Just as films and books have reviews, the municipal bond sector has its own critiques from bond ratings agencies.

In the case of Moody’s, which dropped its report Wednesday on Jacksonville’s status after pension reform, the writeup boils down to six words: “buy now, pay later, assume risks.”

In the case of Moody’s, which dropped its report Wednesday on Jacksonville’s status after pension reform, the writeup boils down to six words: “buy now, pay later, assume risks.”

And Moody’s also asserts that there may be a ceiling in terms of how the agency will see Jacksonville’s performance: “Jacksonville’s reliance on future revenues, rather than current contributions, to address its pension underfunding will continue to negatively impact our key credit metrics related to its pensions … because we do not consider future revenues as pension assets – while city contributions are going to be reduced.”

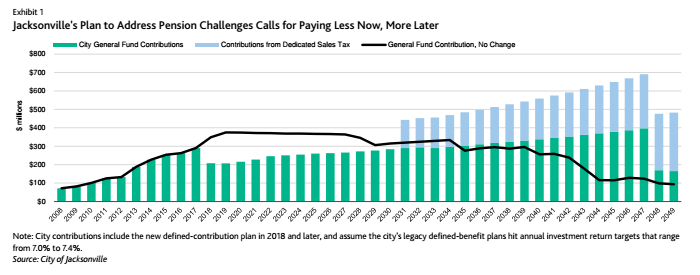

“By eliminating defined-benefit pensions for new employees, the city will shed investment performance risk over time. However, Jacksonville will also provide costly new benefits and salary increases under the plan, which it can only afford because it will defer a significant portion of its legacy pension costs to the 2030s,” reads the report.

“The city’s pension reform efforts come at a cost. While the city will carry no investment performance risk with the defined-contribution benefits for new employees, it will still contribute 25% of payroll for public safety employees. Public safety employees do not participate in Social Security,” the report adds.

Benefits, meanwhile, can be described as a mixed bag: “The longer that the sales tax for pensions must stay in place, the more difficulty the city could face in garnering support for other revenue resources, should the need arise. On the other hand, the city will immediately begin shedding investment performance risk relative to the status quo as new employees with only defined contribution benefits grow as a proportion of the city’s work force.”

Raises for city employees — delayed over a decade — are also factored into the mix.

“By 2020, these raises will increase the city’s salary spending by $120 million annually, which will amount to roughly 10% of the city’s general fund revenues by 2020…. Jacksonville will primarily offset these new costs by lowering its legacy defined benefit pension contributions…. The city will account for the dedicated future sales tax revenues as pension assets, which will reduce reported unfunded liabilities and thus lower its pension contribution requirements. Through this approach, the city will effectively lower its pension costs for the next 12 years, but it must significantly hike contributions once the new sales tax revenues become available.”

This describes the “deferred contribution” approach to pension reform that Mayor Lenny Curry‘s chief lieutenants sold the city on over many months.

One comment

ronald heidler

May 19, 2017 at 5:22 am

Oh joy… Now you will get 60year old Firefighters coming out to try and save your Family. Good luck with that. Fire-fighting is a young man’s game.

Comments are closed.