On Tuesday, Jacksonville’s embattled utility JEA mulled a binary choice. And it took the road less traveled.

On one side: a “status quo” future (also described as a “death spiral”).

That could include double-digit rate hikes, hundreds of layoffs (including half the C-Suite), worse service, and a potential relocation from downtown.

At issue: declining demand for electricity, a function of increased efficiency in building and appliances, and people and companies going solar or getting off the grid.

Over the last couple of years, privatizing the utility outright was floated. And on Tuesday, Option B represented an exploration of what privatization could look like.

In theory, it could bring a billion dollars more value to the city, protect employee pensions, and allow the utility to build its new downtown headquarters. And it could stabilize the utility against a perpetual and irreversible decline in traditional revenue sources.

CEO Aaron Zahn and his chief lieutenants rehearsed three options for potential board approval. Two of them were “status quo.”

The third: radical transformation.

The board moved toward that transformation, culminating a process began early in Mayor Lenny Curry‘s first term when he revamped the board with his own appointees.

Before voting for seismic change, they heard about two more status quo responses.

The mildest “a traditional utility response including … workforce reorganization … rate changes and other revenue initiatives.” President/COO Melissa Dykes said “leaves JEA with too much debt.”

Scenario 2, explained by Chief Administrative Officer Herschel Vinyard, described ways to remove legislative “constraints” to JEA pursuing new business opportunities.

Lobbying for legislative or Constitutional change, as a strategy, would take “multiple years with limited success.”

Scenario 3, the winner, was outlined by CFO Ryan Wannemacher: “a non-traditional utility response … Removing all Constraints.”

This may have an “uncertain outcome,” said the CFO. But it’s a “local process,” a “10-year strategy” to boost valuation.

Traditional approaches? They “delay the inevitable.” They forestall JEA’s ability to “compete.”

The problem: that JEA is owned by the government.

A potential solution: reconfiguration to a “non-governmental structure,” perhaps as a community co-op, or a new corporation that would be an S&P 500 company upon inception.

Other solutions could include outside investors, such as some of the private utility companies that lobbied up last time privatization was discussed, buying in.

Benefits could be major: more than $3 billion of “value” for the city (replacing the JEA Contribution, with an extra billion to spare); $400 million in customer rebates; and 100 percent renewable energy for schools by 2030.

Employees would be guaranteed three years of stability, and the new downtown headquarters would be built after all.

“A once in a generation opportunity … no one will be left behind,” Wannemacher pledged.

From Foley & Lardner, former Jacksonville City Council President Kevin Hyde asserted that this plan would protect employee pensions “in the most secure way possible.”

CEO Zahn said the decision was binary: “to shrink or to grow.”

The board approved three resolutions.

One allowed Zahn, who will become the city’s highest paid employee per board discussion, to pursue the “non-traditional” response to “maximize” JEA’s value.

Another submitted pension reform legislation to City Council. And another protected the employee prerogatives outlined above.

The seismic change, in the end, was played as a fait accompli.

“The board finds itself at a historic moment. If you’d been paying attention, you’d have seen the historic moment coming,” said Board Member Alan Howard.

“We’re talking about exploring options, to grow and protect JEA from a certain death spiral,” Howard said.

Board members Andy Allen, Camille Johnston, and Fred Newbill expressed similar sentiments.

“You already know you’re going to die,” Newbill said.

The board accepted Scenario 3 with some modification. It ultimately decided to lobby for legislative outcomes and operate the business with current best practices, in addition to more aggressive business plan changes.

6 comments

Frankie M.

July 23, 2019 at 12:00 pm

A once in a generation opportunity … no one will be left behind,” Wannemacher pledged.

Where have I heard that before? Someone will be left behind but it won’t be the people in suite C. Who didn’t see this coming? It was as predictable as a cheap Nancy Drew novel. And right after they vote to give the guy whose solution to fix JEA is to sell it—a pay raise?? Half a Mil is on the lower end of industry standard and so is Zahn. I thought he was supposed to bring new ideas instead of the axe?

