Florida’s popular back-to-school sales tax holiday returns this weekend, with tax exemptions on a broad range of school-related products.

The 2016 Back-to-School Sales Tax Holiday, somewhat shorter than in past years, begins at 12:01 a.m. Friday, Aug. 5, through 11:59 p.m. Sunday, Aug. 7.

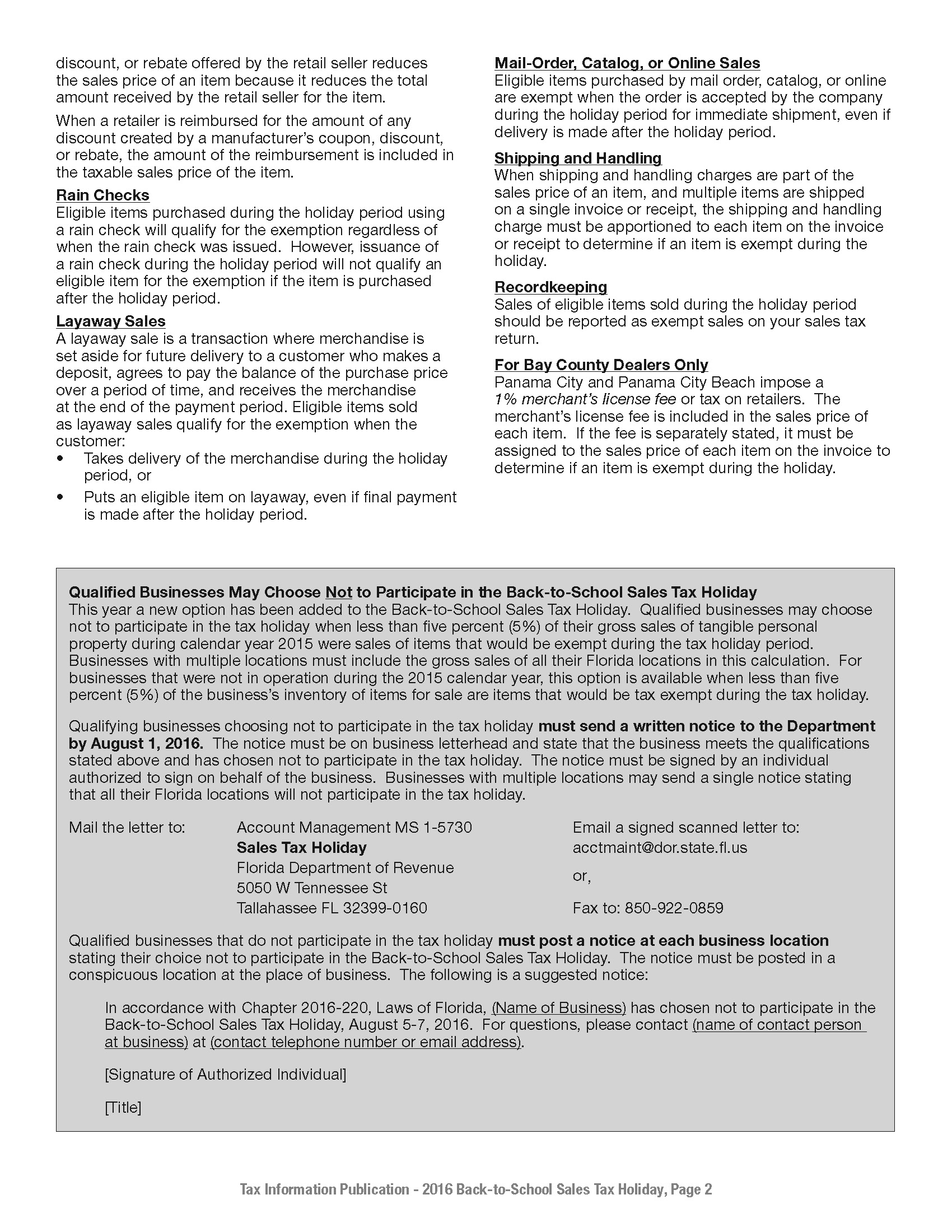

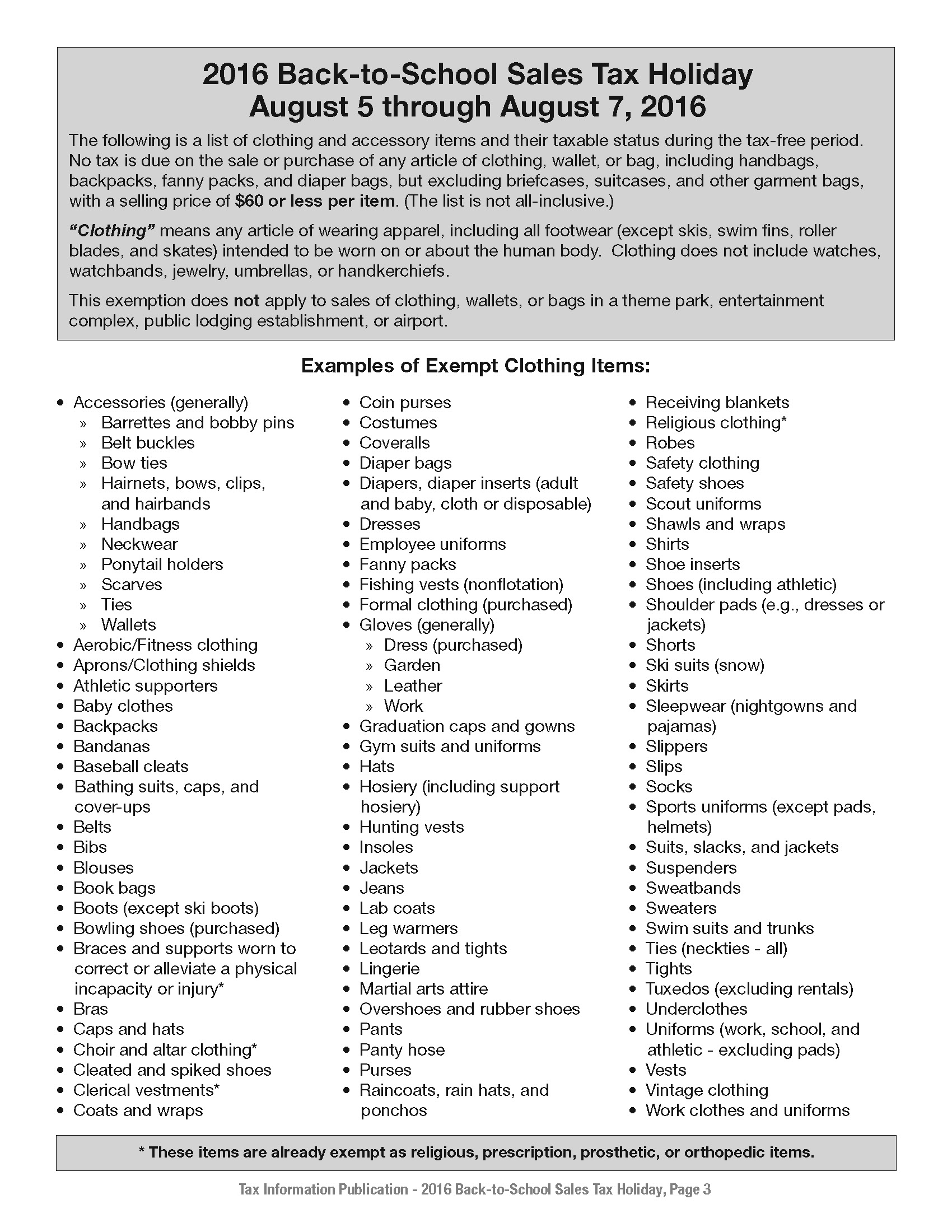

During the three-day period, purchases of specified school supplies and clothing are exempt from sales tax. Tax-exempt clothing and accessories are defined as any article of clothing, wallet or bag, including handbags, backpacks, fanny packs and diaper bags, but excluding briefcases, suitcases and other garment bags, with a selling price of $60 or less per item.

“Clothing” means any article of wearing apparel, including all footwear (except skis, swim fins, roller blades and skates) intended to be worn on or about the human body. Clothing does not include watches, watchbands, jewelry, umbrellas or handkerchiefs.

This exemption does not apply to sales of clothing, wallets or bags in theme parks, entertainment complexes, public lodging establishments or airports.

