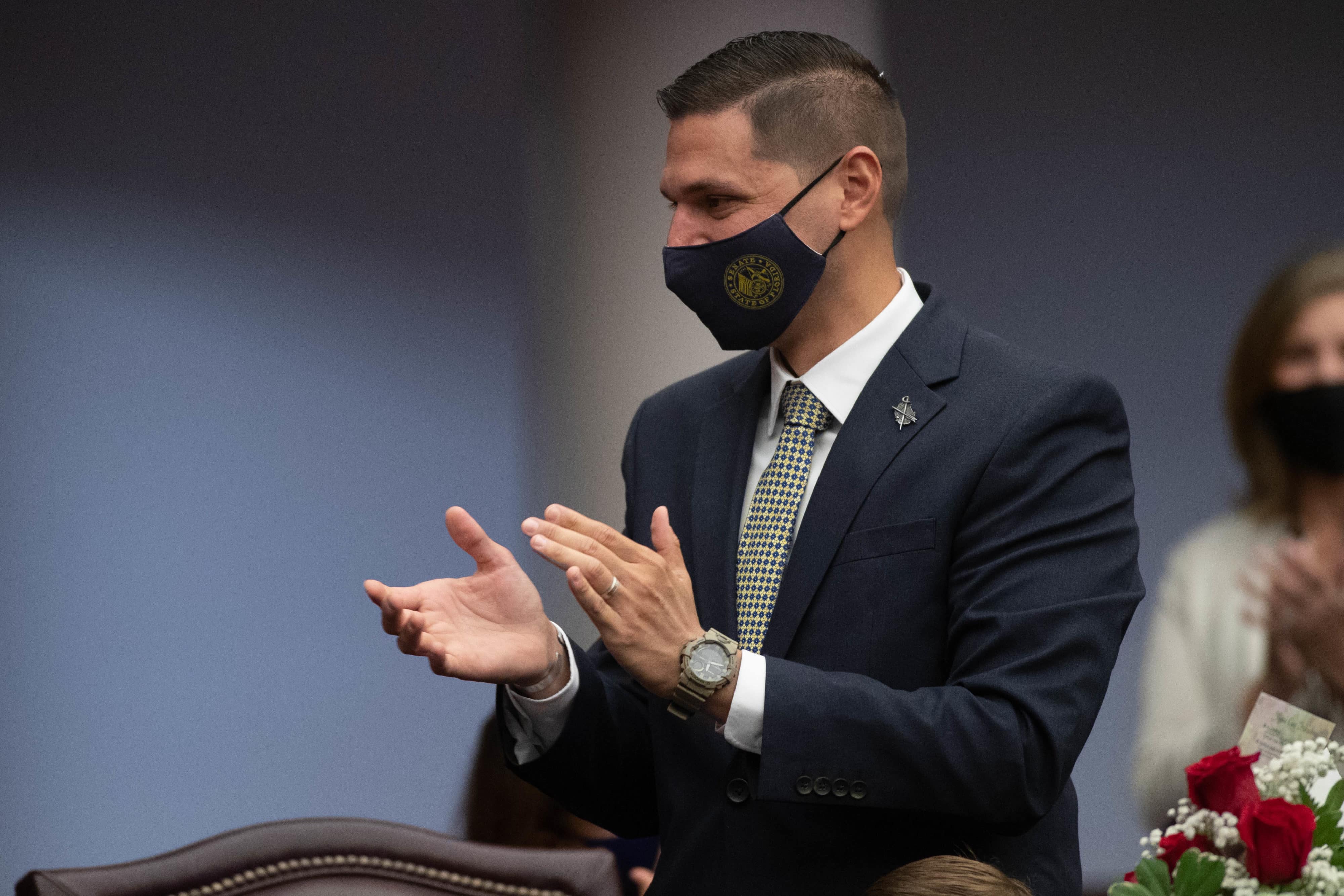

The bill (SB 54), carried by Zephyrhills Republican Sen. Danny Burgess, would end the requirement that Floridians purchase $10,000 in personal injury protection (PIP) coverage and would instead require mandatory bodily injury (MBI) coverage that would pay out up to $25,000 for a crash-related injury or death.

Those backing PIP repeal say the system is rife with fraud and that the $10,000 coverage limit, set in the 1970s, is woefully inadequate five decades later.

