Declining gas tax revenues and mounting adoption of hybrid and electric vehicles (EVs) are leaving Florida with fewer dollars yearly to repair its roadways and infrastructure.

Two proposals now moving through the Legislature aim to address the issue.

One measure (SB 28) by Palm Harbor Sen. Ed Hooper would impose an annual license fee of $200 for EVs, $50 for plug-in hybrids and $25 for electric motorcycles.

The legislation, which takes its fee structure from the Electric Drive Transportation Association, cleared the Senate Transportation Committee on a 6-0 vote Wednesday.

The other bill (HB 107) by Fort Myers Rep. Tiffany Esposito originally contained much of the same provisions. But she tossed it all out Thursday, with approval from the House Transportation and Modals Subcommittee, for a strike-all amendment that would instead call for a study of the economic shortfall and what should be done to fix it.

“This study will find something that is specific to Florida,” said Esposito, adding that the state’s Revenue Estimating Conference projects that by 2030 Florida will have a $65 million yearly deficit if nothing is done to address plummeting gas tax revenue.

“That kind of recurring revenue deficit is devastating,” she said.

Esposito’s amended bill, which the committee temporarily postponed in accordance with House rules, would transfer the 4.35% sales tax currently levied at commercial EV charging stations to the State Transportation Trust Fund (STTS).

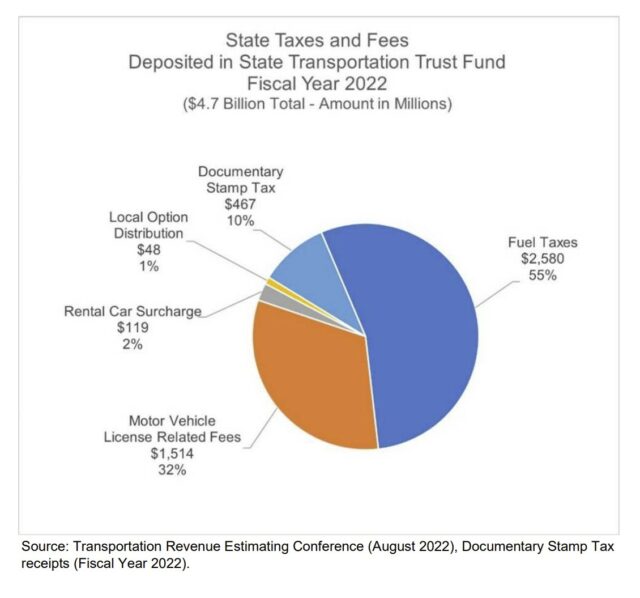

The STTS is used to maintain and develop the state highway system and other state and local transportation-related projects. The preponderance of its funding (87%) comes from fuel taxes and vehicle license fees.

The bill would also require the Office of Economic and Demographic Research to examine the impact continued EV adoption will have on the STTS and sales and gross receipt tax revenues. A report would be due Sept. 1, 2025, from which the 2026 Legislature would draw information for policy changes to address those impacts.

The departure in language of Esposito’s bill from Hooper’s followed complaints from Tesla lobbyist Jeff Sharkey and Senators from both sides of the political aisle that EV owners would be “double taxed” by having to pay an additional registration fee on top of the state’s existing fee for vehicles.

Orlando Rep. Anna Eskamani echoed that concern Thursday. Others disputed the aptness of that label, including Naples Rep. Lauren Melo, a former trucking executive who said she paid an additional $2,000 so her heavier vehicles could operate on Florida roadways.

“I don’t see this as double taxation, I see it as a burden on public dollars,” she said. “I see this as a form of welfare, because (EVs) are using roads and (their drivers are) not paying for them.”

Pensacola Rep. Alex Andrade agreed. He pointed to a “big distinction” between EVs and traditional vehicles that use internal combustion engines: their weight.

Traditional sedans, he said, “weigh about 30% less than an electric vehicle, and when you get into something like a Cybertruck or an EV Hummer, you’re talking about two to two and a half times heavier than their (traditional) equivalents,” he said. “That’s significantly more damage on our roads.”

Thirty-three states have imposed supplement registration fees for EVs, typically in addition to traditional motor vehicle registration fees, a House staff analysis found. The fees range from $49 for hybrids in Iowa to $225 for EVs in Washington.

Florida has no EV- or hybrid-specific registration fee to replace the roughly $283 in motor fuel taxes the typical Florida driver pays yearly into the STTS. The state also does not have any policy in place to compensate for the revenues lost due to an estimated 85% of EV charging happening at home rather than at commercial charging stations.

There’s also a federal incentive to switch to electric. In 2009, the Barack Obama administration created an EV credit that today provides buyers of new plug-in or fuel cell vehicles with an up to $7,500 tax break.

Floridians are second only to Californians in EV adoption, according to the U.S. Department of Energy. By the end of 2022, EVs had a roughly 2.6% market share in the state representing some 167,990 registered vehicles. That’s due in part to Florida’s adoption of an EV Infrastructure Master Plan, which has helped drivers overcome range anxiety.

Public testimony for Esposito’s amended bill was overwhelmingly positive. Supporters included the Florida Automobile Dealers Association, Florida Association of Counties and Sierra Club Florida.

Sharkey said he opposed the original bill but is in favor of its updated version, which he described as taking a more holistic approach to the issue.

The $200 flat fee would have been arbitrary, he said, but the amended bill provides “a fair and responsible way to move forward.”

One comment

rick whitaker

December 7, 2023 at 2:40 pm

a state income tax is the best answer. taxing income over $200,000 a year would bring in lots of money from those most able to pay. working class people are already overburdened. come on florida, try fairness.

Comments are closed.