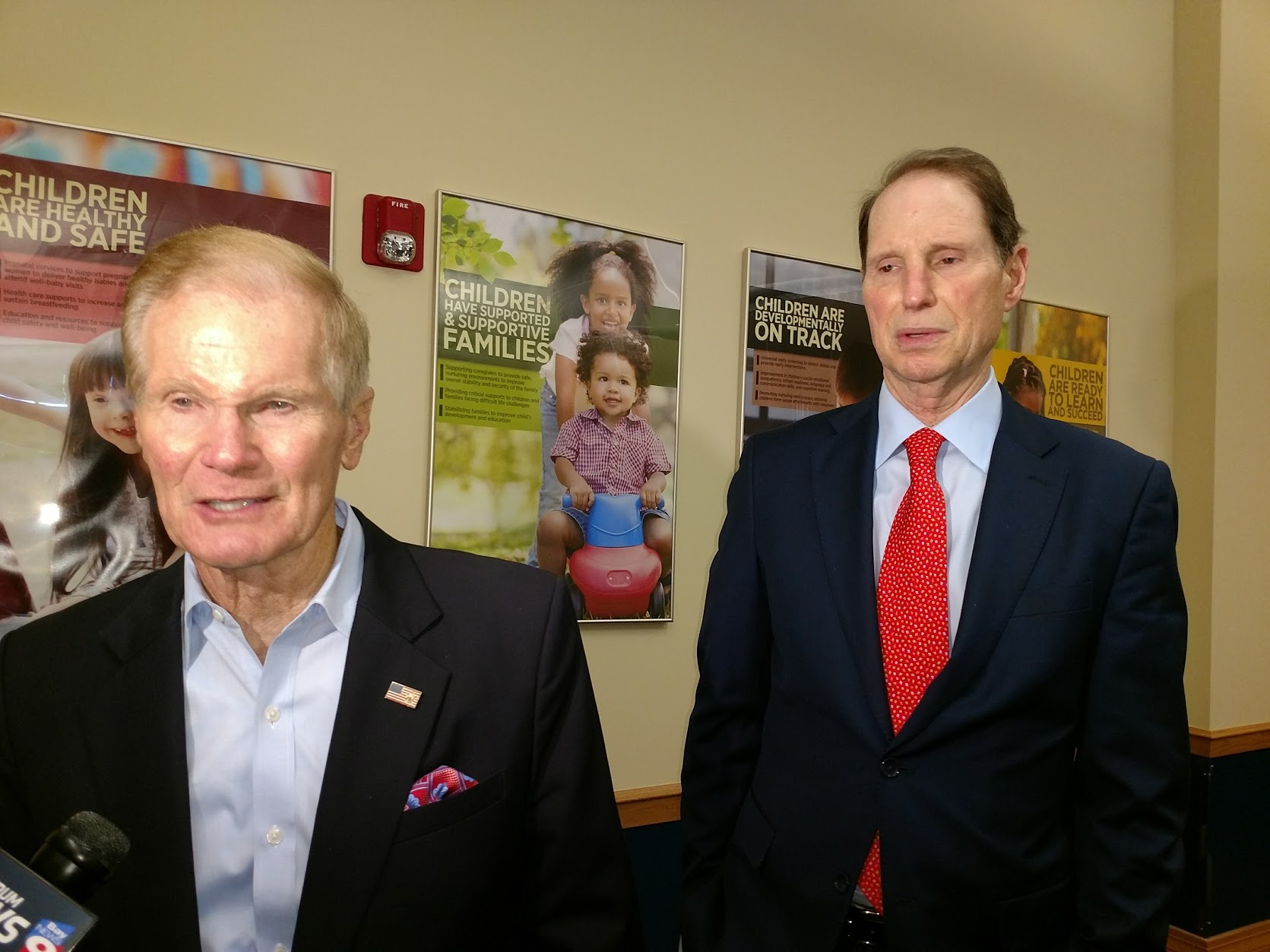

Democratic U.S. Sen. Ron Wyden of Oregon, the ranking member of the Senate Finance Committee, joined his Florida colleague Bill Nelson at a business roundtable discussion in Tampa Monday.

