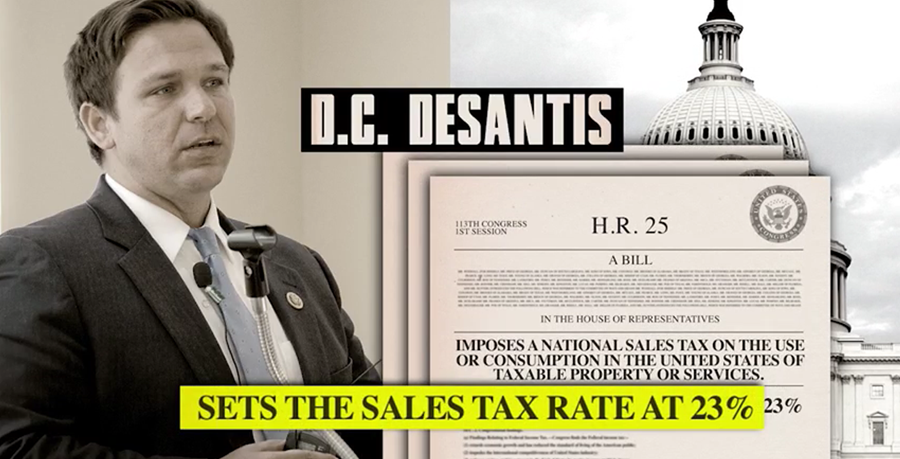

On three separate occasions, U.S. Rep. and GOP candidate for Florida Governor Ron DeSantis co-sponsored Fair Tax legislation.

The bill, a favorite in some conservative circles (even as National Review-types such as Rich Lowry and Ramesh Ponnuru diverge), would overhaul federal taxation as we know it “by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national sales tax to be administered primarily by the States.”

On Tuesday, Florida Grown (a political committee supportive of the gubernatorial campaign of Agriculture Commissioner Adam Putnam) spotlighted in television and radio spots the national sales tax proposal as leading to “skyrocketing costs” for Florida families.

“What would a 23 percent sales tax do to Florida’s economy? If Congressman DeSantis had his way, everything would cost 23 percent more — groceries, gas, home purchases,” the narrator says in the 30-second ad, which appears on cable and broadcast beginning Wednesday.

“Congressman DeSantis sponsored legislation to increase sales taxes by 23 percent, hurting families, destroying jobs, devastating tourism. Washington is full of bad ideas and phony politicians. Ron DeSantis and his huge tax increase fit right in,” the narrator adds.

In making the anti-Fair Tax case, Putnam is seemingly advocating for the current model of taxation on the federal level.

He’s not alone in opposing the proposal: left-leaning PolitiFact, in 2015, said the proposal was regressive, eliminating a graduated income tax in favor of a regressive, consumption-based tax.

The same PolitiFact write-up notes that for the tax to be revenue neutral, the rate may have to be well above 23 percent.

As a candidate in 2012, DeSantis outlined his philosophy regarding the burdens of taxation to the Palm Coast Observer.

“Americans are overtaxed. If you look at somebody who earns a relatively decent income, in Florida at least we don’t have income tax, but like in California you’re making $80,000 in a two-income family, you’re getting hit federally with the 15.4% FICA. Then you’re getting federal income tax and you’re getting state income tax, then you’re paying property taxes, you’re paying gas taxes, paying sales taxes — everything we do is being taxed. I just think we need to draw the line and say OK, we’ve taxed enough, let’s have government live within its means rather than asking us to pay more and more.”

DeSantis was slow to co-sponsor the bill for the third time in 2017 but did after an inquiry from the chairman of the group dedicated to passing the measure.

Campaign manager Brad Herold notes that DeSantis still supports the bill, saying “he’s co-sponsored it three times.”

When asked why Putnam would go on the attack on this point, Herold posited: “Putnam is facing the reality of having to finally get a job outside of politics, and he’ll say just about anything to avoid that. Including attacking Ron for supporting the FairTax.”

Herold, in what has to be considered foreshadowing of the president’s stump speech next week in Tampa, notes that “when President Trump endorsed us, he said Ron is ‘big on cutting taxes.'”

On behalf of the Putnam campaign, spox Meredith Beatrice asserted late Monday evening the candidate has real concerns about the Fair Tax.

“Conservatives have railed against this tax and explained how it would result in higher taxes for the middle class. This policy is particularly bad for Florida considering that retirees, who paid taxes on their wages during their working lives, would find themselves having to also pay higher taxes on everything they used their accumulated savings to buy,” Beatrice said.

75 comments

Stephen Eldridge

July 24, 2018 at 6:55 pm

Rep. DeSantis is very wrong for Co-Sponsoring the FAIRtax (H.R. 25), because it is a Progressive financial scam.

It is NOT favored by Conservatives, at least those who understand how it really works.

Mr. Putnam understates just one of the FAIRtax’s many fatal flaws. Prices would rise by 30% (i.e., not the lower 23% noted in this article). The error results from the fact that the FAIRtax deceptively calculates that 23% rate by dividing the tax by the total charge INCLUDING the FAIRtax (A $100 pre-tax price requires a $30 tax, total $130; $30 tax is “only” 23% of $130, but is 30% the way we all understand sales taxes.

Mason Day

July 25, 2018 at 9:27 am

Stephen Eldridge Your Comment on the 23% vs 30% has Been Debunked Multiple Times. You Obviously Don’t Understand Inclusive Vs Exclusive. Your Calling it a Progressive Financial Scam Shows You Are Clueless. The Current Income Tax Plan Was Passed By Progressives in the 1900’s. I am a Conservative and Have Been on Board With it Since 2006. You’re Batting 1000 All Wrong!!!!!!!!

Stephen Eldridge

July 25, 2018 at 1:53 pm

To Mason Day:

“Debunked multiple times”, by whom? when? where” and especially how?

So that readers can see through your (and the FAIRtax’s) deceptive propaganda, are you denying that if the cost of an item (BEFORE adding FAIRtax) is $100, then you would add $30 (NOT $23) in FAIRtax and the total cost is $130. Please answer “yes” or “no.”

Readers: We have embarrassed the AFFT into admitting that you must add $30, but they now do a song-and-dance trying to confuse people into thinking

that it “compares” to a 23% INCOME tax, but the FAIRtax is NOT an INCOME tax, its a SALES tax as we know it, i.e., a 30% (not 23%) SALES tax.

How in the world does the fact that the original (and current) income tax was progressive serve to prove that the FAIRtax is NOT progressive? Your “logic” appears to me to be non-existent.

Your comments exhibit cognitive dissonance.

If you are a Conservative, then why are you not outraged by the fact that FAIRtax readily admits (advertises) that it is MORE Progressive (more welfare) – see http://sceldridge.wixsite.com/sceldridge%23!fairtaxs-progressive-socialist-heart/c1hzm

If you are a Conservative, then why are you not outraged by the fact that the FAIRtax’s Prebate makes the FAIRtax VERY progressive. see below.

Of prime importance, the Prebate is not a real refund of FT paid, as it appears to be. It is a $600B NEW ENTITLEMENT, with all Americans receiving a big monthly federal check – a very bad idea for those of us who are not Socialists. It is financially and politically unwise to create yet another huge entitlement that will only increase in the future.

FT (Prebate) has the poor pay for no part of the fed budget, pay nothing for their personal SS/Medicare benefits, AND give them a big tax welfare check. FT (Prebate) extends tax welfare to the non-working poor – and also takes the next Progressive Cloward-Piven step towards giving SS/Medicare to all regardless of work, by removing the tax cost of reporting SS Wages, which “invites” fraud in reporting them (as also noted by other authors).

The Prebate is calculated to merely repay the poor for any FT they pay (as if we all agree with that), but it would actually pay them far MORE by “assuming” the poor spend more than the underlying HHS Poverty Guidelines and that they will pay FT on all of their purchases (but they WON’T) – see http://sceldridge.wixsite.com/sceldridge#!ft-increases-tax-welfare/copu

Chuck

July 30, 2018 at 3:30 pm

The Fairtax eliminates 22% hidden federal taxes in ANY retail item purchased. and supplants that 22% with a 23% federal sales tax. You can twist and turn and dance around the numbers, but 23% IS the tax and if you’re interested in abolishing the IRS and saving our country a few hundred BILLION dollars being spent on the federal tax agency, then and only then will you be on the right track.

Stephen Eldridge

July 30, 2018 at 6:26 pm

Chuck,

I have trouble dealing with a mind like yours.

I have explained here, and hundreds of times to you FAIRtax zombies. AND AFFT DOES NOT DISAGREE withthe own bill H.R. 25, which deceptively portrays is rate as 23%, but of a figure that only an alien might use. We Americans calculate SALES tax rates by dividing the sales tax by the price BEFORE the sales tax. FL thus has a 6% sales tax, NOT a 5.66% sales tax. You saying “23% is the rate and that’s it” is moronic. Its 23% OF WHAT – of your ridiculous gross amount INCLUDING the sales tax.