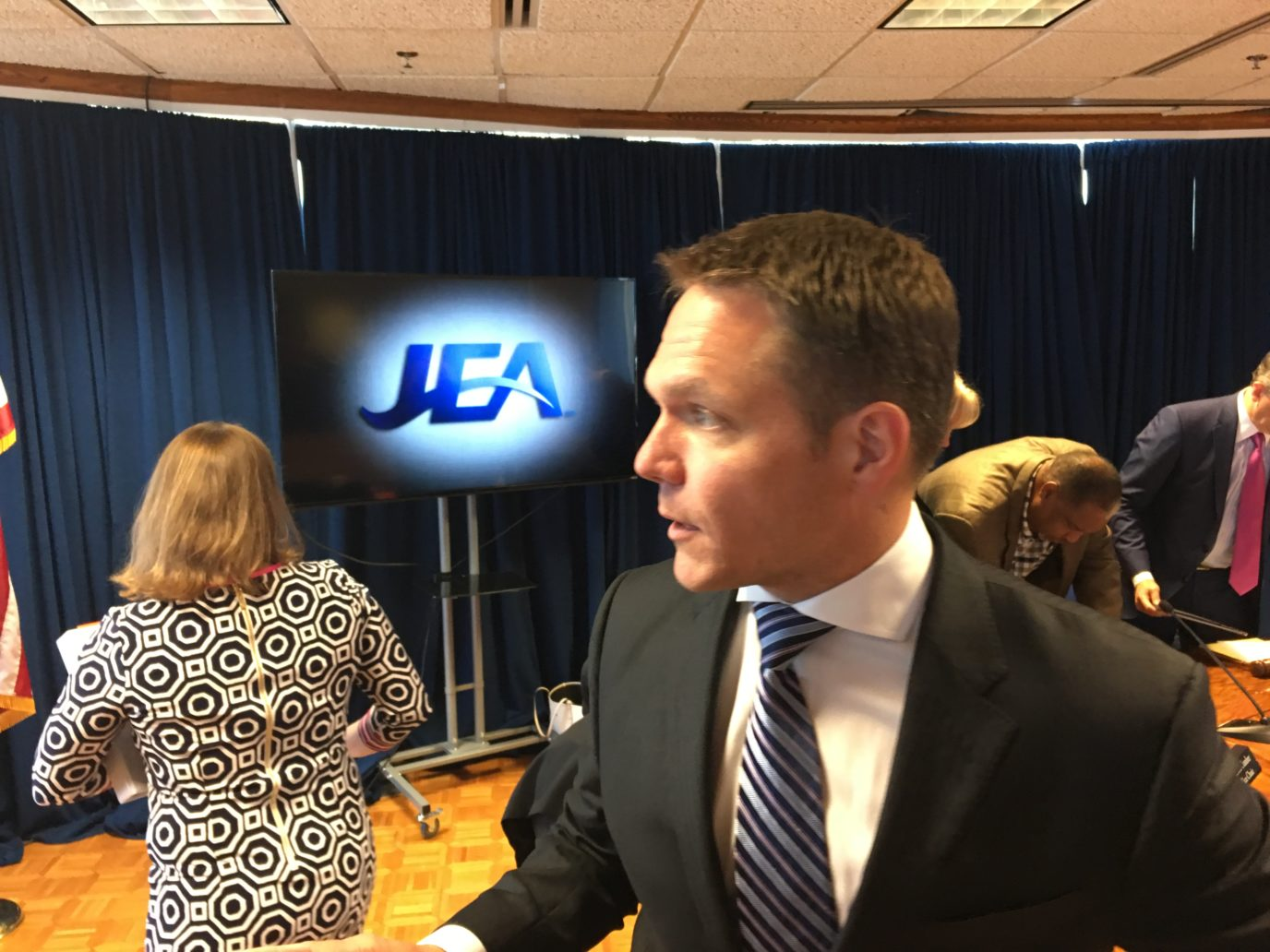

p.s. Is that a picture of JEA CEO Zahn running from T-U reporter Chris Hong? If you’re scared say you’re scared! I guess we all know who’s running the show now and it’s not Zahn.

darlene

July 24, 2019 at 8:50 am

Fast track: Aaron Zahn went from JEA junior board member to CEO in one year.

One allowed Zahn, who will become the city’s highest paid employee per board discussion, to pursue the “non-traditional” response to “maximize” JEA’s value.

At issue: declining demand for electricity,

Seriously????

Willy

July 23, 2019 at 2:18 pm

“A potential solution: reconfiguration to a “non-governmental structure,” perhaps as a community co-op, or a new corporation that would be an S&P 500 company upon inception.”

How can they be certain that the DowJones committee would select them to be part of the S&P 500 index if they went public? Nobody is automatically added to that group.

Perhaps they meant to say Fortune 500. If they are unsure of the distinction, they might want to give their consultants who would help them with an IPO a lot more leeway to call some shots.

Mike

July 24, 2019 at 1:29 am

What does these solutions do to the customer ? Raise the price on a service that goes out with every gust of wind or rain shower ?

John

July 25, 2019 at 6:31 am

This might just be the most horribly written article I’ve ever seen. You can practically see the author using “air quotes” with his fingers every fifth word as he confuses intelligence with sarcasm.

And that’s before even considering the accuracy of his statements. “Declining demand for electricity?” No, more like “slightly slower growth in demand”.

And nowhere in the article does he mention that JEA is and will continue to be profitable for the city government for years to come.

But most important here is intellectual honesty – is it REALLY a foregone conclusion that privatization of utilities is always better? There are lots of examples of other cities, counties, and states that have gone down this road under very similar circumstances – so why aren’t their results mentioned? (Spoiler alert: because moving to privatized utilities almost never benefits customers)

Brandon

July 25, 2019 at 6:54 am

“No one gets left behind” and “safe for at least 3 years” is quite the gap to overcome. Let’s be real, Curry has been pushing for this and got massive voter pushback so he installed the least viable candidate out of the pool to take the job with the caveat that he push Curry’s agenda to go private. I’m not even sure why the hell we vote anymore if these owns are just going to do whatever the hell they want anyways.

Comments are closed.