At the event, the two lawmakers blasted the GOP tax reform bill that passed the House last week and could come up in the Senate as early as next week as a giveaway to the wealthy and a tax increase to those making less than $75,000.

After criticizing the bill, Wyden and Nelson said they could find common cause with a significant number of Republicans to come together on a bipartisan measure that could get up to 75 (or even 80) members of the 100-member Senate.

“That’s our endgame. That’s what we really want,” Wyden said. “We’re going to explain why we don’t care for what is on offer, but we want to let you know why we feel bipartisanship is so important.”

Wyden said a bipartisan-supported bill would give the various business leaders (which included the respective chambers of commerce heads from most major counties surrounding the Tampa Bay area) a degree of certainty that wouldn’t need to be flipped over if a new administration comes into office in three years. Wyden said he has actually co-written such a bill with former Indian Republican Senator Dan Coats (now the Director of National Intelligence in the Donald Trump administration), so he knows it’s possible.

Stressing the bipartisanship certainly made sense talking to a group of business leaders, some of whom were presumably Republican.

Staying with the bipartisanship theme, Nelson cited Wisconsin Republican Sen. Ron Johnson‘s opposition to the Senate bill in terms of how it treats businesses that operate like “pass-through entities,” — which means they their business income on to their individual income tax return.

In the Senate bill, pass-through entities are allowed to deduct just over 17 percent of their business income, an effort to reduce the rate paid on business income to come closer to the 20 percent rate the bill sets for corporate income (down from 35 percent today).

This will still leave many pass-throughs paying a far higher rate than corporations.

“According to this Republican senator, you’re going to pay an average of 32 percent. Now is that fair?” Nelson asked.

The Senate plan calls for tax cuts for individuals and pass-throughs alike expire in 2022, while the corporate tax cuts are permanent.

While Floridians would get a break from the provision that will not allow individuals in high taxed states like California and New York to deduct their state income taxes, Nelson says they’d get hurt with the provision in the legislation that eliminates real estate and sales taxes.

Another bit of criticism the two Democrats had is what Republicans like Tennessee’s Bob Corker have expressed concerns about — that the proposals being offered but the GOP will bust a hole in the deficit.

Not all nonpartisan tax organizations are bashing the bill. According to an analysis by the nonpartisan Joint Committee on Taxation, in 2019, people in the middle of the income spectrum, earning between $50,000 and $70,000, would see their taxes fall by 7.1 percent. Those earning between $20,000 and $30,000 would see a 10.4 percent decline, the report shows, while millionaires would get a 5.3 percent tax cut.

Nelson criticized the rapid speed with which the Republicans have pushed the bill through the House, and decried the fact that the national press is more focused on Roy Moore, Al Franken and “whatever is the shining object that is so much more entertaining than the dullness of tax law.”

There’s no question that the separate bills in the House and Senate are moving through Congress at a rapid-fire pace. House Republicans passed their bill last Thursday night, exactly two weeks after its detailed legislative text was released. Republicans in the Senate released their plan less than two weeks ago and are expected to put to on the Senate floor before the end of this month.

“They want to get this done next week,” said Wyden. “They’re making ten trillion dollars worth of changes in tax policy on the fly.”

Both Democrats also criticized the recent addition of removing the individual mandate in the Affordable Care Act as a way to free up revenue in the Senate bill.

“This is the kind of approach that starts unraveling all of the key elements of the Affordable Care Act, that’s why they’re doing it, it’s an ideological trophy,” Wyden said to reporters before the roundtable.

A Quinnipiac poll released last week shows that 52 percent of Americans disapprove of the GOP tax reform proposals, with only 25 percent supporting it.