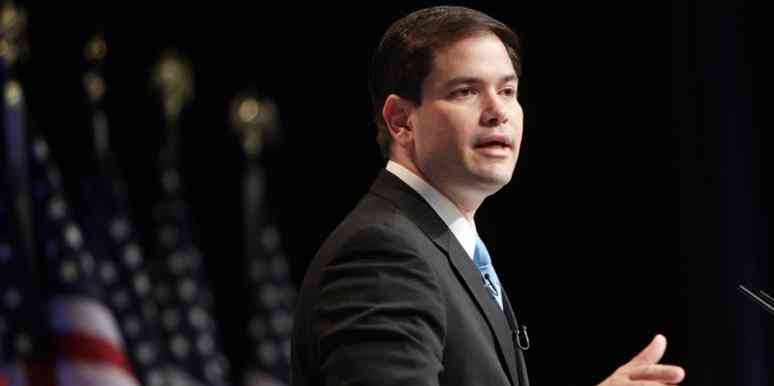

U.S. Sen. Marco Rubio is praising a federal program for approving nearly $5 billion for small businesses in its first day of operation.

The Paycheck Protection Program is slating $349 billion to help small businesses hold onto workers amid the economic slowdown caused by the novel coronavirus outbreak. The program — which went live Friday — was set up under the $2.2 trillion relief package approved by Congress at the end of March.

“Just last week, Congress passed and President [Donald] Trump signed the Paycheck Program into law,” Rubio said in a Saturday statement.

“Yesterday, just days after becoming law, small businesses across the country received billions of dollars in Paycheck Protection Program loans. Nearly all of the lending completed yesterday came from existing 7(a) small business lenders like community banks. As I argued when I first proposed to use the SBA’s guarantee programs to get assistance to small businesses quickly, these community banks were ready to go on day one. Their actions yesterday saved hundreds of thousands of jobs.”

The money is available to companies with 500 or fewer employees to help cover payroll costs during the downturn in the economy due to social distancing. That funding can go toward businesses affected by the novel coronavirus outbreak during a period spanning Feb. 15 to June 30.

The Small Business Administration is overseeing the program, with banks in charge of the actual application process.

But some small banks were not ready to immediately accept applications. Larger institutions, such as Wells Fargo and Bank of America, were mostly able to get started on that application process without incident.

While acknowledging some of those hiccups, Rubio nevertheless argued the program is off to a good start given the unprecedented nature of the crisis.

“The speed with which the administration stood up this program is an incredible feat, but it’s also important for a little patience and a little honesty,” Rubio said.

“When you launch something this unprecedented and far-reaching just seven days after it becomes law there will inevitably be problems. The good news is that every problem we saw yesterday can be fixed. I am on the phone constantly with Treasury, the SBA, and bankers across the country and all across Florida to make sure it gets better each day we move forward.”