Florida’s homeowners’ insurance crisis has led to multiple special sessions and intense focus from Gov. Ron DeSantis and CFO Jimmy Patronis.

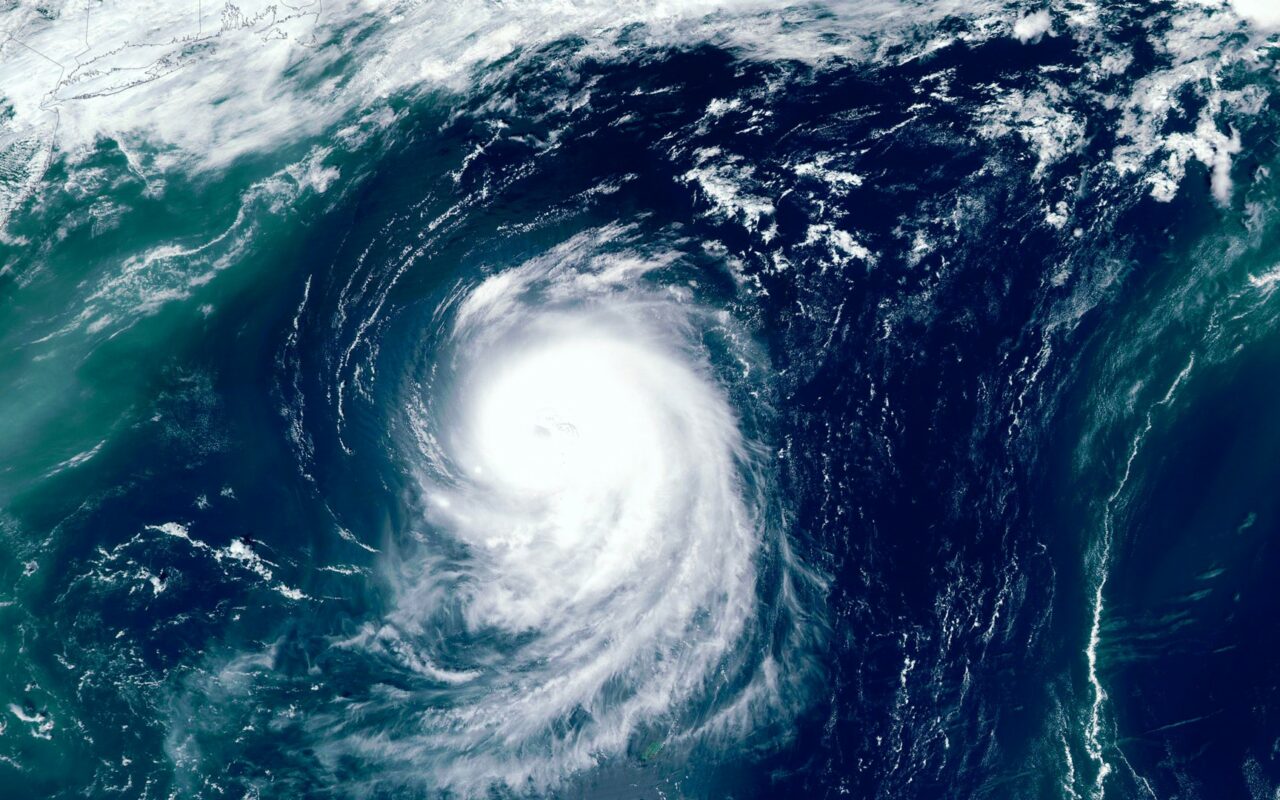

It’s a complicated situation, dependent on several factors, including the whims of Mother Nature’s tropical tantrums.

But one of those factors is quite simple: Floridians who prepare their homes for possible hurricane strikes — with wind-hardened roofs and impact windows and doors — often see an immediate decrease in their insurance bills. This can mean thousands and thousands of dollars in reduced premiums.

The problem: many homeowners have seen their credit scores dip into territory unfriendly for traditional home improvement loans. Some are forced to use credit cards to finance these improvements as banks turn them away. And we all know how ridiculously high those interest rates can be — often pushing close to 30%.

Others are forced to put off replacing roofs, windows and doors and are left to hope they don’t lose the seasonal game of Hurricane Roulette, all the while paying thousands more in insurance premiums.

But there is an alternative. The Florida Legislature approved it and thousands of Florida homeowners have successfully utilized it over the years.

It’s called the PACE program.

Let’s see how many boxes it checks:

— Does it allow homeowners with low credit scores to get home improvement financing? Check.

— At rates less than half what credit cards charge? Check.

— For projects that make their homes safer against hurricanes? Check.

— With no money down? Check.

— With flexible terms? Check.

— And with potentially hundreds or thousands of dollars of savings on homeowners’ insurance? Check.

Sounds good, right?

Unfortunately, some PACE critics fail to acknowledge the benefits of this program that the Florida Legislature passed years ago.

Amortized interest has been around for decades. Everyone should know that a 30-year home mortgage means total payments equal to more than the house’s value. This model PACE works on is the same one banks have used for decades.

The process through which PACE financers take homeowners is rigorous, transparent and multi-stepped. This isn’t a high-pressure timeshare deal. With most PACE financing companies, steps are audio recorded and the terms of the transaction are clearly communicated with homeowners multiple times.

And guess what — most borrowers appreciate the opportunity to improve their homes this way. They also enjoy the convenience of making payments through their property tax assessment, much like many homeowners already do with their taxes and insurance in escrow.

“I was totally stuck,” said Christine Allen of Sarasota County. “I had gone through some tough times, but my roof was way past its life span. PACE gave me the option of a 20-year loan at around 10%.”

“Now I have a new roof, a small monthly payment, a lower homeowners’ insurance bill, and a lot less stress,” Allen said. “There was no way I could pay that amount for a roof out of pocket.”

Allen said the process was transparent and thorough.

“Every part was explained. They tell it to you 10 different ways. They provide every piece of paper you could possibly want.”

You may have heard about legal wrangling over PACE — that’s a story for another day. Right now, it’s time to set the record straight on the value of the program and its positive impact on Florida’s insurance crisis.

PACE checks a lot of boxes for hardworking homeowners who have eagerly taken advantage of the program.