“The key question before us is are the current coverages sufficient, and I think we can all agree that they’re not. This bill seeks to address just that,” Burgess told senators.

PIP coverage pays out regardless of which party is responsible for an accident and it does so quickly. MBI coverage, however, doesn’t pay out until a fault determination is made, which can leave health care providers or patients on the hook for thousands of dollars in medical bills while they wait for a claim to resolve.

No-fault repeal is a perennial effort in the Legislature.

And passing the bill was not effortless. Burgess joked about the several times the bill had been postponed on the floor this month before lawmakers finally considered it Wednesday.

Senators trudged through 12 amendments, all but four of which were withdrawn. Among the approved amendments was one from Senate Democratic Leader Gary Farmer to require drivers have $5,000 in med pay coverage, which was originally optional.

Burgess acknowledged the bill has become a “Frankenstein bill” with inputs from several stakeholders to create what he called a balanced bill.

Republican Sen. Doug Broxson, a former chair of the Senate Banking and Insurance Committee, said he was concerned few Democrats didn’t raise concerns along with him. Despite warning of the bill’s “negative potential,” he ultimately voted in favor of the bill.

“We’re going to try it,” he said. “We’ve been working on this for a while. You’ve got something we can vote on.”

Sen. Jeff Brandes, another Republican, quoted a prominent Democrat in his debate ahead of his vote against the proposal.

“Nancy Pelosi famously said we have to pass the bill in order to find out what’s in it,” Brandes said. “In this case, we have to pass the bill to find out how much it costs. That’s no way for the Florida Senate to do business.”

Brandes would cast the lone nay vote when the chamber voted 38-1 to approve the proposal.

Florida has some of the highest auto insurance rates in the country, and they are rising faster than every other state except Colorado, which pins the blame on repealing its own no-fault law.

Insurers and others warn that the PIP repeal and the ensuing rate increase would only drive more Floridians to ditch their insurance, which would further raise rates for insured Floridians.

“A bodily injury requirement with no personal injury protection like SB 54 proposes would hike up the cost of insurance and only lead to more drivers hitting Florida’s roads uninsured,” said Michael Feiner, a Florida-base personal injury lawyers and founding partner of Steinger, Greene & Feiner. “If there was no personal injury protection, a claimant would not need to meet a threshold of a ‘permanent injury’ to recover non-economic damages (pain and suffering) as is required now.”

Opponents say insured Floridians would pick up the slack, if not through their auto insurance, then through their health insurance premiums or higher taxes. Brandes warned the bill could raise rates on some of the poorest Floridians by more than half.

Still, the repeal effort appears to have the support of Senate President Wilton Simpson, who noted in a statement that every state except Florida and New Hampshire have mandatory bodily injury coverage.

“For everyone’s protection, drivers must be insured at sufficient levels,” Simpson said. “PIP coverage levels are clearly insufficient. It’s the right time for Florida to move to mandatory coverage for bodily injury liability.”

Whether it has the support to make it into law is another question, as other elected officials aren’t sold, including CFO Jimmy Patronis who said early on in the Legislative Session that all indications are it would raise rates for “those that can least afford it.”

The House version (HB 719), carried by Vero Beach Republican Rep. Erin Grall, awaits a hearing in its second and final House committee after passing its first panel more than a month ago.

4 comments

Cris Boyar

April 14, 2021 at 10:34 pm

Renzo,

If this passes trial lawyers will make an EXTRA $3,333 to $4,000 on every car crash case. Plus, this will hurt Floridians without health insurance or those with large deductibles the most.

Stuart

April 14, 2021 at 10:45 pm

Doesn’t that mean the injured party would make a larger recovery or more likely, a recovery as 60% of drivers have no BI coverage? You sound a bit angry with trial lawyers or maybe just ignorant?

David Hunter

April 15, 2021 at 1:46 pm

It should be $15,000 Med-pay mandatory and $25,000 BI mandatory. $10,000 in 1970 is the equivalent of $60,000 now a days. No more 14 day rule it should be 90 days to get treatment and the EMC are a joke.

Mark

April 19, 2021 at 12:21 pm

The rates are going up in Colorado not because No Fault was repealed but because claims are going up fast. Some of this is due to the marked increase in accidents due to the legalization of marijuana.

Comments are closed.