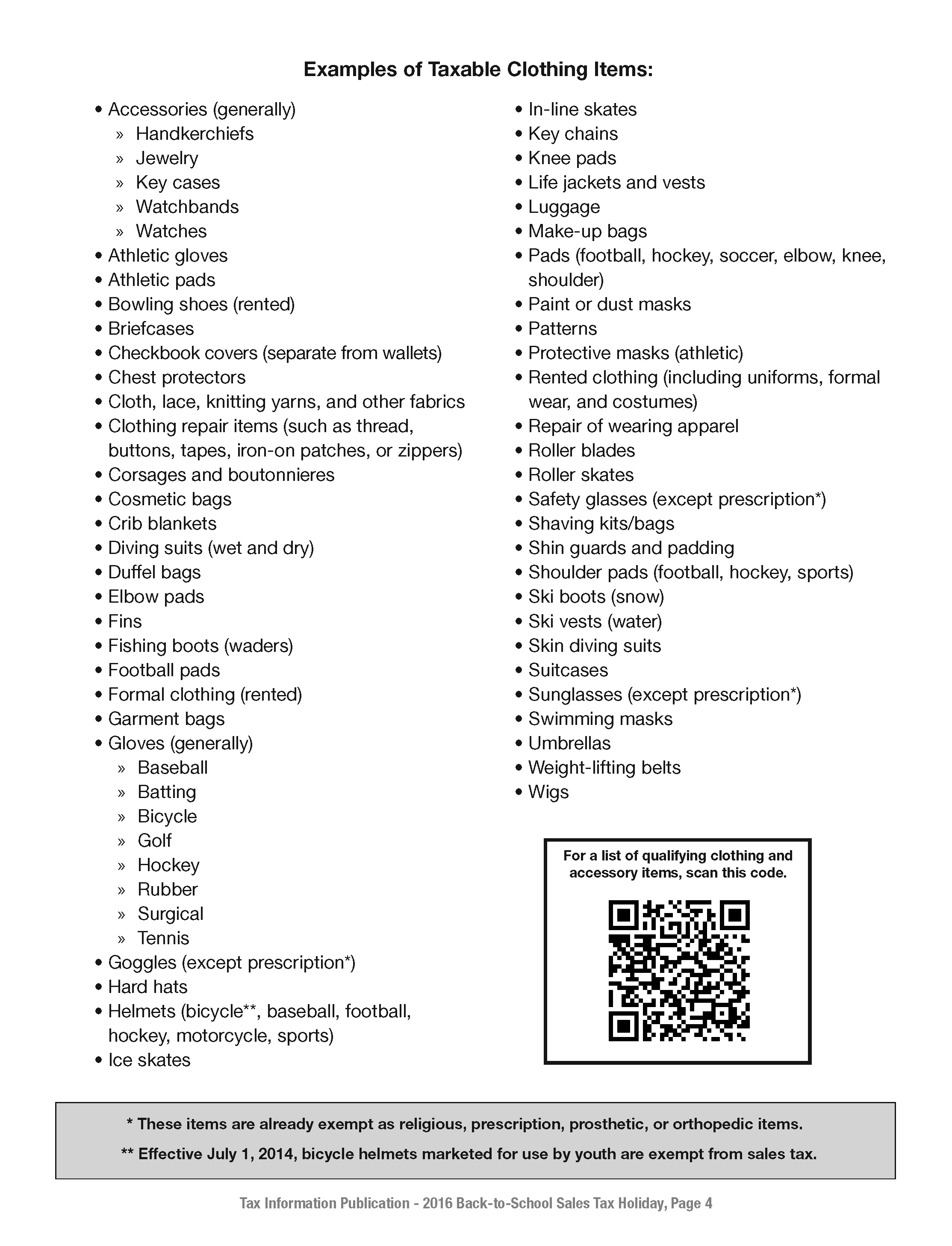

Among the tax-exempt products: Clothing, garments and accessories up to $60 each. Shoes up to $60 per pair. Sales tax will not be charged on items such as pens, pencils, erasers, rulers and glue. The state set a price limit of $15 per item for this category, but not on items such as staplers and computer paper. Personal computers and computer accessories are no longer included on the Florida Sales Tax Holiday.

All books, besides the Bible, are still taxable during the Florida Sales Tax Holiday 2016.

To maximize savings during the tax holiday weekend, consumers are welcome to use coupons or take advantage of buy-one-get-one-free sales. Retailers are planning on becoming more competitive during the back-to-school period, so there will be a chance customers will find better bargains over the weekend than they would other times of the year.

The full list of what is exempt and what is taxable is available here: