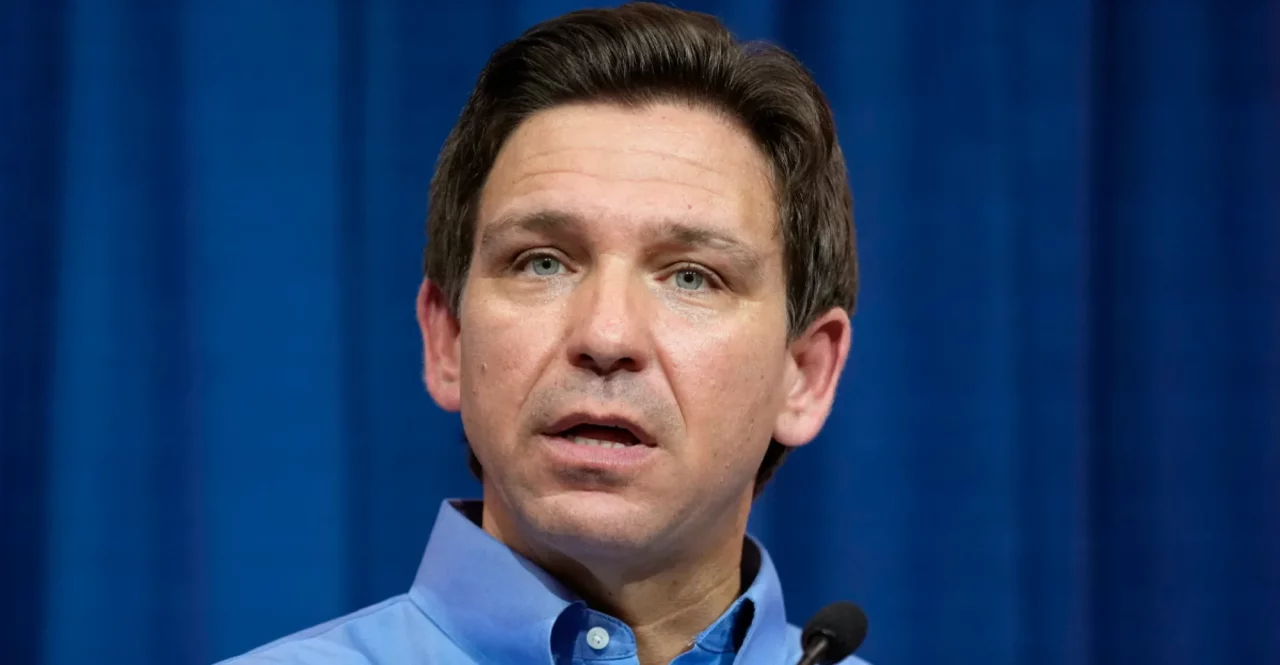

Gov. Ron DeSantis has signed legislation giving bank customers who believe they’ve been discriminated against based on their political affiliations a way to file complaints against the financial institution.

The measure (HB 989) also includes several provisions important to Chief Financial Officer Jimmy Patronis and his Department of Financial Services.

But DeSantis said cracking down on discrimination by banks against customers for political viewpoints was critically important.

He pointed to Moms for Liberty, the nationwide advocacy group behind removing many LGBTQ-themed books from schools, which saw their PayPal account frozen for a brief period in 2022. DeSantis also mentioned the National Committee for Religious Freedom, an advocacy group, which had their account frozen by Chase Bank in 2022. Chase denied it was discriminating against the conservative group.

Florida banned the practice of “debanking” customers over political viewpoints last year, but no complaint process was set up to follow through on an alleged violation. The bill establishes a way to file a complaint, which will trigger an investigation.

“There’s now going to be a more robust process for people who have been in this situation,” DeSantis said during a bill signing event at a Vystar Credit Union in Jacksonville. “So if you own a firearm store … and they just cut you off you have recourse here in this piece of legislation.”

“They want to be able to use their commanding position in our society to twist it in the direction they want to do,” DeSantis added.

Vystar, which is headquartered in Jacksonville, could stand to gain from another provision in the bill allowing credit unions to accept deposits from state and local governments. Current law prevents credit unions from accepting public deposits, which go instead to banks.

“It didn’t really make sense why you wouldn’t really want more options?” DeSantis said. “This bill ends that artificial barrier.”