Not less tha 3 times did I post in this discussion a full explanation of the fraud that you people perpetrate with that 22% down and 23% up comes out even, NONSENSE – I think that you are in denial and refuse to try to comprehend that (maybe you just don’t have the skills to grasp it). Even the AFFT has officially come off their original lie (-22%+23%), but they are still lying – it’s almost 30% UP!

How thick can you bde. I have explained innumerable times that the FAIRtax has its own IRS (i.e., the STAA, which may audit you rather intrusively). AND the old IRS would surely come back to life with a NEW Income Tax that is assured by HUGE tax tax shortfall from (illegal) evasion) and (legal) avoidance of the FAIRtax, which its “economists” laughably “assume” would be ZERO.

Readers: These FAIRtax zombies cannot allow themselves to read the truth. I have written these points over and over agin many titme before and even in this discussion, but the can’t or won’t read it. They are either in denial or simply too ignorant and unable to grasp the necessary concepts and understanding.

Stephen Eldridge

July 30, 2018 at 9:08 pm

Readers,

Chuck is a perfect example of the FAIRtax target audience.

No matter how many times you explain in detail the truth to them, all they can do is regurgitate FAIRtax propaganda talking points. That is why I call them “zombies.”

Can you imagine issuing a formal proclamation, “but 23% IS the tax “, after I explained over and over again that a $100 Pre-FT price results in a $30 (not $23) FT, total $130. I find that to be astounding.

The FAIRtax targets such ignorant, closed-minded, superficial people who are easily swayed by years of false propagada. They cannot think for themselves, cannot reason nor analyze – people who will automatically spew out the propaganda that they have swallowed.

Mason F Day

July 25, 2018 at 9:36 am

Wow Stephen Eldridge I Remember Now. Neal Boortz Attempted to Educate You regarding Inclusive and Exclusive But, You Never Did Understand or Just wanted to Argue !!!!!!!!!!!!!!!!

Stephen Eldridge

July 25, 2018 at 12:38 pm

Mason,

I read Boortz first book and found it to be a giant load of nonsense and hot air.

I guess you consider Boortz’s tax expertise (ZERO) to be superior to my lifetime of education and professional experience as a tax lawyer CPA and my hundreds of hours of alanyses of the FAIRtax.

I feel sorry for you and wish you well.

Readers: The FAIRtax targets this level of ignorance and gullibity.

Stephen Eldridge

July 25, 2018 at 12:40 pm

Readers;

Please note that Mason offfers no substantive reply to my substantive criticisms.

He offers nothing more than one of their propaganda mantras.

Mason F Day

July 26, 2018 at 4:38 pm

Stephen ….Actually I Have a Life and Have Other Things to Do … Example Stopping Adam Putnam!!!!!!!!!!!!!!Please Save Your Pity and Look in The Mirror. I’m Not a Doctor But, I Think I See a Case of FairTax Derangement Syndrome !!!!!!!!!!!!!!! Have a Nice Day !!!!!!!!!! Mason

Neal Boortz

July 26, 2018 at 5:08 pm

I have challenged Eldridge to an an open debate before whatever crowd he can assemble on the FairTax. Let’s see what he says

Stephen Eldridge

July 26, 2018 at 9:11 pm

Mr. Boortz,

As I just replied to you, I would LOVE to debate you FULLY.

Again, please contact me via my website’s Contact Me page (sceldridge.wixsite.com/sceldridge) and we can exchange contact data and set up the debate, with a truly independant moderator, or better yet no moderator – just the 2 of us.

Stephen Eldridge

July 26, 2018 at 10:21 pm

Neal Boortz,

In case you missed it, plerase see my added response to you that I am awaiting your contact.

Surely the great Neal Boortz and the AFFT can assemble a large audience for this debate.

Stephen Eldridge

July 26, 2018 at 5:51 pm

Mason Day,

From your replies, I can tell that you have virtually no relevant expertise relevant to the FAIRtax.

It appears to me that you are the perfect target audience for FAIRtax marketers – superficial and gullible.

Stephen Eldridge

July 27, 2018 at 8:33 am

Mason Day,

Neal Boortz replied to you “I have challenged Eldridge to an an open debate before whatever crowd he can assemble on the FairTax. Let’s see what he says.”

Well, this (below) is what I replied to Neal Boortz this morning, renewing my LOVE to debate him.

READERS:

Now that I have gotten some refreshing sleep, I re-read the comments from late last night and notice something I missed a nuance.

Please note carefully how the Great Blowhard, Neal Boortz LIES and tries to weasel out of his clear request to debate me.

First, please note that I have not yet received a contact from Mr. Boortz that If offered him last night ata little after 9 PM (EST).

Secondly, If you read Mr. Boortz’s challenge to ME, “Having read your postings I would find debating you to be a delight.” Mr. Boortz, a lawyer, sets NO qualifying conditions precedent to debating me.

However, in Mr. Boortz’s next reply to Mason Day (above), he adds a laughable pre-condition, “I have challenged Eldridge to an an open debate before whatever crowd he can assemble on the FairTax. Let’s see what he says.”

First, Mr. Boortz LIED to Mason Day. That is, in his challnge to ME, he did NOT add the words “to an open debate before whatever crowd HE CAN ASSEMBLE on the FairTax.”

I cannot believe that the Great Blowhard Neal Boortz is so transparent in his laughable attempt to weasel out of debating me. He is telling the world that the Great Neal Boortz, with his lifetime of broadcasting experience and connections to large FAIRtax audiences, his friendship with fellow broadcaster and FAIRtax marketer Herman Cain, cannot generate a large audience for this debate is beyond INCREDIBLE.

That all the senior AFFT officials commenting in this discussion cannot generate a huge FAIRtax audience is also beyond belief. They have always run away from debating me, because they know that they cannot defeat me on SUBSTANCE – all they can do is flail away and fling Alinsky-denigration.

The fact that Neal Boortz and the AFFT are saying that I (one old guy with a laptop) am responsible for generating a large audience, and that THEY, with their combined large following audience and media connection are afraid to do so, ALONE should tell readers that the FAIRtax “Emperors have no clothes.”

Mr. Boortz, if you have not done so before this, you have now exposed yourself to be the official the FAIRtax BUFFOON!

Stephen Eldridge

July 31, 2018 at 11:00 am

Mason F. Day,

Have you yet contacted your hero, The Great Blowhard Coward, Neal Boortz and asked him why he LIED to you by telling YOU (NOT ME) that he would debate me publicly ONLY if I could generate an audience?

Don’t you thibk that is is immensley laughable that Boortz-Cain-AFFT suposedly have a giant audience, but the chicken out from debating me unless I (one old guy with a laptop) gin up the audience.

Don’t you think is very telling that these giants would give up the opportunity to “destroy” their most persistent critic? The FAIRtax Emperors have no clothes.

It’s been several days no that the Great Blowhard Windbag, Boortz inited me to a debate, and yet the little man behind who pretends to be the all-knowing Wizard of Oz hides in his bank vault and laughs at all the fools who bought, “The Book” tht he co-authored.

Mason F Day

July 31, 2018 at 11:58 am

Stephen Eldridge No Actually I Have Not Contacted Neal Boortz. After Reading all The Comments I have Decided Just to Let it Be. My Best Revenge will Be to Enjoy My Life. Leaving You to Spit and Fizz in Your Own Bile. Have a Nice Day…

Stephen Eldridge

July 31, 2018 at 1:41 pm

Mason F. Day,

Thank you for exposing your extreme emotional illness (as a FAIRtax zombie).

Rather than acknowledge the truth of your hero, Boortz’z lie to you, you run away and hide from that truth that you cannot tolerate hueling silly insults expose uour emotional defects.

I reply here not ti hurt your feelings, but to expose to open-miknded readers the emotional illness of you FAIRtax zombies (and to remind readers about that “empty suit”, the cowardly bully Neal Boortz who ran away from his offer to debate me)?

Neal Boortz

July 26, 2018 at 5:13 pm

You’re a “tax professional”? God help your clients.

As you know, Along with John Linder I wrote The FairTax Book as well as FairTax, the truth.

I’ve debated former Asst. Treasury Secretaries and Yale Tax Law professors in forums at CUNY and testified before the Senate in Washington on this issue. Having read your postings I would find debating you to be a delight.

Let’s have at it so I can expose what is, at worst, your blatant lies or, at best, your inability to comprehend the legislation.

Randy Fischer

July 26, 2018 at 7:53 pm

Pay for view for charity. I bet it would raise a tidy sum.

Stephen Eldridge

July 26, 2018 at 9:19 pm

Randy Fischer,

What a wonderful idea!

If we could educate those who are open minded AND raise money for charity that would be great. I have not been involved in such financings, perhaps Neal Boortz might know sometghing about that.

