Florida lawmakers poised to act against soaring property-insurance rates may address allegations of insurance fraud and may manage to lure jittery reinsurance companies back into Florida’s crippled marketplace.

But one thing they can’t do is change the weather.

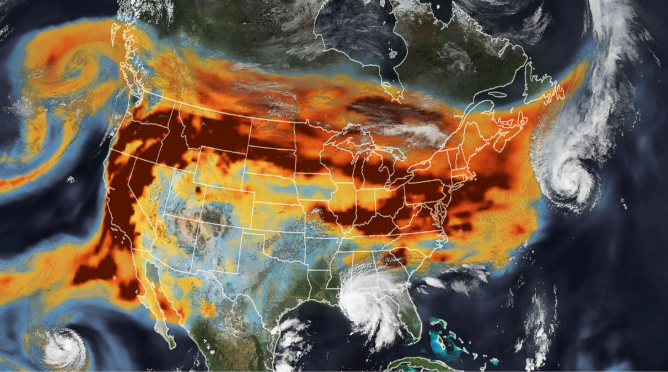

“Insurers believe that due to climate change, this is the new normal. They’re finding that catastrophic and non-catastrophic weather events are increasing in severity every year,” said Paul Handerhan, president of the Federal Association for Insurance Reform, a national nonprofit advocacy organization based in Fort Lauderdale.

The consequences of climate change not only include catastrophic — and increasingly expensive — weather such as hurricanes and wildfires, but also more everyday events such as storms that pelt residential and commercial properties with straight-line wind and hail.

Add in fast population growth in Florida, high demand for high-risk areas such as coastal communities, higher prices for construction and labor, and alleged abuse by contractors who lure policyholders to file inflated damage claims, and you have what one prominent insurance executive calls “total collapse of the overall Florida marketplace.”

The actuarially sound way to respond to the new normal is to raise rates, reduce coverage, or throw in the towel, as eight property insurance companies in Florida have done since 2018. Just this week, three others asked state insurance regulators to approve hefty rate increases — as high as 49 percent on policyholders not among the tens of thousands who recently lost coverage altogether due to non-renewals.

Over time, Handerhan said, property insurance coverage will become so expensive that only the wealthiest of the wealthy can “afford to live in paradise.”

The imminent problem

Job 1 for lawmakers convening in Special Session next week, said Handerhan, is to secure as much reinsurance coverage as possible for Florida’s remaining insurance companies by June 1, the start of the official hurricane season, 13 days away.

Reinsurers with access to vast capital insure primary insurance companies to cover payouts for catastrophic events that exceed the primary companies’ available funds. Without reinsurance, primary insurers cannot afford to offer coverage in risky areas — which applies to most of Florida.

“The most pressing, imminent problem is addressing the reinsurance issue,” Handerhan, a 20-year property and casualty executive, said in an interview Thursday.

“That has to be a part of the agenda and that has to be meaningful. They have to provide some comprehensive reforms to provide an ample supply of reinsurance capacity, so these insurers are able to complete their programs and have the reinsurance capacity they need to get them through this hurricane season.”

Handerhan said that means lawmakers must tap billions of dollars in Florida’s Hurricane Catastrophe Fund. The so-called Cat Fund provides reinsurance coverage but likes to be stingy with it to keep a strong surplus on hand in case Florida suffers another Hurricane Andrew (1992) or season of back-to-back hurricanes like the series that clobbered Florida four times in 2004 (Charley, Frances, Ivan, Jeanne).

Citizens Property Insurance Corp., the state’s insurer of last resort, has more than doubled its volume of policyholders in less than two years to absorb customers left stranded when their insurers non-renewed their policies or went out of business. On Wednesday, its board of governors authorized spending $400 million to buy $4.25 billion in reinsurance coverage. That’s nearly double what it needed last year.

“This market is completely,100% out of control,” said Barry Gilway, president, CEO, and executive director of Citizens, during the board of governors meeting. “It all has to do with the total collapse of the overall Florida marketplace, and that collapse continues.”

