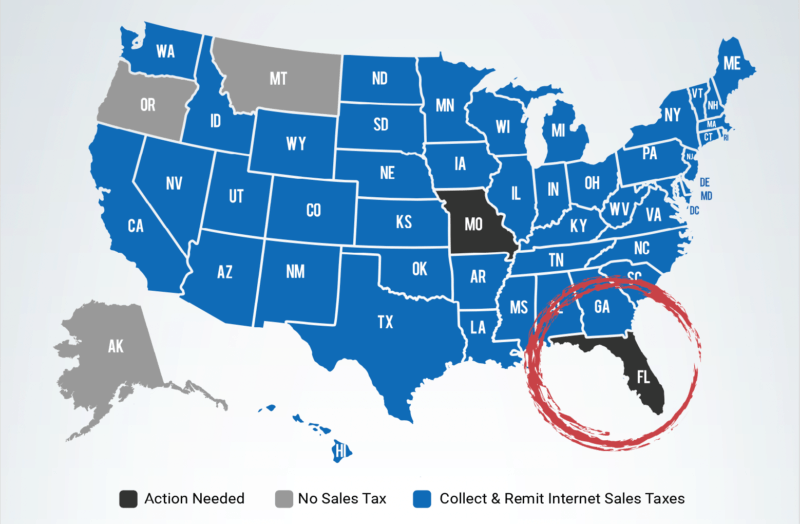

Florida is one of only two states that hasn’t changed its sales tax laws since consumers began fleeing to the world wide web for gifts, groceries and other everyday needs.

But that could change next year.

A pair of bills have been filed for the 2020 Legislative Session that would require online retailers to collect and remit sales taxes to the state, just like brick-and-mortar stores.

The proposal has heavy backing in the Legislature.

Sarasota Republican Sen. Joe Gruters is sponsoring the Senate version, SB 126, and fellow Republican Sens. Ed Hooper, George Gainer, Dennis Baxley, Keith Perry, Gayle Harrell, Ben Albritton as well as Democratic Sen. Linda Stewart have signed on as co-sponsors.

Gruters, who lists online sales tax as his “top priority” for the 2020 Legislative Session, said the bill “restores the free market.”

“The current system picks winners and losers. Foreign companies and out-of-state interests are winning out over Florida retailers. We’ve got to level the playing field,” he said.

SB 126 has already started moving. In October, the Senate Commerce and Tourism Committee advanced it with a unanimous vote. Its next stop is the Senate Finance and Tax Committee, which is chaired by Gainer.

Newberry Republican Rep. Chuck Clemons is the lead in the House. Joining him as co-sponsors for HB 159 are Republican Reps. Melony Bell, Heather Fitzenhagen, Sam Killebrew, Rene Plasencia, Anthony Sabatini and Charlie Stone as well as Democratic Rep. Mike Grieco.

“States are the laboratories of democracy, and Florida is most often the leader in the nation when it comes to good policy,” Clemons said.

“But when it comes to this issue, we’re one of just two states that has not yet fixed this problem. Florida businesses are losing out, and Florida families are suffering because of it.”

The only other state lagging behind in online sales tax laws: Missouri. The Show Me State is edging closer to a solution. If it gets it done, Florida would be dead last.

Currently, state law requires consumers to remit taxes owed on purchases made from out-of-state and foreign businesses

That means every time a consumer finds a product online at a cheaper price because taxes are not factored in, it’s on them to remit taxes owed to state and local governments.

Few Floridians go through the process of sending a sales tax check to the state, but if online retailers were assigned that duty, compliance would shoot up. Brick-and-mortar stores also wouldn’t be at a competitive disadvantage.

2 comments

Lary Sinewitz

November 12, 2019 at 2:44 pm

It’s about time

Dan Lanske

November 13, 2019 at 5:34 am

If they do this, then they best lower property taxes, or lower the overall sales tax. Tallahassee dont heed anymore money to play with

Comments are closed.