Stephen Eldridge

July 26, 2018 at 9:07 pm

Neal Boortz,

If you are the real Neal Boortz, it is my privilege to take this opportunity to call you out as one gigantic bag of wind – a paper tiger. You may call the tax the “FAIR” tax and you may title your book “The Truth”, these are nothing more than marketing hype (and false). I read your first book and found it to be volumes of hot air. I tried to read your 2nd book, but got sick of all the hot air (but you made money).

No, I was not a Professor, I was a leading, nationally recognized expert as private sector tax practitioner in a major firm, who incidentally co-authored a 3-volume treatise in my area of tax specialty and lectured all over the world. My clients included major corporations.

I saw a tape of your interview with Yale’s Dr. Michael Graetz. You were an absolute idiot in taxation, when compared to Graetz. You were too ignorant of the depth and complexity of taxation, to comprehend that you had no business debating him – you were Dumb & Dumber while he was Albert Einstein.

I called your show one time and you avoided the truth by controlling the microphone and you just shut me off the air.

It’s very telling that you must stoop to insulting me (“God help your clients”), because you cannot defeat me on the merits.

I understand that you must bluster that I am either lying or unable to understand the legislation, but certainly you have read that I spent my entire life in the private sector practice of taxation and know very well how to read a tax statute (that’s how I came to understand some of its frauds). I don’t think that you have much tax expertise at all, or do you? In any event it is surely not remotely as much as mine, but that doesn’t seem to bother you.

Mr. Boortz, I would LOVE to engage you in civil, gentlemanly, full public debate on the FAIRtax, moderated by a truly independent party. It should allow for as much time as is necessary to fully explore the issues. I will stick to the issues and substantive arguments and will not stoop to ad hominem attacks, except possibly to counter any of yours, as I have done here.

Because you would love to do so, I hereby accept your “offer” to debate me. Why don’t you contact me on the Contact Me page on my website, sceldridge.wixsite.com/sceldridge and we can then exchange contact info and discuss specifics of our public debate. I very much look forward to a meaningful, professional public conversation with you.

Stephen Eldridge

July 26, 2018 at 9:15 pm

Neal Boortz,

It’s late and I had a long day.

I misread a word you wrote. I misread “Professiona” as “Professor.”

Mason F Day

July 26, 2018 at 10:42 pm

Neal / Stephen Perhaps we Could Set a Date in a Neutral Area. How about The Villages Florida ?????

Stephen Eldridge

July 26, 2018 at 10:17 pm

Neal Boortz,

It’s after 10 PM and I have stayed up awaiting your contacting me via the Contact Me page on my website, sceldridge.wixsite.com/sceldridge, but alas you have not done so (it has been about an hour).

Please don’t expose to readers that the great “Emperor (Neal Boortz) has no clothes.”

Readers will assume correctly that after you invited me to a debate, you are now afraid of me, a retired tax professional who in your opinion either tells blatant lies or is unable to comprehend the legislation (and you feel sory for my clients).

If you were sufficiently fearless to debate Michael Graetz, you should have no problem at all debating me.

I would publicize your backing out on your blustering offer of a debate.

I do hope to see your contact in the morning. Going to bed now.

Stephen Eldridge

July 27, 2018 at 8:29 am

READERS:

Now that I have gotten some refreshing sleep, I re-read the comments from late last night and notice something I missed a nuance.

Please note carefully how the Great Blowhard, Neal Boortz LIES and tries to weasel out of his clear request to debate me.

First, please note that I have not yet received a contact from Mr. Boortz that If offered him last night ata little after 9 PM (EST).

Secondly, If you read Mr. Boortz’s challenge to ME, “Having read your postings I would find debating you to be a delight.” Mr. Boortz, a lawyer, sets NO qualifying conditions precedent to debating me.

However, in Mr. Boortz’s next reply to Mason Day (above), he adds a laughable pre-condition, “I have challenged Eldridge to an an open debate before whatever crowd he can assemble on the FairTax. Let’s see what he says.”

First, Mr. Boortz LIED to Mason Day. That is, in his challnge to ME, he did NOT add the words “to an open debate before whatever crowd HE CAN ASSEMBLE on the FairTax.”

I cannot believe that the Great Blowhard Neal Boortz is so transparent in his laughable attempt to weasel out of debating me. He is telling the world that the Great Neal Boortz, with his lifetime of broadcasting experience and connections to large FAIRtax audiences, his friendship with fellow broadcaster and FAIRtax marketer Herman Cain, cannot generate a large audience for this debate is beyond INCREDIBLE.

That all the senior AFFT officials commenting in this discussion cannot generate a huge FAIRtax audience is also beyond belief. They have always run away from debating me, because they know that they cannot defeat me on SUBSTANCE – all they can do is flail away and fling Alinsky-denigration.

The fact that Neal Boortz and the AFFT are saying that I (one old guy with a laptop) am responsible for generating a large audience, and that THEY, with their combined large following audience and media connection are afraid to do so, ALONE should tell readers that the FAIRtax “Emperors have no clothes.”

Mr. Boortz, if you have not done so before this, you have now exposed yourself to be the official the FAIRtax BUFFOON!

I challenge you to prove me wrong by working with me to set up this debate.

Readers: Ask yourselves why wouldn’t Neal Boortz and the AFFT take this great opportunity to generate a large audience of FAIRtax fanatics AND people trying to decide (if there are any after the 20 years the FAIRtax garbage has been stinking up the halls of Congress). This would be a great opportunity for them to publicly defeat their biggest critic

Neal Boortz

August 2, 2018 at 8:55 am

Let’s re-visit my offer to debate you on the FairTax.

Since I co-wrote The FairTaxBook I’ve been involved in many conferences, debates and meetings regarding this tax plan. As I’ve previously told you, I’ve debated a former Asst. Treasury Secretary before a packed audiotorium at CUNY in NYC. I’ve debated Yale tax law professors and have testified before the United States Senate. There is one common thread that existed through all these debates and more. The people I was debating did not refer to FairTax supporters as “Zombies” or other pejorative terms. They were polite and presented their side of the issue in reasonable terms.

You, on the other hand, have been irresponsibly aggressive and insulting and have presented your points in plebeian, inaccurate, incomplete and often childish terms. The people who designed the FairTax spent over $22 million developing their tax plan. I would imagine that you have spent less than $25 doing research for your opposition views.

To put it bluntly, the arguments, insults and positions you bring to this issue make it plain that you are incapable of a reasonable and responsible debate. So you just carry on with your irresponsible writings and insults, and I’ll stand ready to debate someone who shows a modicum of responsibility and knowledge.

Neal Boortz

Stephen Eldridge

August 3, 2018 at 12:55 pm

Neal Boortz,

I replied to you twice yesterday from my cellphone while riding in a car, which made writing difficult.

First, I will translate your reply into English; “I, Neal Boortz, am a coward afraid to debate a true professional tax practitioner when I can’t control the microphone and bully my opposition into submission.” Intelligent readers can hear the “cluck, cluck, cluck of a frightened chicken (YOU).”

The bottom line of all of this is that you are exposing yourself a complete phony, with nothing of substance to offer and you are terrified to debate me. Let’s get before a crowd and you can “destroy” me. You can prove that my substantive arguments are wrong and as you insult. “plebeian, inaccurate, incomplete and often childish terms” (even though you do not offer any substantive reply – not even the hot air, drivel with which you filled your two books).

You began your first conversations with me by being nasty and aggressive (while offering no substantive comments), but I am still not afraid to debate you, in fact your laughable excuses make me even more willing to debate you. You are fooling no-one with your embarrassing attempts to wiggle out of the debate.

Your reply here is typical FAIRtax (“FT”) tactics of hurling many charges, that require a longer explanation. It is easy for you to fling charges, and then you ignore my substantive responses.

Here you have once again, pumped up your own sense of self-importance by trying to impress us with people you have “debated”. As brilliant as the Yale professor was, he was too sensible to waste the hundreds of hours that I did studying and analyzing the FT and you were too ignorant and arrogant to know that your tax expertise was laughably insignificant compared to his (and that you LOST that debate badly). From memory, you lost one debate against a former Asst. Treas. Secy. ( the CUNY debate does not sound faimiliar, please post the link), as well, and he too had too much sense waste as much time as I did in analyzing the FT. Many people bloviate and try to sell garbage to Congress.

Yes, when I explain the simple math (i.e., that you must add $30, NOT $23 to a $100 Pre-FT purchase, total $130, and that you deceptively get to 23% by dividing the $30 FT by the total $130, again, again, and again) and a person replies, “it’s 23% and that’s it” – yes, I ACCURATELY call that person a brain-dead “zombie.”

Similarly, when I explain in detail and present a reasoned professional reply, and people can only spew back your propaganda catch-phrases, I accurately call them brain-dead “zombies.”

To create your lame excuse, you turn into a snowflake. Because, I accurately called someone a zombie, you just wilt and refuse to debate me – it’s just too much for you to bear. You are a transparent fraud.