Gilway said the massive growth in the state’s last-resort insurer, caused by the massive drop-off of private coverage, has seriously spooked reinvestors. It would be “an amazing event” if Citizens is able to land even a substantial portion of the $4.25 billion in reinsurance capacity it seeks, he said.

“Were struggling, frankly, to get reinsurers interested, knowing that level of growth, not knowing when it’s going to stop, and how far it’s going to go,” Gilway said. “We’re struggling to find reinsurers that are willing to provide that level of capacity.”

Gilway said the insurance industry is watching closely to see “whether anything relevant” will come out of next week’s special session.

“That will be a determinant, I think, in terms of whether reinsurers in any way, shape, or form reverse their position and release capacity into the marketplace.”

The long view

At the Federal Association for Insurance Reform, Handerhan recommends tapping into the Cat Fund, reducing the state’s “Rapid Cash Buildup Factor” that imposes a 25% surcharge on policies to keep the Cat Fund flush with cash, and other measures to “treat the symptoms” of the crisis.

The long view, he said, is that property insurance rates will remain high and get higher as modeling companies, which calculate likely losses in various scenarios for specific areas hit by specific events, improve their accuracy.

These companies increasingly are setting higher and higher estimates on catastrophic and non-catastrophic losses, based on historical data showing the costs of the new normal of severe weather.

But also, as legislators have widely asserted, fraud adds to the escalating losses. Handerhan said the fraud at hand mostly involves roofing contractors who search for “localized” events of severe weather and go there to encourage policyholders to file claims, whether or not it is clear the roof was damaged by the weather event.

“They always find something,” he said. “It’s almost impossible to disprove it.”

Insurance companies in Florida want to stop insuring aging roofs, which would impose financial hardships for low-income and fixed-income residents who may not be able to privately afford to replace their roofs, Handerhan said. That can lead to the mortgage holder “force-placing” insurance on a homeowner’s property that typically costs two to three times as much as private market coverage and only covers the outstanding balance owed to the mortgage company. And that, he said, can lead to increases in foreclosures.

“Fraud is really, truly a problem … and it has a ripple effect, especially for the most vulnerable,” Handerhan said.

“It’s going to get more expensive. People of means can do it. It could become cost-prohibitive for others. That’s Florida.”

___

Laura Cassels reporting via Florida Phoenix.

Florida Phoenix is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Florida Phoenix maintains editorial independence. Contact Editor Diane Rado for questions: [email protected]. Follow Florida Phoenix on Facebook and Twitter.

7 comments

AC

May 20, 2022 at 11:38 am

No-one is talking about the 25% rule that requires many homeowners replace their entire roofs instead of just the areas that were damaged. About 9 years ago, my permit for roof repair (about $3k in repairs needed due to a tree falling) was denied due to the 25% rule and I was required by the county to replace the entire roof. Citizens at the time refused to pay for the entire roof replacement even after mediation during which they said they don’t have to follow the rules other insurance companies have to follow.

Bottom line was trees fell, legitimate covered damage occurred, repairs needed, state required full replacement and wouldn’t let me complete just repairs, insurance company refused to pay requiring I pay for the roof replacement on my own (which I did) then later sue them which I didn’t do because of the additional time and expense involved.(I found no roofers willing to replace the roof and bill the insurance company back then.)

IMHO, The insurance industry created this animal through denial of valid claims. The states 25% rule helps ensure these claims are winnable through litigation for roofing companies and attorneys, legitimate or not. 9 years ago I needed 18k for the replacement of my roof for which I was going to pay another 10k out of pocket to upgrade to a 50+ year metal roof. If this were to happen today I could just call a roofer, get a replacement with a 25 year roof and then they would handle everything for me, likely costing the insurance company 3-4 times as much though inflated costs and litigation expenses. Meanwhile you have insurance companies not accepting good roofs over 10 years old and dropping policyholders for older effective roofs… so I guess if someone shows up and says, hey you’ve got some damage, you want a new roof?… The average homeowner is going to take the opportunity because they need a new roof every 10 years to be sure they can be insured.

