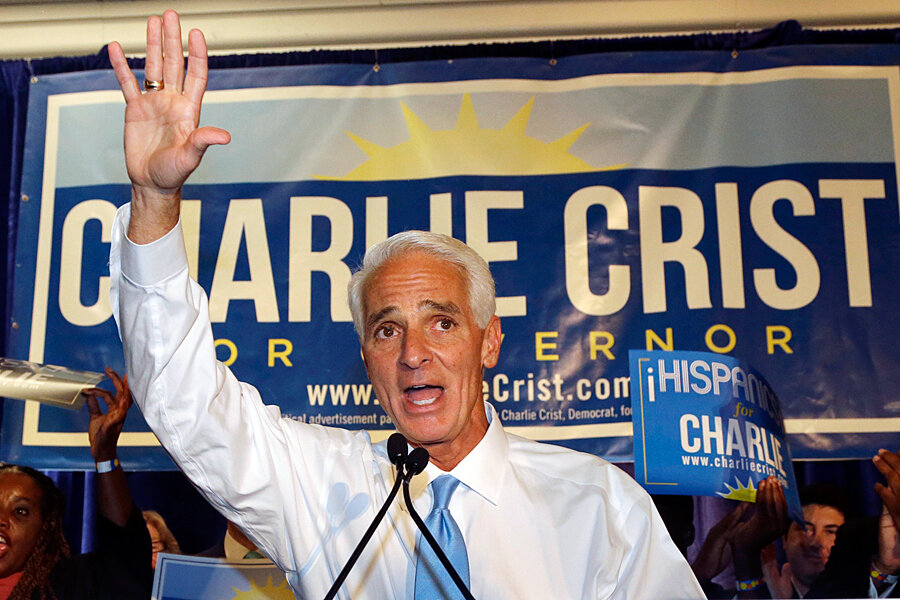

Rep. Charlie Crist, a Democratic candidate for Governor, slammed Gov. Ron DeSantis on Monday for not pushing to fix Florida’s troubled property insurance market, which has seen steep rate hikes for most homeowners

“Prices are rising and Floridians are hurting, but Gov. DeSantis is ignoring the problem — he’d rather focus on culture wars and his 2024 political ambitions,” Crist said in a released statement.

Five companies last year opted not to renew more than 120,000 policies, and another company, St. Johns Insurance Co., went insolvent. Although St. Johns’ policies were taken on by Slide Insurance Co., those moves put pressure on the rest of the market, which received large rate increases by state regulators, driven mostly by surges in roof claims and litigation costs.

DeSantis has said if the Legislature can come to an agreement on insurance reforms he’ll sign it into law, but the Special Session he called to address congressional redistricting that starts April 19 won’t include property insurance or any other subject. Also, the reforms pushed in the last Legislative Session would not have immediately lowered premiums.

“Gov. DeSantis has turned a deaf ear to the insurance crisis facing our state. When I was Governor, I lowered property insurance premiums,” Crist said. “And when I’m elected, I’ll do it again.”

The GOP-led Legislature considered some changes to the market during its 60-day Session that ended last month, but ultimately couldn’t pass anything. The Senate advanced SB 1728, which would have installed a new roof-only deductible for new policies — a provision endorsed by the DeSantis administration. But the House was skeptical of the measure.

Insurance Commissioner David Altmaier, however, said during last week’s Cabinet meeting that he’s allowing insurers to offer the roof deductible as an option for customers.

Other parts of the bill were aimed at making Citizens Property Insurance, a state-run company, have rates more in line with the private market. Citizens is designed to be an insurer of “last resort” — an insurer for homes the private market won’t cover.

But Citizens’ rates are capped at 10% increases per year, while some large private companies have seen rates rise by more than 30% in parts of the state. That’s pushed homeowners into Citizens rather than the private market.

GOP lawmakers have sought to keep the Citizens policy count low, because if a large enough hurricane hits the state and erases its $6.5 billion surplus, assessments would be placed on all homeowner and auto policies in the state to pay for the claims.

Crist has tangled with Florida’s complex property insurance market before. When he was a Republican Governor from 2007-2011, he famously said “good riddance” to State Farm. At that time, the insurance giant threatened to leave the state in the face of Crist’s refusal to soften regulations or allow larger rate hikes as the market rebounded from the massive losses stemming from the damaging 2004-2005 storm seasons.

5 comments

Arthro

April 5, 2022 at 1:25 pm

Charlie Crist is a first class tool. He’s hoping that enough time has passed for us to forget that he made a mess of the Florida property insurance market when he was Governor, then he bailed out and ran for Senate after just one term. He doesn’t have any solutions, other than raising the Citizens policy count, putting the state on the hook for billions, and bringing in undercapitalized new Florida domestic insurers – like the ones who have failed over the past few years. Charlie has no answers. Only pandering, his specialty.

Vértice

April 5, 2022 at 8:46 pm

Nice speech Republican

Make sure you go over the notes again. Lies have to be memorized to be effective. Or else your just like each other.

Reedman Bassoon

April 6, 2022 at 10:37 am

Insurance is a form of gambling. It is not a right. There is no “insurance crisis”. California had the same problem with earthquake insurance after Loma Prieta and Northridge. The legislature thought they were smarter and more powerful than the private market — and they were wrong. (Identical to what happened with the Enron/California blackouts electrical deregulation fiasco). People will choose to do no maintenance and let property disintegrate — look at the Surfside collapse. The owners VOTED, and CHOSE the lowest cost result. People will choose to go without insurance. The only real issue is: do the banks require insurance as a prerequisite for getting a mortgage? The realtors will go nuts if mortgages become harder to obtain.

FL Consumer

April 6, 2022 at 4:07 pm

Charlie did a great job with insurance when he was Governor, so consumers like me would like to see him back in office. Charlie signed major reforms that stabilized the Florida market and it has worked ever since, despite the best efforts of some legislators to undo his work. What Charlie did was give consumers the right to buy a policy from Citizens if they couldn’t find a reasonably priced policy on the private market. This steadies the market and holds prices down using a “glide path” for rate increases to avoid rate shock. And despite Citizens having the rejects from all the private companies, it made money last year. Imagine that!

And FYI, Florida is NOT on the hook for millions. Citizens made money last year, check it out, and the Cat Fund which offers reinsurance to insurers at a discount is also profitable and could pay for any storms that hit the state. Some private insurers are still profitable or had only small losses, while others were mismanaged and lost their investors shirts.

Don Thompson

April 12, 2022 at 3:36 pm

Is Kinsurance Company out of Tampa a reputable insurance company in the state of Florida. Their rates for homeowner’s insurance raises the question of claims being successfully handle in Florida.

Comments are closed.