The Government Accountability Office (GAO) recently published a report stating that federally issued Direct Student Loans placed in Income-Driven Repayment (IDR) plans will cost the government $74 billion, which is higher than previously estimated.

The Government Accountability Office (GAO) recently published a report stating that federally issued Direct Student Loans placed in Income-Driven Repayment (IDR) plans will cost the government $74 billion, which is higher than previously estimated.

According to the GAO, as of June of this year, 5.3 million student loan borrowers are repaying their loans in IDR plans. This means 5.3 million borrowers are repaying their loans with smaller monthly payments, thereby extending the time in which they will actually repay the entirety of these loans. All the while, loan interest continues to accrue, holding borrowers underwater even longer. Couple this with the usage of Public Service Loan Forgiveness, and other forgiveness programs, it is clear the federal government, and the taxpayers backing these loans, will never see the money it has lent.

I believe all who desire to obtain an education should have the opportunity to do so. Education, particularly higher education, has the ability to raise individuals and families from less than desirable situations in life and open the door to greater opportunities. Education prepares us for much more than just work. It gives us the ability to better contribute to our families and society, and enables us to more effectively help others and ourselves.

Loans are, indeed, an important component in helping students obtain an affordable education. Unfortunately, most students today are saddled with extraordinary debt and have entered one of the weakest economic recoveries in history. Such a dangerous combination limits students’ ability to start paying back their taxpayer-backed loans after graduation. This is a serious problem we cannot continue to ignore.

Throughout the past 25 years, the cost of attending college has quadrupled. About 60 percent of students take out loans to finance their education, and more than half borrow over $10,000. In fact, more than 43 million Americans owe nearly $1.3 trillion in student loans, with a repayment delinquency rate of 11.6 percent. That is more than $150 billion in student loan delinquency, not including interest.

As the cost of a college education continues to rise, student loan borrowing will continue to take place. Something must be done to incentivize and enable borrows to pay off their loans and lessen the burden on the government.

In order to do just that, I introduced the Student Loan Repayment Act of 2016. This bill adds employees with student loans as a qualifying population to the Work Opportunity Tax Credit. In order to receive this credit, the employee must be an individual with an associate degree or higher and have at least $10,000 in student loan debt.

Additionally, the Act allows for a $1,500 tax credit to employers who implement a repayment match program for their employees. This tax credit is available for each program enrollment by an employee and is spread over three years. In order to receive this credit, employers must meet a minimum qualifying match contribution of $2,000 per year.

Lastly, this bill states the match program contributions made by the employer are considered income to the employee. Therefore, the employee will be taxed on the contributions made by the employer, and thus, is held accountable to our tax system.

The Student Loan Repayment Act does not provide a bailout or exempt student loan borrowers from repaying their incurred debt. Instead, this bill helps students become gainfully employed and pay off their loans while employers are benefited by hiring skilled and educated employees with a vested interest in long-term employment.

As the father of two sons and a former small-business owner, I know firsthand the important role education plays in today’s society. Students are the foundation of our country’s future, and we must ensure they have the ability to afford a college education and compete in an increasingly global marketplace without being bogged down by crippling debt.

As we focus on helping students repay their taxpayer-backed student loans, improve their credit and contribute to our communities, I will continue working with my colleagues on solutions to create jobs, boost our economy, and reduce our debt and deficit.

___

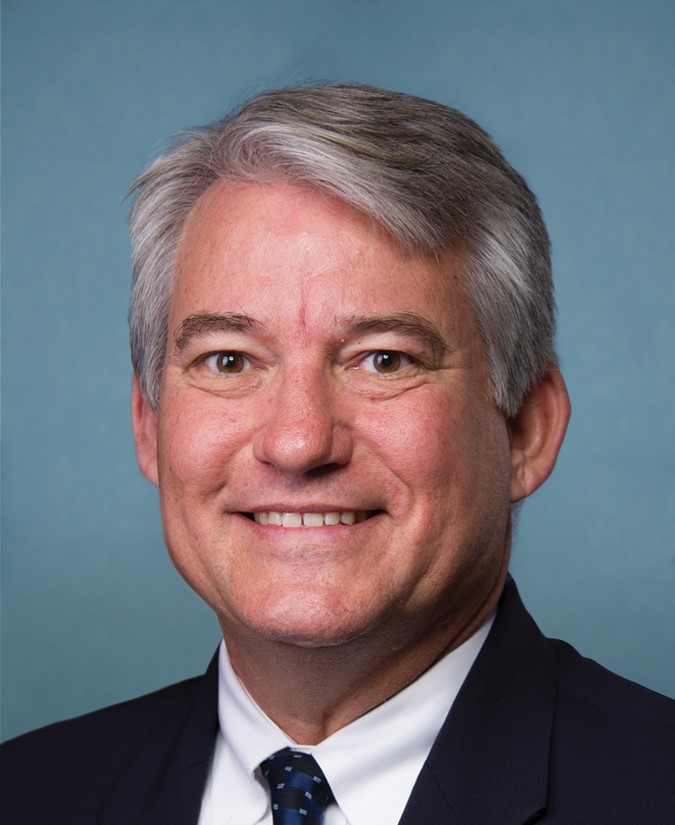

U.S. Rep. Dennis Ross represents Florida’s 15th Congressional District.