Gov. Rick Scott is continuing his soapbox tour of the Florida Legislature on behalf of his proposed $1 billion in business and other tax cuts for 2016-17.

On Monday, he visited the Senate Finance and Tax Committee, where he got a largely cordial and positive reception, even from the panel’s Democrats. The 2016 Legislative Session starts Tuesday.

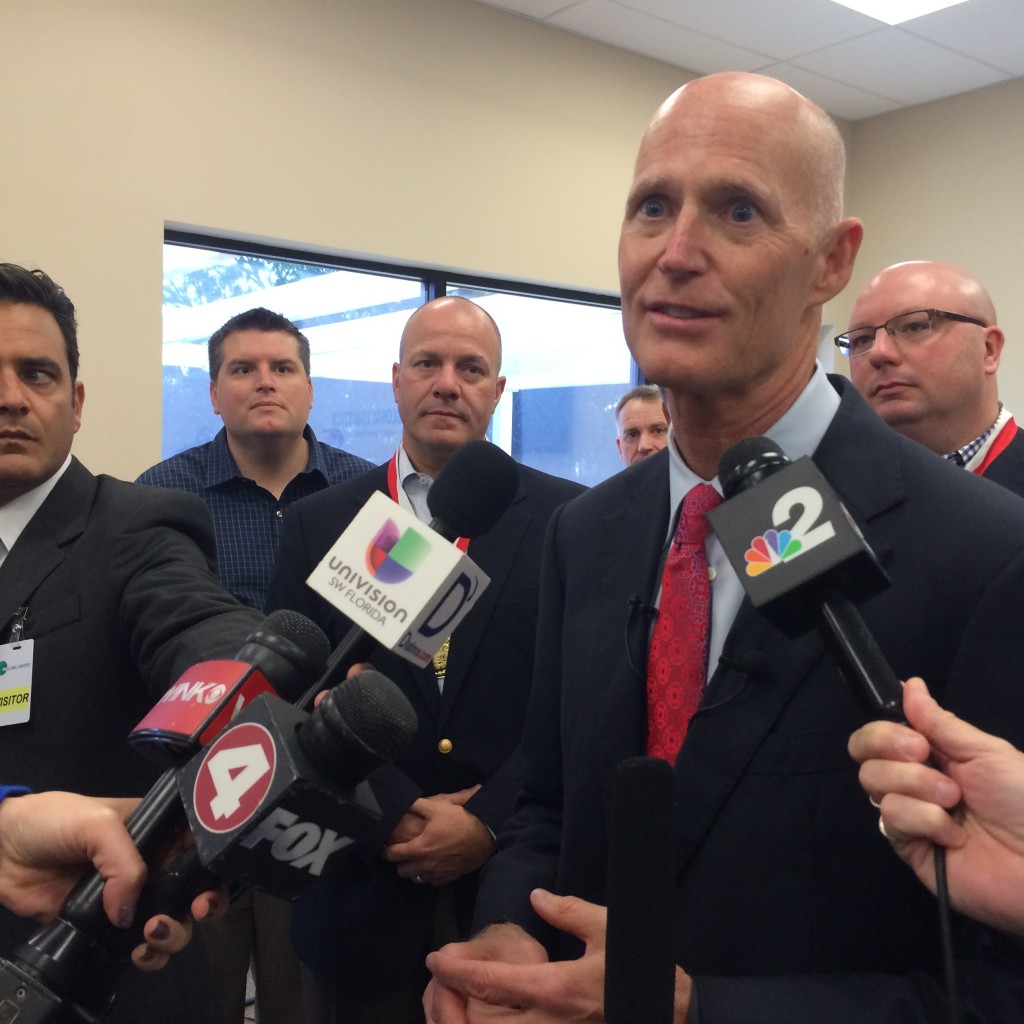

After his presentation, Scott took questions from reporters. Here are a few excerpts from the back and forth:

On using sales tax revenue to pay down pension debt: The entire Jacksonville City Council is behind a plan by Republican Mayor Lenny Curry for a half-cent local sales tax to pay down municipal pension debt.

Scott at first took a pass, saying he hadn’t seen the plan. When asked whether he supported the concept, he also punted.

On whether the state has enough money to support his tax cuts: Scott’s budget advisers and legislative economists have differed over how much surplus will be available for next fiscal year’s spending plan.

The Scott team has said $1.3 billion to $1.6 billion; the Office of Economic & Demographic Research, the research arm of the Legislature, has predicted a $635 million surplus.

Scott stuck with the $1.3 billion number Monday: “We have the money to be able to do this … this is an investment to get more jobs.”

But will it actually pay off with increased employment, he was asked.

Scott was confident: “This is a not a giveaway, these are your dollars. This is a state that is growing … we have an opportunity to give these dollars back to business people, give it back to individuals. When we do that, we will see more jobs.”

On reducing property taxes: Part of the reason the state is flush with cash is increased home values after the recession, resulting in more property tax collected.

Scott says that’s not properly termed a “tax increase”; critics say whenever Floridians pay more taxes, it is, in fact, a tax increase. The governor was asked whether he was open to property tax relief for middle-income earners.

His answer: Not this year.

“I mean, I’d like to reduce everybody’s taxes,” he said. “I know the most important thing for a family … is to get a job. My goal is (that) every year, we’ll continue to see revenue growth and continue to look at tax after tax that we can reduce.”