I guess you feel the you were civil when you opened your conversation with me, you wrote “If you (me) were a professional, I feel sorry for your clients.” And after your offer to debate me, you said that I either blatantly LIED or I (a retired professional tax lawyer/CPA) don’t understand know how to read the FT statute.”

I find you to be most uncivil, aggressive and a bully, but that would not stop me from debating you – in fact, it makes me want to debate you even more (that’s why I am trying to embarrass you into debating me, but you have no sense of shame).

I have presented my arguments entirely in reasonable terms, both here and on my website sceldridge.wixsite.com/sceldridge. I note that amidst your pathetic excuses for not debating me, that you offer no substantive replies to my criticisms. My earliest paper, (2010) Replacing the Income Tax, was over 100 pages and contained over 100 footnoted citations. And that was before I learned even more about the fatal flaws of the FT.

You whine that I am “irresponsibly aggressive”, but you called me and Adam Putnam “blatant liars” – how is THAT not aggressive???? I am RESPONSIBLY aggressive in combatting the FRAUD that is the FT.

You whine that I “presented your points in plebeian, inaccurate, incomplete and often childish terms.” However, I note again that you do not offer any substantive reply – not even the hot air, drivel with which you filled your two books. Your argument is laughable – the tax treatise and many articles I wrote, as well as the countless speeches I made all over the world, were well received by professionals and thus could not possibly have been “in plebeian, inaccurate, incomplete and often childish terms.”

You yet again repeat your 20-yearold propaganda lie that FT performed $22MM in “research.” I have exposed/explained this FT lie, over and over again. Originally, AFFT said that they spent the $22MM on “research AND MARKETING”, but later dropped the words, “AND MARKETING.” AFFT never produced an accounting for how that money was spent. The only old paper that I think you commissioned was Dale S. Jorgenson’s and you likely did not pay much for that. A lot of your “research” was MARKET research (i.e., what would people LIKE), not economic research which would still mean nothing.

Lobbyists typically get some economist to write a favorable paper about their proposal (for a fee).

Further, a mature economist wrote a editorial in the WSJ several years ago, in which he admitted that economists cannot predict anything, because there are far too many variables. You take advantage of unsophisticated, superficial people who are easily swayed by “A PhD economist likes our proposal.”

As a typical Alinsky tactic, you unilaterally declare me to be…” incapable of a reasonable and responsible debate,” just to evade having to debate me. Note that I kept getting asked to engage in several debates with IRS specialists (as well as teach the IRS), successfully. But if you think you are right, then you could easily show me up in a debate and thereby shut down the most persistent FT critic (me). So why would anyone who “believes “in the FT give up such a great opportunity.

Bottom Line: you fool no-one with your pathetic attempts to avoid a full, public debate. You have no professional tax nor economics expertise – you are a nothing more than a superficial marketer (of snake oil). You are afraid of me and now everyone can see it. Your unilateral declarations of my shortcomings have zero credibility and support – they expose you fear of debate.

Stephen Eldridge

August 3, 2018 at 5:27 pm

Neal Boortz,

As an after-thought, I want to give you the comfort of knowing that in 2010, I engaged in a very brief and limited debate with AFFT VP Phil Hinson (and the FT’s TN State Chairman) at a Tea Party Convention, and also had a limited debate with Phil again a few years ago at a brief debate generated by Bob Barr who was running for Congress again.

You should take comfort that Phil Hinson survived both debates, without being “wounded”, because I did not insult him and I treated him respectfully (which YOU fail to do with respect to me and others).

However, Phil Hinson (and the FT) was wounded by my substantive, well-reasoned, professional, accurate, complete and adult arguments.

I address the many fatal flaws of the FT, I do not attack FT messengers on issues NOT related to the FT. If they are lying or saying something fraudulent, I will point that out. If you try to bully me, I will stand up to you and will push back.

Come on snowflake, you are fooling no-one. Emperor Boortz has no clothes.

You do not have the power to unilaterally declare me to a number of negative things. I accuse you of being a fraudulent load of hot air and a bully.

Your ad hominems directed at me, notwithstanding, I am now M ORE willing

(if that’s even possible) to debate you than I was before.

Let’s have a FULL, fair debate, so that OPEN-MINDED people (i.e., not FT “zombies”) can make up their own minds.

Your refusal to debate me SCREAMS OUT that you are a total phony.

Ed Connor

July 25, 2018 at 8:31 am

Aside from the madness of a 77,000 page Federal Tax Code being compared to a 133 page simplified tax bill known as the Fairtax, just witness the abusive behavior and dismissive attitude of the IRS. They no longer consider themselves subject to congressional oversight nor subject to consequences of overt illegal and political bias. They have imprisoned American citizens without a trial, without due process and without filing any charges in violation of the First Fourth and Fifth Amendments to the constitution. Look up the story of Peter Schiff’s father, Irwin Schiff for a lesson in third world behavior. The Fairtax embraces simplicity and transparency above all. Characteristics that are anathema to swamp dwellers who lobby to write the tax code amendments while funding favorite candidates who are complicit in undermining the same concepts. The grass roots understand and over 70 legislators have co-sponsored the Fairtax in the last ten sessions of Congress including Ted Cruz, Mark Meadows, Kevin Brady and Devin Nunes as well as DeSantis. I convinced Ron to renew his co-sponsorship and he agreed immediately . Don’t fall for fake news like the Putnam accusations.

Stephen Eldridge

July 25, 2018 at 8:39 am

Mr. Connor has swallowed and merely regurgitated the superficial, deceptive FAIRtax propaganda.

If you want to understand the FAIRtax’s fatal flaws and deceptions, see sceldridge.wixsite.com/sceldridge

Stephen Eldridge

July 25, 2018 at 12:27 pm

Mr. Connor notes that “over 70 legislators have co-sponsored the Fairtax in the last ten sessions of Congress including Ted Cruz, Mark Meadows, Kevin Brady and Devin Nunes as well as DeSantis.”

Mr. Connor dceptively failes tro note that the current House has only 46 Co-sponsors (DOWN from 70+).

In any event, such Co-Sponsorship is meaningless. Mr. Connor includes Kevin Brady, who upon his elevation to Chairmanship of the tax-writing House Ways & Means Committee was asked by the WSJ whether FAIRtax would now be on top of the pile of tax reform proposals. In a nice political way, Brady replied, forget about it, thus throwing FAIRtax into the garbage, where it belongs.

Stephen Eldridge

July 25, 2018 at 12:48 pm

Readers:

I just learned that Ed Connor is the FL Political Coordinator for the FL FAIRtax group.

Isn’t is interesting that Mr. Connor failed to disclose that, nor did Mr. Fischer, above.

Stephen Eldridge

July 25, 2018 at 8:56 am

Rep. DeSantis is very wrong for Co-Sponsoring the FAIRtax (H.R. 25), because it is a Progressive financial scam.

It is NOT favored by Conservatives, at least those who understand how it really works.

Mr. Putnam understates just one of the FAIRtax’s many fatal flaws.

Prices would rise by 30% (i.e., not the lower 23% noted in this article). The error results from the fact that the FAIRtax deceptively calculates that 23% rate by dividing the tax by the total charge INCLUDING the FAIRtax (A $100 pre-tax price requires a $30 tax, total $130; $30 tax is “only” 23% of $130, but is 30% the way we all understand sales taxes.

David Boone

July 25, 2018 at 9:06 am

Mr. Eldridge has harrangged against the FAIRtax for years. He always begins his comments with ad hominems against whoever puts up a favorable post or comment. FAIRtaxers are left to wonder at his motivations, since his reasoning does not stand up to objective analysis.

Stephen Eldridge

July 25, 2018 at 10:53 am

Notice first that Mr. Boone does NOT in any way offer SUBSTANTIVE rebuttals of my substantive criticisms if the FAIRtax, but offers only rhetoric.

His assertions that his fellow “true-believers” wonder about my motives is laughable, as is his claim of their “objective analysis” because they have had all of my professional research and analysis available on my website sceldridge.wixsite.com/sceldridge, which fully explains fully deceptions and the fatal flaws of the FAIRtax.”

It appears that Mr. Boone (a long-term “true believer”) does not understand that an “ad hominem” attack is a PERSONAL attack on the person who makes comment that disagrees with you that is irrelevant to the substance of the issue being discussed. I challenge Mr. Boone to point out exactly where I made an hominem attack.

Similarly, he does not understand that my substantive, supported criticisms of the FAIRtax do NOT constitute “harrassment.”

Mr. Boone does not understand that he himself makes ad hominem attacks upon me, by saying that I “harrass.”

Mr. Boone also does not understand how the FAIRtax really works.

Chuck Bailey

July 25, 2018 at 3:17 pm

The FAIRtax is based on over $22 million in scholarly research by world class economists and definition using the results of their studies. Back-of-the-envelope scriblings by a lonely retired income tax “expert” don’t hold much of a candle to the FAIRtax!