Solutions? The current ideas of allowing insurers to not cover roofs and prorate roofs will land the homeowner in jeopardy of getting forced place insurance for their mortgage if their policy doesn’t fully cover the potential roof replacements or potentially getting foreclosed on if they can’t afford to replace their roof from a legitimate claim leaving the home in jeopardy from further damage. The state needs to do more to facilitate legitimate repairs without requiring replacement and require/facilitate reasonable payment without litigation. I hate to say it but they need to also cap profits on roof replacements and repairs for roofing companies while allowing repairs to be more profitable than replacements incentivising repairs. If the state proceeds in letting insurance companies not pay or completely for roofs they need to make sure mortgage companies aren’t going to force place additional insurance for roofs, perhaps by requiring mortgage companies to finance the difference through a second priority mortgage or creating a state loan program that guarantees the low interest funds to cover replacement where needed. These mechanisms should also kick in as soon as the roof isn’t fully covered to allow homeowners to replace and fortify their roofs before disaster strikes at now cost to the insurance companies.

IMHO these types of solutions and more are needed to reduce the insurance burdens and claims. I’m not really confident that our state legislature that has already waited way too long in addressing these issues will do anything that will help fix them in a way that will significantly reduce the insurance cost and burden on homeowners.

Renae

May 20, 2022 at 5:24 pm

I paid to have inspections done 7 months ago to keep my insurance with citizens. 6 months later my insurance doubled. Now after 7 months they want to come back and have the whole home inspected again…..oh boy it’s free this time! My roof isn’t even 5 years old yet and I have my own termite bond and inspection each year. I’m disabled and this is ridiculous.!

AC

May 21, 2022 at 12:57 pm

Yup, citizens it the worst. I was in a similar situation as you where they kept trying to drop me for a different reason every six months… the Florida Office of Insurance Regulation was able to permanently resolve this after 1 complaint in only about a week and they never tried to drop me again. (May take longer now with more homeowners having issues.) I’m not sure how these links will appear but here is their info for complaints:

Request assistance with an insurance question or file an insurance-related complaint (c/o Department of Financial Services)? https://apps.fldfs.com/eService/Default.aspx

Consumer Helpline Contact Information

Statewide Toll-Free: 1-877-MY-FL-CFO (1-877-693-5236)

Out of State Callers: (850) 413-3089

TDD Line: 1-800-640-0886

Email Address: [email protected]

Best of luck.

Peter Olson

May 21, 2022 at 8:24 am

This raises the whole question of other states responsibility to support financial aid through the federal welfare of FEMA and other disaster relief agencies and loans, let alone increased private insurer rates that will rise not just in Florida because of politicians corruption but everywhere else as well. I think most US citizen supports natural disaster relief, but when that disaster is the result of decisions made by the injured state’s politicians for years, why should those who have taken better care of their own people be required to pay for others mistakes? As storms become more intense off the Floridian coasts this is just the tip of the proverbial iceberg. Best for the Sunshine State to start paying into a massive rainy day fund.

AC

May 21, 2022 at 1:13 pm

Very good points. Our legislature loves those kinds of funds… so they can re-allocate them to private entities for unrelated things through state contracts later.

Like the housing fund (Sadowski Fund/SAIL Programs for reference) where they keep taking money out of for other things… over the last 20 years since it was created for a total of about $2 Billion redirected for other purposes with just $365 million left currently. The funds go to development incentives for affordable housing that when distributed gives the state a 6 to 1 return on investment. So $2 Billion would have equated to $12 Billion in new affordable housing over the last 20 years had it been properly distributed… but its not being properly distributed and now we have an affordable housing crisis. (This wouldn’t solve the problem alone but just shows how short sighted, greedy, and corrupt our legislature is as these funds get redirected for “special” purposes.)

Just a comment

May 22, 2022 at 10:33 pm

Disaster zones are the best places to flip your homes for 100 of thousands

Just a comment

May 22, 2022 at 11:15 pm

We heard the call for money’s now money’s Time

Comments are closed.