- coronavirus

- COVID-19

- DEO

- Florida Department of Economic Opportunity

- Florida Small Business Emergency Bridge Loan Program

- Ken Lawson

- new coronavirus

- novel coronavirus

- Ron DeSantis

- SBA

- Small Business Administration

- Small Business Emergency Bridge Loan

- Small Business Emergency Bridge Loan Program

- U.S. Small Business Administration

The Florida Department of Economic Opportunity (DEO) approved its first two small business emergency loans Friday for businesses impacted by COVID-19.

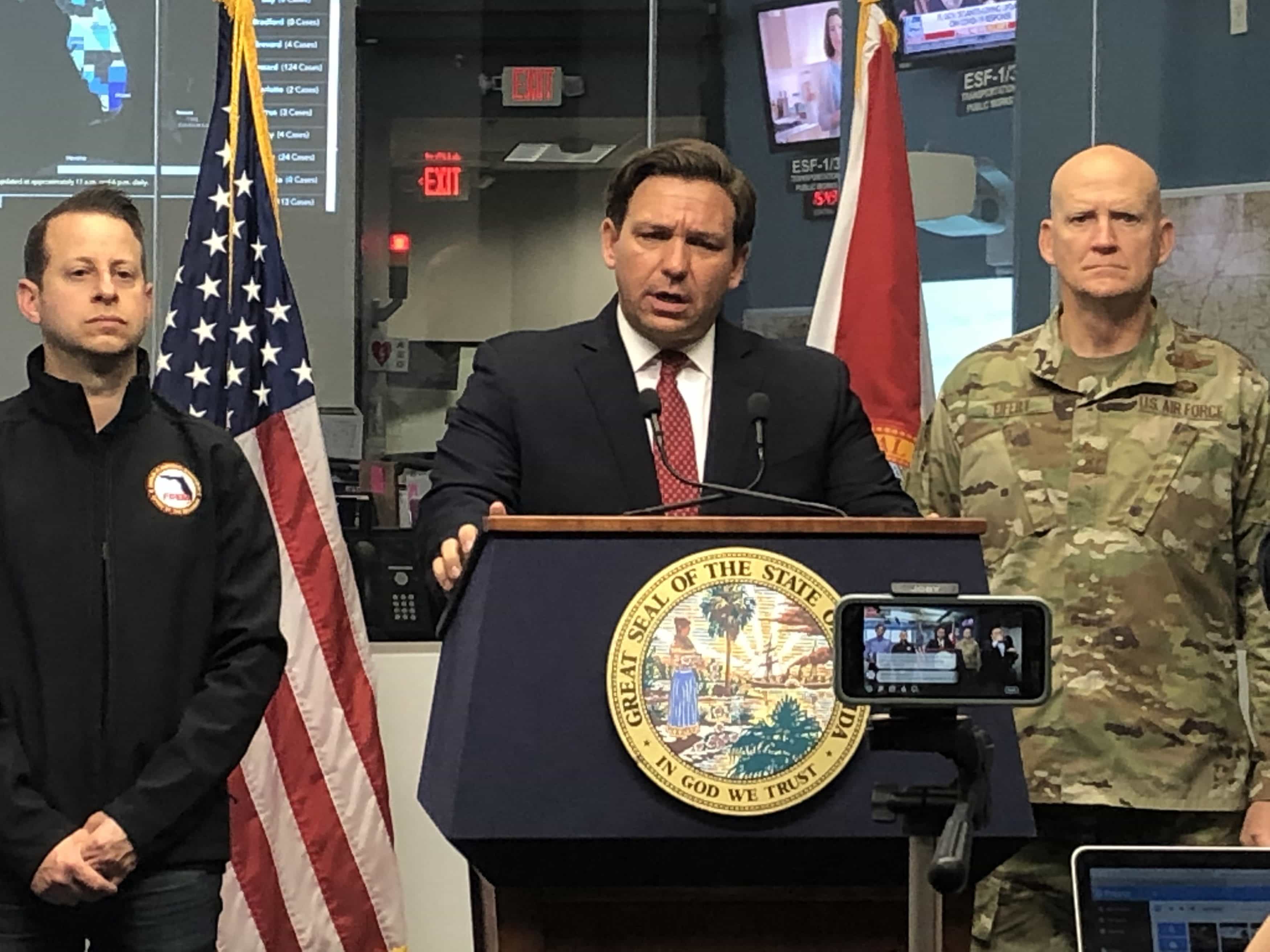

Gov. Ron DeSantis announced the Small Business Emergency Bridge Loan disbursements during a press conference later in the day. The two one-year, $50,000 loans were approved after a three-day review process after DEO kicked off the short-term, interest-free loan program Monday.

“For government work, it doesn’t get any quicker than that,” DeSantis told reporters.

The bridge loan program provides short-term, interest-free loans to small businesses that experienced economic injury from COVID-19.

Daniel and Tracey Shrine, owners of Full Press Apparel, and Angelo and Kimberly Crowell, owners of a Jersey Mike’s Subs location, both in Tallahassee, are the first recipients of the loan.

“I am pleased to be able to provide our first loans to the small business owners who are in a tough time through no fault of their own. I look forward to other businesses following suit,” the Governor said in a later statement.

DEO administers the loan program in partnership with the Florida SBDC Network and Florida First Capital Finance Corporation to provide cash flow for small businesses hit economically by COVID-19. Up to $50 million has been allocated for the program.

“We appreciate Governor DeSantis keeping small businesses as a priority during this difficult time,” DEO Director Ken Lawson said. “Providing support to small businesses throughout our state will help to expedite our recovery.”

Small business owners with two to 100 employees located in Florida affected by COVID-19 can apply for short-term loans up to $50,000. These loans are interest-free for up to one year and are designed to bridge the gap to either federal Small Business Administration loans or commercially available loans.

He has previously asked the SBA to turn on its loan program.

To be eligible, a business must have been established prior to March 9, 2020, and demonstrate economic impacts as a result of COVID-19. The application period ends May 8, 2020.

One comment

Sonja Fitch

March 24, 2020 at 7:21 am

Desantis thank you. Shut all of Florida down til may. Stop the piecemeal approach. Shut Florida down. Ignore the paranoid delusional liar trump! I still have hope that you will serve and protect Florida and America. This will not be over for months. Tighten restrictions. Shut us down for all of us. I know you “love” you some trump. But the paranoid delusional liar trump does not have the ability to make decisions. Stay the course sir and shut us down

Comments are closed.