The only tax bill that has actually competed with the FAIRtax is the so called Tax Cuts & Jobs Act. To make it work, some of the FAIRtax features were stolen by the congress to accomplish the TC&JA.

1. The standard deduction for a couple is twice the amount of a single person to almost remove the marriage penalty.

2. Marginal tax rates on individuals were lowered for several years. Will have to be extended as end dates are reached over the next few years.

3. Many deductions, credits, etc., were eliminated.

4. The “corporate tax rate” was permanently reduced to 21%, with a one year (2018) grace period at 15.5%.

The results so far support finally enacting the FAIRtax.

1. Jobs and wages are increasing for the first time in decades.

2. Companies are investing in facilities and new hires.

3. Current employees are receiving bonuses.

4. Companies are repatriating tens of billions of dollars each: Apple alone returned $245 billion and paid $38 billion in taxes, plus increased its investments to grow its US operations. Apple expects to invest over $30 billion in capital expenditures in the US over the next five years and create over 20,000 new jobs through hiring at existing campuses and opening a new one. Apple already employs 84,000 people in all 50 states. Just think of what Apple could have done with that $38 billion income tax if the company had been able to keep it. With 0% FAIRtax on Apple, $38 billion more would be free to invest in the U.S.

Based on these few results, looks like abolishing the income tax and replacing it with the FAIRtax is the correct way to go. With no income or payroll taxes taken from paychecks, nor corporations being burdened with accumulation and reporting taxes to the government, Americans would be free to spend their money as they wish, not how the government mandates through the income tax system.

Pass the FAIRtax now!

Stephen Eldridge

July 25, 2018 at 5:15 pm

Ah yes, Mr. Bailey, Head of the FAIRtax in Alabama (he did not tell you that), chimes in with more of the same old (false) FAIRtax propaganda.

He touts AFFT’s supposed $23MM in economic “research.” Originally AFFT claimed they spent that on “research AND MARKETING” but later dropped the last 2 words. AFFT never produced a detailed accounting of that $23MM so that it could be challenged. It appears that virtually ALL of it was spent on MARKETING.

Perhaps one research paper was produced by Harvard’s Dale S. Jorgenson, who among other thongs wrote that retail prices would decline over 30 years after enactment. AFFT glossed over this point and advertised that retail prices would decline by the full amount IMMEDIATELY.

Likely in frustration with AFFT’s misuse of his paper, Professor Jorgenson issued a “clarification” in which he explained that 2/3 of his estimated price decline would NOT occur, because they represented employees’ tax reductions that would not be available to employers.

Professor Jorgenson later said words to the effect, “The FAIRtax takes on too great a burden for it to carry.”

Economics “research cannot predict anything, as a mature economist admitted in a WSJ editorial.

One can easily get an economics opinion that supports one’s proposal, merely by funding it.

So much for AFFT’s “$23MM in research.”

As a retired tax lawyer/CPA, I have conducted hundreds of hours of research and analyses. I have read their proposed statute and analyzed all of their arguments in hundreds of conversations and found that the FAIRtax just kept getting WORSE.

Of course, Mr. Bailey, a FAIRtax “true-believer” is forced by lack of substance to denigrate my research as “Back-of-the-envelope scriblings by a lonely retired income tax “expert…” Note his Alinsky tactics of insulting — and false—use of “lonely” and putting “expert” in quotation marks (I was a tax author/lecturer), and incidentally his mis-spelling of “scribblings.”

I wonder if Mr. Bailey has ANY comparable tax expertise – he has never divulged any.

Moving on to the rest ofMr. Bailey’s rhetoric, how in the world does the recent Tax Cuts & Jobs Act borrow from the FAIRtax and how in the world does the results of recent Tax Cuts & Jobs Act, “support finally the FAIRtax? This is rhetoric on steroids.

James Bennett

July 25, 2018 at 3:31 pm

The ad by Adam Putnam is perfidious. The FAIRtax would do more for the economy of the entire nations by removing today’s taxes on capital and labor. The FAIRtax is revenue neutral and stops business-to-business taxation and taxation of exports. No other tax, existing or proposed, is a transparent, efficient, conducive to economic growth, or fair as the FAIRtax. The FAIRtax is also neutral in application and unintrusive.

Stephen Eldridge

July 25, 2018 at 5:29 pm

Now we hear from the Secretary of the AFFT, Mr. Bennett, himself, a (non-tax) lawyer.

He claims that the FAIRtax would be tax-revenue-neutral. On what planet? Later AFFT research papers used an economics sleight-of-hand trick of “assuming” that there would be ZERO tax evasion (you see they simply “assume” whatever they need to achieve their desired outcome).

Otherwise, Mr. Bennett merely rehashed old generic propaganda. Notice that he sticks to their latest marketing strategy of “don’t get into details, just offer glowing promises and claims.”

Jim, the word “unintrusive” should be hyphenated.

Randy Fischer

July 25, 2018 at 8:09 pm

Stephen I am glad we could keep you entertained. I gave up years ago trying to reason with you. Maybe a Nobel honored PhD economist Dr. Laurence Kotlikoff can give you more fodder. Kotlikoff, Why The FAIRtax Will Work, January 2008 http://www.kotlikoff.net/sites/default/files/Revised%20Kotlikoff%20on%20Barlett%201-15-08.pdf. If I recall correctly your tax “publication” was an in house manual for KPM.

Stephen Eldridge

July 26, 2018 at 7:58 am

Randy Fischer (the Joseph Goebbels of the FAIRtax),

You would keep me entertained, but for the seriousness of the fraud that you are perpetrating.

You may have given up trying to “reason” with me because you “arguments” are nothing but deceptive, superficial that can be determined by a competent former professional tax practitioner. You may be a general lawyer, but you know next to zero about the complex topic of taxation.

Your “Nobel honored” PHD economist Larry Kotlikoff strangely does NOT mention his supposed “Nobel honor” in his BU bio. This is obviously just a little more of your bull….

Secondly, to expose your propaganda, even if he was “Nobel honored” (which you employ to fool your uneducated, gullible target audience), even winning a Nobel prize in economics proves nothing. The looney left-wing PhD economist Paul Krugman won that prize. The great (?) economist John Maynard Keynes advised that endless government spending would solve all economic problems.

By the way, Larry Kotlikoff does not prefer the FAIRtax. He prefers his own “purple tax”, which is a combination of DEM blue and GOP red, under which the wealthy would pay more tax, but they would be happy about bthat because they would feel less guilty about their wealth (you have just GOT to be kidding).

It is most revealing that you can do no more than resort to Alinsky denigration. Not only is your intelligence and integrity faulty, but so is your “memory.” The 3 Volume tax-treatise that I co-authored, Federal Income Taxation of Life Insurance Companies and Their Products, was published by the premier tax publisher, Matthew Bender (I also edited the annual international publication of the Hartford International Institute on Insurance Taxation), and I lectured extensively across the U.S. and internationally. But, surely you have read that before today. You just can’t stop lying and propagandizing.

Stephen Eldridge

July 26, 2018 at 10:33 am

Randy Fischer,

I forgot to mention that your PhD economist, Larry Kotlikoff laughably explain ded his (BHI’s) failure to take ANY revenue shortfall from evasion and avoidance into account.

He wrote to the effect that they did not ignore evasion, but that would be overcome by the $1T tax “windfall” the govt would get from an inflation factor applied to the National Debt. You have GOT to be kidding. LOL!

It is beyond me that Larry would embarrass himself (and BHI) by making such an outrageosly false statement. You couldn’t pay me enough money to write something that patently false and ridiculous. But, I guess Larry went to Harvard and has a PhD in economics, so to your target audience of the low-intelligence and the gullible, that makes him credible (not at all).

Stephen Eldridge

July 25, 2018 at 8:34 pm

Jim,

I forgot to mentkion the obvious, that is that evasion woud be ENORMOUS!

Evasion of the 30% FAIRtax, PLUS up to 15% State & Local sales taxes, would become the new national pastime. America would have the world’s largest black market.

The resulting enormous tax shortfall, would surely lead to a NEW Income Tax

(CATO Institute agrees, see https://danieljmitchell.wordpress.com/2012/08/11/a-primer-on-the-flat-tax-and-fundamental-tax-reform/),

Mason F Day

July 25, 2018 at 11:39 pm

Stephen You Allude Evasion Will Be Enormous!!!!!! Please Explain !!!! Use Florida as an Example. You are Buying a Toaster !!!!!!!!!!!!!!!!!!

Stephen Eldridge

July 26, 2018 at 8:32 am

Mason,

At a 30-45% combined (fed +S/L) sales tax rate smacking them in the face, consumers, would create the most inventive black market in this country, employing tactics that we cannot even conceive of today.

Smaller (legal) retailers would sell for cash (“off the books’) and sales would migrate away from the big box stores whose prices would be 30-455 higher because of the sales taxes.

