Democrats running against Miami-Dade Rep. Carlos Curbelo are claiming his support for the GOP tax reform bill that passed the House earlier this month is a boon to his corporate supporters, and not his constituents in Florida’s 26th Congressional District.

Shortly after joining most of his fellow House Republicans to vote in support of the tax reform bill in mid-November, Curbelo extolled how the legislation will benefit everyday Americans.

“What a country and what a day,” Curbelo said. “Today is a big day for so many in this country, especially for those who have been struggling to get by; who haven’t been able to get ahead; who have read about the economic recovery for years but have never experienced it. Today is a great day for them.”

As a member of the House Ways and Means Committee that was responsible for drafting the legislation, Curbelo’s message is one that Republicans have made over the past few weeks: it will provide tax cuts to working-class Americans (while ignoring how it will benefit the well-off).

As nonpartisan organizations have reported, every income level would receive an immediate tax cut from the Republican proposal, something that changes in the out years.

According to the Tax Policy Center, under the House plan, every income group would see tax cuts through 2027, but the richest one-fifth of Americans would receive 56 percent to almost 75 percent of the cuts.

Under the Senate plan currently under deliberation, every income level would receive a tax cut in 2019, but those earning $20,000 to $30,000 annually would face a tax increase the subsequent year, according to the Joint Committee on Taxation. By 2027, most people making under $75,000 each year would see a tax increase, while those making more would continue to receive a tax cut.

Supporters of the Senate plan say the bill offers a 20 percent small business tax deduction for all small businesses earning less than $500,000 a year, which they contend would allow them to keep more of their earnings, helping them to compete with their big business and international competitors – as well as hire more employees, raise wages and expand.

According to the Tax Foundation, 97 percent of small businesses earn less than this $500,000 threshold, meaning the overwhelming majority of small businesses would see relief from this provision.

Among those being called winners in the House bill is the commercial real estate industry.

“Commercial Real Estate, Which Fueled Trump’s Fortune, Fares Well in Tax Plan,” the New York Times reported Nov. 3.

Specifically, the paper reported that the industry had been concerned that the special tax treatment of “carried interest” — fees that are taxed as capital gains and not income — would be changed, or that they wouldn’t be able to deduct interest expenses from their taxable profits. There were also fears that that certain exchanges of commercial property, which currently enjoy a tax deferral, would face immediate taxation.

However, those provisions weren’t included in the House.

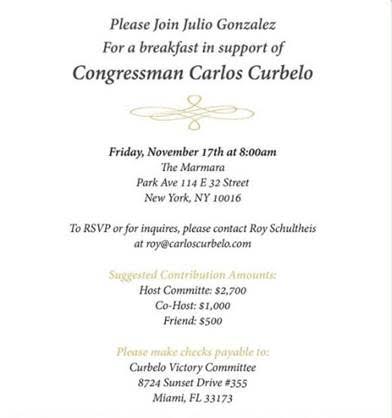

The day after Curbelo voted along with the majority of his GOP colleagues to support the Tax Cuts and Job Act, he flew off to New York City, where he attended a fundraiser held in his name by Julio Gonzalez, the CEO of Engineered Tax Services from West Palm Beach, which specializes in assisting property investment firms and their CPAs in identifying areas of “tax savings opportunities,” according to the organization’s website.

On their website, Engineered Tax Services boasts that “as a commercial property investor and owner, there are several IRS-sanctioned tax benefits within your reach designed to uncover hidden value and profitability within your investments.”

New York Republican Chris Collins turned some heads earlier this month when he described the intense lobbying from special interests seeking to protect favored tax provisions, saying, “My donors are basically saying, ‘Get it done or don’t ever call me again.”

Some of his Democratic opponents said the fundraiser echoes Collins’s gaffe.

“Curbelo’s tax plan is a handout to big corporations and the most wealthy at the expense of middle-class families so it’s not surprising they would want to throw him a thank you fundraiser,” said Debbie Murcasel-Powell, one of three Democrats who is running for the seat. “He’s a Washington politician playing quid pro quo with special interests plain and simple and at the end of the day, it’s our families in South Florida that will suffer.”

Curbelo is running for reelection to his District 26 seat next year, which runs from Miami-Dade County down to Key West. It’s become one of the most desired seats that the Democrats hope to flip next year, and the Sabato Crystal Ball Thursday calls the race a toss-up.

A spokesman for Curbelo’s reelection campaign said he intended to respond to the report, but ultimately did not reply back to Florida Politics.

The Senate is scheduled to resume work on their tax reform bill Friday.