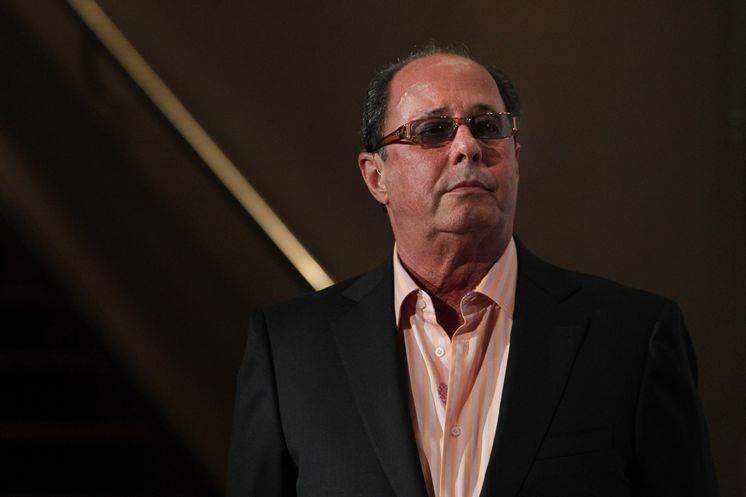

Former Tampa Bay Rowdies owner Bill Edwards is off the hook for what could have been a multi-million dollar lawsuit after a federal judge in north Georgia granted Edwards’ motion to dismiss the case this week.

Edwards and his company, Mortgage Investors Corp., has been battling a lawsuit claiming the company was defrauding veterans on home loans for nearly 13 years.

The St. Petersburg-based company refinanced home loans for veterans as a broker or lender in about 30 states, according to documents.

The lawsuit claimed defendants “have repeatedly violated the rules of the Interest Rate Reduction Refinancing Loan program” by overcharging veterans, charging unallowable fees and deliberately concealing those facts from the U.S. Department of Veterans Affairs to obtain taxpayer-backed guarantees for the loans.

The lawsuit also alleged Edwards’ company falsely certified to the VA that they were not charging unallowable fees.

While U.S. District Judge Amy Totenberg dismissed the case, she did so with clear reservations noting the case was “rife with disputed issues of fact.

But Totenberg had to apply precedent from a 2016 U.S. Supreme Court ruling in Universal Health Services v. Escobar to her decision. That ruling upheld the ability to hold a contractor liable for fraudulent claims under the False Claims Act, but it also found standards were not rigorous enough and instead required stricter interpretation.

“This case, in light of the record presently before the Court, fails to survive the summary judgment not because no fact issues exist (they do) but rather, because the facts relevant to materiality … simply cannot surmount the ‘rigorous’ and ‘demanding’ materiality threshold required by Universal Health,” Totenberg’s ruling read.

Totenberg expressed strong concern over Mortgage Investors Corporation’s business dealings with veteran loans, but could not overlook “controlling law.” The Universal Health decision, she said, “chokes the life out” of the defendants’ case.

The lawsuit could have come with a hefty price tag for Edwards, who was personally named as a defendant. Considering the 450,000 loans Mortgage Investors Corp. handled, most of which were taxpayer-backed VA loans, damages could have reached $180 million.

There were initially eight defendants in the case. Six settled in 2012 for a total of $161 million. Wells Fargo later settled over the lawsuit for $108 million.

Edwards did not respond to a request for comment Wednesday, but his company issued a statement.

“After substantial discovery and litigation, the federal court confirmed what MIC and Mr. Edwards have adamantly stated all along: All of the claims in the lawsuit lack legal merit,” the statement read.