Illegal sellers would arise. Think of Tony Sopranso selling out of the back of a stolen truck.

Efven today, with much lower state sales taxes only, there is substantial sales tyax evsaion. Just imagine what would happen when the combined sales tax rates are 30-45%.

European VAT’s (which REDUCE evasion) are still subject to very high rates of evasion, and the FAIRtax evasion would be much greater than with VAT’s.

The methods of evasion will grow with much creativity.

The is also pefectly legal tax “avoidance.” It is easy to imagine the Mexico side of the border, from Brownsville, TX to San Diego, CA, would develop into the world’s largest US retirement community (Mexico is alrteady home to many US retirees), wherein consumers would spend and consume LEGALLY (and they would have busses to take them to the US for Medicare paid health care).

It would also become the worlds largets shopping mall with a huge flashing sign saying “Americans Welcome.” We can’t keep people from entering the US, how are you going to keep out smuggles I-Phones.

You need to read my 2010 Paper, Replacing the Income Tax (I learned even more since then of why the FAIRtax is so fatally flawed). Go to fairtaxblog.com and find under Research Papers.

Philip Hinson

July 25, 2018 at 7:08 pm

I agree with Jim Bennett’s comments and would add that his use of the term “revenue-neutral” is critically important. The republican fake tax reform bill is NOT believed to be revenue neutral (notwithstanding claims of some members of Congress to the contrary) and as a consequence, we are looking at the return of trillion dollar a year deficits very soon and extending as far as the eye can see. I wonder how many Americans who voted the republicans into the majority in both houses in 2014 and 2016 understood that they were voting for the return of enormous deficit spending. The critical question is how many years will it take for investors (many of whom are foreign nationals) to recognize that the United States has neither the intention nor the capability of repaying this mountain of debt we are accumulating. When we have a bond auction that fails to sell all of the available T-bills, we will know that the end is near. Yes, the economic numbers are quite good now as this bubble is inflating, but we have seen other bubbles inflating over the past decade or two and we should know by now how this ends.

Stephen Eldridge

July 26, 2018 at 7:27 am

Phil Hinson,

Readers, Phil is my first, my favorite AFFT (the FAIRtax national marketing organization) officer (V.P.). He is the only AFFT official who even has a remote understanding of the subject of taxation. He is a financial (non-tax) CPA. Notwithstanding his emotional illness of loving the FAIRtax, I like him. He may be well-meaning, but he and his fellow true-believers are dead wrong.

Phil focuses in this comment on first repeating the FAIRtax lie that it would be tax-revenue-neutral, but he does not even try to explain that (because he could do no more than spout deceptive, superficial propaganda.

Phil, I am very disappointed that you failed to read the 100+ page paper, fully footnoted, that I wrote after our initial debate at the tea party convention in Gatlinburg, TN in 2010, Replacing the Income Tax, which you can find at fairtaxblog.com under Research Papers. The following is a short portion, starting at page 23 (the actual footnote numbers are 24 & 25, not 1 & 2).

“Another major consideration is the potential rate of tax avoidance (legal) and tax evasion (illegal). H.R. 25 assumes that there will be virtually no tax avoidance or evasion. People not paid by AFFT as well as those paid by AFFT are of the opinion that as the sales tax rate rises, tax avoidance/evasion rises dramatically. (FN 24)

They believe a sales tax rate, even as low as 30%, would generate substantially more tax avoidance/evasion than the current tax law. (FN 25) How about at a sales tax rate of 150%?

FN 24: See American Enterprise Institute, Panel discussion, Taxing Sales Under the Fair Tax: What Rate Works, The Rate of the NRST by Jane G. Gravelle, Congressional Research Service, Feb. 28,2007. Panel included Laurence Kotlikoff and William G. Gale. See also, Investment Volume 3, Lifting The Burden, Tax Reform, Capital Formation , and U.S. Economic Growth, Dale Jorgenson and Kun-Young Yun, The MIT Press (2001), at page 323.

FN 25: See, Report of the President’s Advisory Panel on Federal Tax Reform, Simple, Fair and Pro-Growth, Chapter 9 National Retail Sales Tax, at p. 217, and Fair Tax Fantasy by Adler and Hewitt, Chapter 11.”

Steve Curtis

July 26, 2018 at 8:40 am

The FairTax must be very popular, since a large number of folks are supporting it, while only a single, rather vitriolic, individual is working to undermine it.

All that aside, no one can argue that the problems addressed by the FairTax (IRS unaccountability, complexity of tax code, tax evasion, etc) are real. Nor can anyone deny that the FairTax replaces federal income taxes, rather than being added on top of them.

Is the FairTax a new idea….. absolutely!! Would it “shake up” Washington and the political Establishment who depend on and manipulate the current federal income tax system to their benefit….without a doubt!! Are there some people who will be hurt by the FairTax (lobbyists for instance)…… you bet!!

But, the real question is whether America, and the law-abiding, hard working, citizens of the United States would be better off under the FairTax than our current federal income tax system. On that there is absolutely no question!! The FairTax wins!!!!

Stephen Eldridge

July 26, 2018 at 1:13 pm

We now hear from Steve VCurtis, a national AFFT Officer and head of its Ohio unit, who I have tried to educate over the years, but one cannot teach people who don’t WANT gto learn.

Note Mr. Curtis’ use of deceptive salesmanship. He says that everyone in this discussion supports the FAIRtax. Well they are almost ALL FAIRtax national and State Officers. That is their prejudice. Very few people have spent the time and professional skills necessary to understand the FAIRtax’s fatal flaws, as I have. Many of them have moved on to other issues because the FAIRtax is DEAD! Even Rep. Kevin Brtady (a Co-Sponsor) , upon his elevation to Chairman of the House tax-writing Ways & Means Committee, politely dumped ikt in the trash (where it belongs).

On my website sceldridge.wixsite.com/sceldridge, please go to the FAIRtax page and to the subpage for Debates, etc. and you will find a link to my debate with Mr. Curtis and my commentary/replies to his superficial, deceptive propaganda.

Because he has nothing of intelligence or substance to offer (he is a “safety engineer” who knows virtually NOTHING about taxation) and cannot defend against my substantive, professional criticisms of the FAIRtax, Mr. Curtis is left with the intellectually bankrupt Alinsky dengrations of calling me “vitiolic.” If someone offer substantive, professional criticisms of the FAIRtax, they must be attacked as “vitriolic.” This is cpommon FAIRtax alinsky tactics they they are forced to use because they have nothing of SUBSTANCE to offer abd acannot substantively rebut my criticisms.

Carol Kay

July 26, 2018 at 11:16 am

If Putnam’s ad had been about Desantis supporting the Fair Tax, I might still be on the fence about which candidate to support. But this ad (and others approved by Putnam) is so deceptive that it helped me decide to support Desantis for Governor

Stephen Eldridge

July 26, 2018 at 12:54 pm

Carol Kay,

I have no other interest in either candidate.

Please explain how this ad is about anything other than DeSantis’ support for the awful FAIRtax and how is it deceptive (other than the fact the he understated the problem by stating the sales tax rate was only 23% when it is in reality 30% and failed to mentiona any of the other fatal flaws of the FAIRtax?

Note that it was Politfact that got it wrong., when they said it was “regressive” when in fact it is advertised as being very “progressive.”

Samuel Gowan

July 26, 2018 at 6:36 pm

I believe Mr Eldridge is more concerned about his loss of income than he is about explaing the full benefits of the Fairtax. I note much of the “heart” of the bill was ignored.

Stephen Eldridge

July 26, 2018 at 8:30 pm

Samuel Gowan,

Precisely HOW could you have possibly missed the fact that I am a long-time, fully RETIRED tax lawyer/CPA, i.e., I have no financial income from today’s Income Tax and HOW coyld you possibly have missed the fact that I propose a very simple Flat Income Tax that would eliminate the tax profession?????

Don’t you feel rather foolish to accuse a retired tax lawyer/CPA, who has spent hundrreds of hours researching and analyzing the FAIRtax, of ignoring the “heart” of the bill.

Exactly what do you consider to be its “heart” and I will post the relevant comments that I have made either here or on my website that I have noted here (sceldridge.wixsite.com/sceldridge) that you have obviously not bothered to read.

And please tell readers exactly what is the extent of you tax expertise.

Samuel Gowan

July 26, 2018 at 10:59 pm

Probably missed yout earlier posts because I just logged on to the site to, 7/26/2018. It may be helpful to read the entire bill as proposed. I am not in favor of the bill but, am in favor of the one DeSantis voted for this past year.

Stephen Eldridge

July 27, 2018 at 8:53 am

Samuel Gowan,

While i likley said that I WAS (past tense) a tax lawyer/CPA, I have made that point perfectly clear over the many years I have battled these FAIRtax “true-believers” (although they can’t seem to grasp that).

