If Congress passes a major tax package, one oversight group says Florida’s wealthiest lawmakers will reap personal financial rewards. But thousands of their constituents will lose health care benefits.

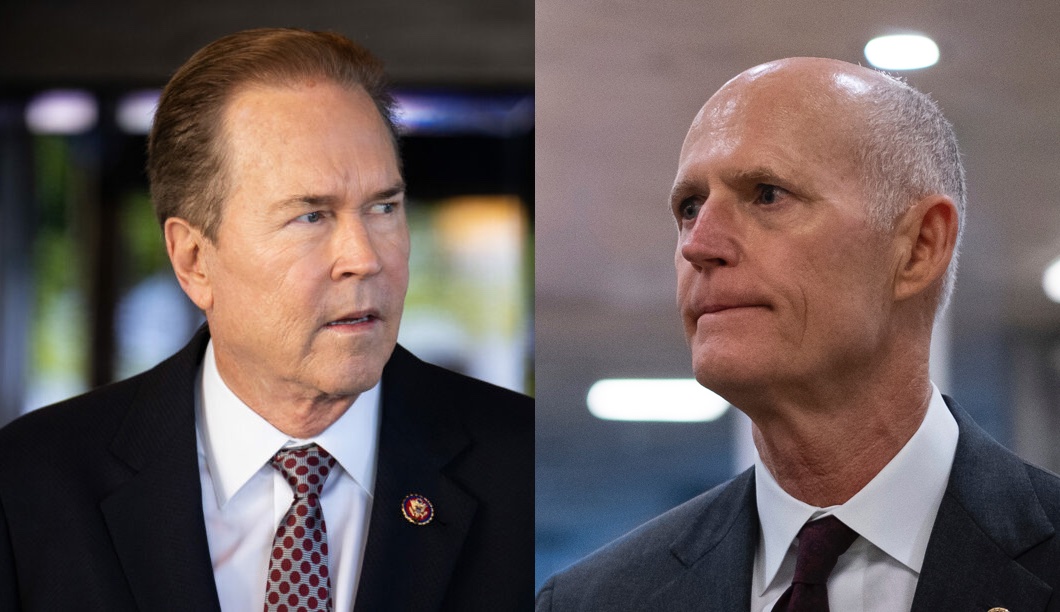

Research released by Accountable.US, a corporate and government watchdog, says the richest Republicans in Congress have a huge personal stake in passing the “One Big Beautiful Bill,” which makes tax cuts enacted in President Donald Trump’s first term permanent. That includes U.S. Sen. Rick Scott and U.S. Rep. Vern Buchanan, the wealthiest Republicans, respectively, in the Senate and House.

“The richest Republicans in Congress are happy to raise costs for millions of their own constituents and jeopardize healthcare for millions more, while they get a tax cut for themselves,” said Accountable.US Executive Director Tony Carrk.

“The Trump tax scam is a grift for the ultra-rich, including those who are in charge of passing this legislation themselves, and a betrayal to hardworking Americans everywhere.”

Scott, whose net worth sits at $551.7 million according to financial closures as of May, sits on the Senate Budget Committee, which is expected to consider the tax bill in coming days and produce a final package for the floor. If the tax cut package passes as written, it will permanently set a cap on tax exemptions for gifts and estate taxes at $15 million. He could also benefit from cuts to corporate taxes on businesses in which he holds substantial stake.

His worth includes $128.7 million in private investment funds, $72.2 million in government securities, $54.5 million in investment and hedge funds, $40.5 million in residential real estate and $37.7 million in other personal property.

But the tax cuts come with substantial reductions in spending on Medicaid. Throughout Florida, Accountable.US said cuts could impact 2.97 million constituents relying on the Supplemental Nutrition Assistance Program (SNAP) and 3.57 million individuals on Medicaid. Additionally, spending cuts associated with the bill could impact more than 1.15 million federal loans and grants in the state.

“Senator Rick Scott — worth over $550 million — is expected to vote in favor of the most severe Medicaid cuts in history,” Carrk said. “If the Republican tax scam passes as it is, Florida could see over 1.3 million people lose their insurance, including nearly 600,000 children lose insurance while Scott likely enjoys a huge tax break.”

Similarly, Buchanan, a Longboat Key Republican worth an estimated $249.4 million, would see significant benefits as well. The research shows he holds $60.5 million in ownership interest and $79.3 million in real property. The group also said Buchanan reported $14.3 million in exchange-traded funds and another $4 million in mutual funds. He serves as Vice Chair of the House Ways & Means Committee.

Meanwhile, Florida’s 16th Congressional District is home to about 79,000 SNAP recipients and more than 118,000 constituents on Medicaid, while almost 5,900 federal loans and grants to the districts could be impacted by the tax package.

Buchanan, for his part, supported the legislation when it passed in the House, and said the cuts would boost the U.S. economy.

“The ‘One Big, Beautiful Bill’ cuts taxes for all Americans, including working-class families and seniors. Our bill makes permanent lower tax brackets, the doubled standard deduction and the doubled child tax credit, which will increase take-home pay for the average American family by several thousand dollars,” he said.

“We’re also cutting federal income taxes on tips, which will help our 193,000 waiters and waitresses in Florida make ends meet. What’s more, we’re protecting Medicaid benefits for the most vulnerable populations who need them most: the elderly, pregnant women, disabled Americans and needy children. This is a pro-growth, pro-family, America-first bill.”

Scott did not respond to a request for comment on the Accountable.US research, but he penned a Washington Examiner op-ed stating his support for passing the bill while calling for even more spending reductions.

“We must spend more wisely, stop robbing red states to pay blue states, ensure programs like Medicaid serve their intended purpose, extend the Trump tax cuts, roll back the economy-killing Green New Scam, balance the budget, and spur innovation and economic growth to pay down the debt,” he wrote. “We just need to roll up our sleeves and get to work delivering on the president’s promises and our mandate from the public.”

Accountable.US calculated impacts on every district in the country, and also identified the net worth of federal representatives in Congress. The group found a significant number of Congress’ wealthiest members represent the Sunshine State. Buchanan is one of four Florida delegation members who are among the 25 wealthiest Republicans in the House, according to the group.

Other rich members include U.S. Rep. Scott Franklin, with the 12th-highest net worth in the GOP caucus. The report shows the Lakeland Republican is worth $25.8 million and represents 152,000 SNAP recipients and 183,000 Medicaid subscribers. And 28,500 loans and grants reach his district.

Not far behind in wealth is U.S. Rep. Cory Mills, at a $24.2 million net worth. More than 117,000 of the New Smyrna Beach Republican’s constituents rely on Medicaid and 96,000 use SNAP, while his district saw more than 14,000 grants and loans land there.

And U.S. Rep. María Elvira Salazar, a Coral Springs Republican, just made the list of the 25 wealthiest House Republicans with a net worth of almost $18.9 million. Her South Florida district serves as home to 158,000 SNAP recipients, 118,500 Medicaid subscribers and recipients of more than 102,500 federal loans and grants.

Of note, both Mills and Salazar are top targets for House Democrats this year. Accountable.US officials stressed that the report didn’t spotlight members based on political vulnerability, but rather on how much in personal benefits could be reaped and how many constituents will be detrimentally impacted by the tax bill’s passage.

3 comments

Dan Caine

June 27, 2025 at 7:07 am

Can I get the same investment advice that Nancy Pelosi receives?

Michael K

June 27, 2025 at 7:13 am

Yet another new name, but same old schtick!

Michael K

June 27, 2025 at 7:12 am

Of course they will.

Comments are closed.