The issue was heavily debated and lobbied during the Regular Session. Banks opposed the measure, arguing that the nonprofit status of credit unions allows them to be taxed at much lower rates than the for-profit banks, giving them an unfair advantage.

The original standalone bill advanced in the House (HB 611) but the Senate version (SB 1018) wasn’t heard in that chamber. Instead, the measure was slipped into HB 989, a larger financial bill, on the second-to-last day of the Regular Session.

“Options and competition are always good,” said Vystar President and CEO Brian Wolfburg. “The price of this closed market and less competition has been borne by individuals, families and small businesses in our state.”

9 comments

Tom

May 2, 2024 at 1:22 pm

There is a lot of “they” out there I guess. No idea who “they” actually are but “they’re” everywhere apparently. This place gets dumber by the day.

Dont Say FLA

May 2, 2024 at 1:48 pm

“They” are coming for out children. To debank them! LOL I guess “they” finally got tired of grooming our children.

JD

May 2, 2024 at 1:36 pm

How is it “They” get to have it both ways? They don’t have to make the gay wedding cakes, but they can complain about someone not wanting to do business with them?

And like the Book Banning process didn’t have a way to vet the books, this doesn’t a way to vet the complaints (or file the complaints). More knee jerk culture war BS.

F@ck that. You cannot have it both ways and this will get challenged at taxpayer expense.

“It’s not the heat, it’s the stupidity” – of the FL Republicans. I pine for Jeb Bush and the supposed RINOs (i.e. true conservative Republicans).

Dont Say FLA

May 2, 2024 at 1:46 pm

“Let the market sort them out” is not anything today’s G0P ever says.

And whenever folks make claims about “them,” there is no “them.” There is only a whiner whining.

But since it was Rhonda opening their Kermit the Frog mouth, we already knew whatever was coming out would be a whiny whiner whining.

And what might the result of this whining? More businesses deciding Florida’s not worth the trouble imposed by the G0P run state government getting all up in their business.

Is everyone enjoying the formerly deprecated WWW versions of ordering delivery now that delivery apps don’t do Florida?

rick whitaker

May 2, 2024 at 2:50 pm

DSF, desantis has turned florida into a place you DON’T want to do. the market, is soon to follow. good luck if you can’t move for some reason.

Ron Forrest Ron

May 2, 2024 at 1:55 pm

Gov DeSantis to commence with boating about murdering his goldfish when he was twelve years old in 3….. 2……. ……. 1!

And his parents told him that was a very naughty fish that deserved the death penalty and that he was very good boy for administering the death penalty to his Fish Named Rhonda.

Confederacy of Dunces

May 2, 2024 at 4:16 pm

This is utter nonsense. All the bankers out there, why don’t you explain to the governor how regulations work on lending institutions, and how banks and credit unions MUST comply with national AND INTERNATIONAL risk criteria standards set forth by U.S. Treasury, FinCEN, OFAC, DOJ, PATRIOT ACT, BSA/AML, the UN, the EU, FATF, etc. etc. There is so much risk management and compliance required. Lending institutions do NOT seek to debank anyone. That’s um, not their business model. They are forced to when, if they don’t, they can lose their charters, face fines and individual criminal charges, violate sanctions regimes, etc. They are hog-tied between being required to uphold community lending standards and heavily audited to ensure that is happening and can face criminal investigations by CFPB and the DOJ if it is determined they are coming up short in that regard. And on the other hand entirely responsible for the risk they take on and maintaining full compliance with a byzantine network of laws, regulations, etc.

Long story short – will someone please explain to the effing governor and this effing legislature how things actually work in the real world.

Biscuit

May 2, 2024 at 4:43 pm

“So if you own a firearm store … and they just cut you off…”

Gosh, who knew gun stores were being picked on by banks? How do the 2,847 gun stores in Florida squeak by, I wonder.

And it sure looks like a Florida Problem in need of a Florida Solution, because according to Everytown Research and Policy, “The US has nearly 78,000 licensed gun dealers, more than all post offices in the United States, and more than the number of McDonald’s, Burger King, Subway, and Wendy’s locations combined.”

Sounds like we’ve fallen behind the rest of the country. Good thing we have a Florida Man like Governor DeSantis to pinpoint this Florida Problem and take aim at it.

Arf.

What happen to americanism

May 3, 2024 at 10:24 am

It says bring me your tired and weary. It does not say bring in the one that spts on you.

Breaking the chains not putting them back on and not using that for fake employments.

Comments are closed.