Are you suggesting that YOU must read the entire proposed bill (I have read most all of it, as well as economics papers, as well as mosr all of the AFFT propaganda and countless arguments, and also performen numerous financial analyses and reviews. Over the years, I keep finding more nuggets of nonsense oin the FAIRtax.

You need to not only READ the bill (with a LAWYER’s skills), but you also need a fair amount of experience in the field of taxation to understand the practical implications of the bill.

If by “I ………. am in favor of the one DeSantis voted for this past year” , you mean TCJA, while I would generally agree that reducing the corporate tax rate and reducing individual taxes a little is a good thing, gthe bill hase some major flaws.

First, by doubling the Standard Deduction and the Child Tax Credit, they have take MORE people OFF the taxpaying rolls. This is critical because (according to the IRS) even before that bill, the top 20% pay an astounding 95% of all the individual Income Tax, while earning only 60% of the income. The next 20% pay only 5% with about 25% of the income and the bottom 60% pays ZERO while earnin about 15% of the income. The Republic cannot survive this.

Also, Congress blew a great opportunity to simplify the tax code and make it far more transparent and make it easier to comply with. Congress also blew the opportunity to make the tax code LESS progressive (i.e., less Marxist). If anything, the bill made it equally or more complex and progressive.

Stephen Eldridge

July 27, 2018 at 11:22 am

ALERT; BREAKING NEWS:

Last night at about 9PM The Great Blowhard Neal Boortz wrote “Having read your (my) postings I would find debating you (me) to be a delight.” Note; that he made no pre-conditions.

I replied that I would LOVE to debate him and asked him several time to contact me via my website. He has not yet done that.

Right after he made his offer to me, he replied to Mason Day in this discussion, and therein he added a sly, silly escape hath for himself, That is, he said, “I have challenged Eldridge to an an open debate BEFORE WHATEVER CROWD HE CAN ASSEMBLE (all caps are m ine for emphasis)on the FairTax. Let’s see what he says.”

What a slimely move on his part to escape from debating me. Surely he has a wide audience (and so does his FAIRtax pal Herman Cain). He can enlist the help of Jenny Beth Martin of Tea Party Patriots and John Linder and Rob Woodall and the entire AFFT whose officers have been active in this discussion.

AFFT Officer, Randy Fischer made a good suggestion of a pay-for-view show to benefit charity, which I applauded, but we have heard no more from AFFT.

It is most telling that Neal Boortz (and with the apparent approval of the AFFT , at least Randy Fischer) have made a blustering offer to debate me, but are quickly running away.

This would be their great opportunity to prove me wrong and thereby defeat their greatest critic. But, they are slinking away from that opportunity.

See the message. They have NOTHING. They know that they cannot defend their garbage FAIRtax on a substantive basis. Instead, they rely on their target audience of the more ignorant, superficial, gullible people who are susceptible to the repeated propaganda lies.

The FAIRtax “Emperors have no clothes.”

Ken

July 27, 2018 at 11:20 pm

Mr Eldridge,

You made an original point about the $100 item would now cost $130. What was missing is the fact that the $100 item would cost less to manufacture/distribute since the corporation making it would pay no corporate income tax or FICA and neither would any of the other companies involved in the supply chain of making that item. The item would lower in price. It would not stay at $100. In the case of a Florida tourist attraction, the tourist would pay no income tax and neither would the amusement park. The price of everything that is supplied to the amusement park would have a lower price since those companies would pay no corporate tax or payroll tax either. The fair tax would actually make goods made overseas less attractive for American businesses to purchase.

Stephen Eldridge

July 28, 2018 at 8:49 am

Ken,

You missed my point and confused 2 diffreent points I made.

First, my illustration was intended to illustrate if an item costing $100 (BEFORE adding FAIRtax), it would attract a $30 (NOT $23) FAIRtax. The AFFT does NOT dispute this.

Secondly, you have bought into the FAIRtax (false) propaganda that all of today’s taxes would come out and that prices would remain the same (including the FAIRtax). For yourconvenience, I will re-post here, my explanation of why the FAIRtax propaganda is false (that I posted above).

For some technical reason, my link to Karen Walby’s paper, below, does not appear. If you contact me via the Contact Me page on my website (seceldridge.wixsiye.com/sceldridge) we will figure out how to get her paper to you (I am obviously NOT a digital techie).

FAIRtax(sm) Will INCREASE Prices by Almost 30%:

For an overview, understand that AFFT’s original promise that we all get a raise while prices stay the same, just could not be true. It is impossible for all of us to be such big winners when the FairTax® is supposed to have us paying the same total dollars in federal tax, with only a very small dollar savings in compliance costs. If we all get a raise, prices must go up by virtually the same number of dollars.

Originally, AFFT claimed that prices would remain the same under FairTax®. That is, they claimed that prices would first drop by 22% for today’s taxes that are “embedded” in the cost of goods we buy (i.e., from $100 down to $78) and then rise by $23 ($78 x 30% tax), and would thus remain relatively unchanged.

This original AFFT claim was purportedly based upon a report issued by Harvard Prof. Dale Jorgenson for AFFT, but may have mis-stated Dr. Jorgenson’s conclusions. Among other things, Dr. Jorgenson stated that his 22% price decline would occur over a rather extended period of years, not immediately.

In any event, Dr. Jorgenson later “clarified” that 2/3 of his original 22% price decline consisted of the savings in the employees’ taxes and “assumed” that employees would surrender their “raises” to their employers – i.e. that their old net pay would become their new gross pay.

He “clarified” that he believed that would not occur – i.e., he believed that employers would be required to pay employees their full gross pay without reduction for now non-existent employee income and payroll taxes.

Thus, Dr. Jorgenson was predicting a 7% (i.e., 1/3 x 22%) price decline and a 21% net price increase (i.e., $100 – $7 = $93 x 130% = $121).

Next, AFFT Chief Economist Karen Walby demoted Dr. Jorgenson’s status to merely “one of many economists AFFT consulted.” She proceeded to claim, instead of Dr. Jorgenson’s 7% decline, that she believed there would be a 12.5% decline, which translates to a 14% price increase ($100 – $12.5 = $87.5 x 130% = $114).

However, one of her items of reduction was a 7.9% factor for business income taxes – there were also separate factors for the employers’ share of payroll taxes and for compliance savings. Based upon available data (which in not fully precise), it appears that business income taxes are no more than 2+%, rather than her 7.9% (I challenge her calculation and ask to audit her numbers). When one corrects her 7.9% figure to the 2+%, her figures are in agreement with Dr. Jorgenson’s.

Next, note that the (Jorgenson and corrected Walby) 21% price increase, “assumes” that fully 100% of their maximum potential 7% initial decline would be passed on to customers in the form of lower prices.

In my opinion, that is entirely unrealistic. That 7% consists of about 4% in the employers’ share of payroll taxes. Many economists believe that employers view that as a cost of labor and thus such savings would be used to fund employee raises and thus would not be available to reduce prices. Of the remaining 3+%, it is more realistic to assume that some of that would be reinvested in the business and thus would not be available to reduce prices. Assuming that only one-half of that would reduce prices, prices would increase by 28-30%.

Although one senior AFFT Board member admits that AFFT’s original “prices-stay-the-same” claim was a “mistake”, senior FairTax® propagandists (e.g., Glen Terrell & Dan Borowicz) continue to issue propaganda pieces that perpetuate the original AFFT “mistake” and others (e.g., Steve Curtis, AFFT Board member claims lower increases than even AFFT Chief Economist Karen Walby now admits to).

AFFT’s Chief Economist Karen issued a new White Paper in 2013, which purported to show that the FAIRtax lowers the “true cost” of a US produced car. However, a study of her Paper reveals that that she shows (finally admits to?) the same pre-tax price (i.e., no price reduction) under both taxes and then adds the full 30% FAIRtax.

This appears to admit to a full 30% price increase, giving up on her earlier baseless claim of a 12.5% decline noted above, which she does not reserve in this Paper. She notes that “While economists can dicker over how much producer prices-and therefore the costs of the vehicle-will fall, one factor is “indisputable” (i.e., her interest rate reduction) – that first phrase does not in any way rise to the level of her reserving her earlier claim of a 12.5% price reduction, before adding 30% FAIRtax.

Walby then attempts to magically show that other savings will overcome the 30% FAIRtax.

First, she claims that it is “undisputable” (in the opinion of FAIRtax marketers) that interest rates (on installment payments) will decline by 25%. No economic prediction is “indisputable” – by definition, all economic predictions are purely theoretical.

Second, Walby attempts to justify her claim using Payroll and Income Taxes “saved” by FAIRtax. However, she uses very high (28%) marginal Income Tax rate that only a minority of taxpayers would pay, rather than using a much lower overall effective tax rate.

Also, the FAIRtax would require consumers to pay for all former income and payroll taxes as well as all prior corporate income and payroll taxes. This added burden is far greater than her theoretical interest rate savings (and their additional-taxpayers claim has been disputed by independent economists and in any event will be overwhelmed by the new Black Market).

Note in summary of this Paper, that the cost Walby shows is the same under both taxes, and that the FAIRtax adds a full 30% so that the price paid at retail is 30% higher. Walby’s attempt to overcome that additional 30% cost is just more FAIRtax smoke and mirrors, i.e., claims that work only on the unsophisticated.

Glen Terrell

July 28, 2018 at 10:17 am

I have a few comments:

(1) When the dust has settled after the Income Tax is abolished, the shelf price of ALL AMERICAN PRODUCED GOODS will decrease by about 17% (see fairtax.org for latest figures).

(2) With the pre-bate a family can earn about $35,000, and spend it all, and pay NO TAX AT ALL; ZERO. If you earn $100,000,000 per year AND SPEND IT ALL, the tax you pay approached 23% of your income.

(3) Regardless of your earnings…THE IRS, the biggest pain in the ass of every working American, is GONE FOREVER.

(4) Go to fairtax.org for complete informaation.

Stephen Eldridge

July 29, 2018 at 8:52 am

Glen Terrell,

Yet another long-term FT “zombie” chimes in.

(1) No less than 3 times in this discussion (the last one is still pending approval) I have posted my explanation of why prices would rise by nearly the entire full 30% FT. It includes critical admissions by the AFFT. Yet, Mr. Terrell and others simply refuse to process reality (they arte in denial).

(2) The FT is VERY progressive (Marxist). it INCREASES the large class of people who pay NO federal Income Tax and No SS/Medicare Tax.

Of prime importance, the Prebate is not a real refund of FT paid, as it appears to be. It is a $600B NEW ENTITLEMENT, with all Americans receiving a big monthly federal check – a very bad idea for those of us who are not Socialists. It is financially and politically unwise to create yet another huge entitlement that will only increase in the future.

FT (Prebate) has the poor pay for no part of the fed budget, pay nothing for their personal SS/Medicare benefits, AND give them a big tax welfare check. FT (Prebate) extends tax welfare to the non-working poor – and also takes the next Progressive Cloward-Piven step towards giving SS/Medicare to all regardless of work, by removing the tax cost of reporting SS Wages, which “invites” fraud in reporting them (as also noted by other authors).

The Prebate is calculated to merely repay the poor for any FT they pay (as if we all agree with that), but it would actually pay them far MORE by “assuming” the poor spend more than the underlying HHS Poverty Guidelines and that they will pay FT on all of their purchases (but they WON’T) – see http://sceldridge.wixsite.com/sceldridge#!ft-increases-tax-welfare/copu

(3) The IRS.

It is a myth that “IRS is Abolished.” FT’s new IRS (i.e., STAA) may be more invasive than today’s IRS – the buyer is liable to pay FT and receive/show a receipt and so STAA may audit consumers – see Sec 101(d). Also we may well have to file an “Annual FT Summary”. See http://sceldridge.wixsite.com/sceldridge#!the-myth-that-the-irs-is-abolished-/c1tu0

As also noted by Cato Institute (see https://danieljmitchell.wordpress.com/2012/08/11/a-primer-on-the-flat-tax-and-fundamental-tax-reform/), FT leaves us more vulnerable to winding up with both a NEW Income Tax and FT (instead of adding 20-30% on top of the FT’s already high explicit 30% rate). Congress would surely repeal FT’s laughable Sunset Clause and (with the 16th Amendment surely still firmly in place) would use the excuse of the large revenue shortfall from evasion/avoidance to (in lieu of raising the already high FT rate) enact a new Income Tax which I believe is Congress’ true ultimate objective – i.e., to be able to grab even more of our money to redistribute to those who will vote for them and contribute to their campaigns.

Stephen Eldridge

July 29, 2018 at 8:54 am

Glen Terrell,

My reply to you is awaiting moderation.

Rob Crews

July 28, 2018 at 6:12 pm

Taxing on income discourages income. Taxing on spending discourages spending. However, it all comes down to this: I taxing spending can get all the underground economic benefactors (rug dealers, prostitutes, illegal immigrants) to pay their fair share of taxes, I’m for it. please advise where the debate will take place.

Stephen Eldridge

July 29, 2018 at 8:39 am

Rob Crews,

With a combined fed +S/L 30-45% sales tax, virtually EVERY American will engage in America new favorite past-time, (illegal) tax evasion (in the largest Black Market in the world)) and (legal) tax avoidance. Thus, we would have 320 MM tax evaders-avoiders.

Even in the FT’s La-La -World, the underground would pay no more in FT than they pay today in the taxes “embedded” in the cost of goods, as 2 UT economists noted in their paper on the effect of the FT on the States (I can dig out the cite if you are interested).

I agree that taxing spending discourages spending – in the legal market. It encourages spending in the Black Market and outside the US.

Taxing income does not discourage earning income. What does discourage earnoing income are generous welfare benefits, steeply progressive income tax rates, and tax “incentives” like the EITC which discourage working when the maximum income point is reached and the EITC starts to reduce).

Stephen Eldridge

July 29, 2018 at 9:20 am

Rob Crews,

I forgot to adddress your last point.

Did you read through the comments here where the The Great Blow-Hard Neal Boortz invited me to debate him (without any pre-condition) and then he LIED to Mason Day by telling him that he told me that he would debate me IF I brought the audience (which is laughable given his and AFFT’s large audience, while I am just one old guy with a laptop).

I told Boortz that I would LOVE to debate him, but he has NOT responded to ME after I accepted his offer. He is now exposed as a fraud, a big bully (when he controls the microphone and cut off people telling the truth, as he did on his radion show), and he is just a big bag of wind..

YOU need to tell Boortz that his emarrassing attempt to slip away from debating me by telling Mason Day (not me) that he won’t debate me unless I gin-up an audience, is disgraceful. Tell him that unless he debates me, people will know the truth, i.e., that Boortz is just a load of hot air who is laughing at all the fools who were in awe that Booortz wrote “The BOOK” and ikt “the “expert” (he is certainly NOT).

Dreamer

July 31, 2018 at 7:13 pm

The only fair tax is no tax at all.

What needs to happen is that a new money-less society be formed by our government. Money is not essential to life. Resources are what we need to live, not money. Money is just a tool, invented to help organize the distribution of scarce resources. Modern technology now offers us a potential abundance of these resources such as food, water, shelter, and a high standard of living. We can procure, produce and manufacture all of life’s necessities more easily now than ever before. The only thing scarce nowadays is money itself! In a money-free world, the concept of rich and poor will be meaningless as everyone will have equal access to all life has to offer.

Human nature has just one function: to survive. This survival instinct drives all our behaviors. So when we are faced with scarcity, we automatically become greedy, because it’s good for survival. Today, money is scarce and we need it to live, so we try and get as much as we can. It’s a perfectly natural response to a world where people who don’t have money die. Once people realize there is no longer any real scarcity, and they are a vital part of a community that supports them, greed and selfishness will become unnecessary. Our instincts will then drive positive behaviors such as cooperation, trust and compassion which are also necessary for survival.

Any political system, including communism, that uses money is ultimately doomed to fail, because it embodies inequality and oppression. Money, by definition, creates inequality, and upholding that inequality necessitates oppression. The level of inequality and oppression in any political system determines how long the regime will last.There is only one real law that we must obey, and that is the law of nature. Failure to abide by it ultimately results in extinction. We need to move beyond traditional politics and governance and solve our common problems together in accordance with nature!

By removing money, you remove the main motivation for greed. Where there is no greed, there is no struggle for ownership. Also, when everything is free, no-one needs to covet your property when they can just as easily get their own. In a free world, people will also respect each other’s entitlement to safe dwelling, privacy and security, because that’s how they will be taught from the earliest age – about communities, nature and how we’re all connected and mutually dependent.

Read More:

freeworldcharter.org/en/faqs

Stephen Eldridge

July 31, 2018 at 8:54 pm

Mason F. Day,

Thank you for exposing your extreme emotional illness (as a FAIRtax zombie).

It’s sad that you think that the truth is “bile & fizz.”

Rather than acknowledge the truth that your hero, Neal Boortz’s lied to you, you run away and hide from that truth that you cannot tolerate, while hurling silly insults that expose your emotional defects.

I reply here not to hurt your feelings, but to expose to open-minded readers the emotional illness of you FAIRtax zombies (and to remind readers about that “empty suit”, the cowardly bully Neal Boortz who ran away from his offer to debate me)?

Stephen Eldridge

August 2, 2018 at 9:23 am

Excuses, Excuses, Excuses!

And poor ones st that.

Your cowardice is fully transparent.

You know full well that as a retired tax lawyer/CPA who has spent hundreds of hours studying and analyzing the FAIRtax, that I am better capable of exposing its fatal flaws than any of those others with whom you have purported to debate.

You offer nothing more than your typical false bravado and self-aggrandizement.