For interior designer Michael Dolatowski, this was supposed to be a banner spring. His Miami company Deft Union was working on three bars about to open in downtown Miami with another job likely near the beach. The attention on those spaces could lead to more jobs in South Florida’s beloved hotel and restaurant scene.

But like many a business plan, the COVID-19 pandemic changed everything. A number of prospective clients ended talks and existing ones put plans on hold.

He felt hope, though, as a number of state and federal programs were announced as a way to save the U.S. economy through loans and grants. He applied for it all. But nearly two months into the epidemic, he’s received nothing but bad news.

“I’ve received no money at all,” he said.

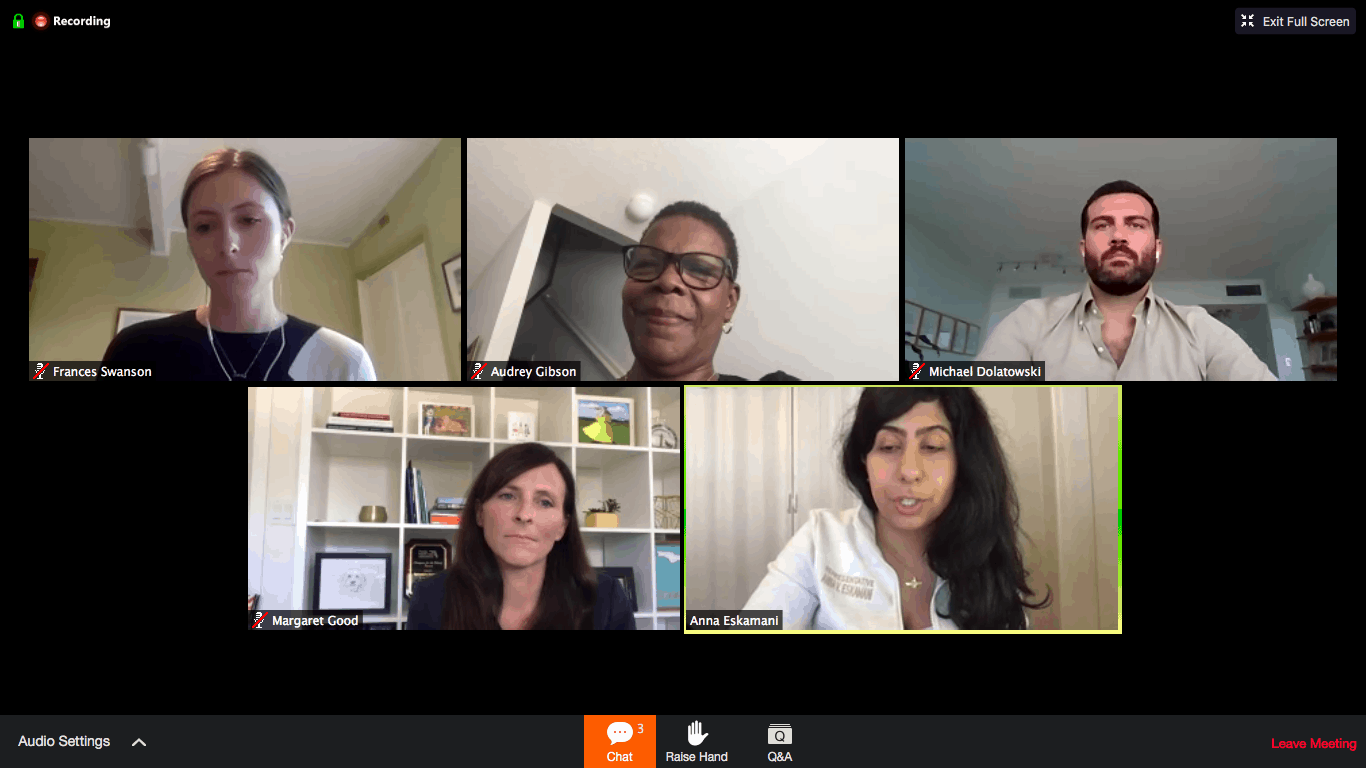

It’s a story that upsets Democratic lawmakers in the Florida Legislature, in part because they heard similar ones too often. On a press webinar, Senate Democratic Leader Audrey Gibson joined Reps. Margaret Good and Anna Eskamani in lambasting Florida’s economic recovery for favoring corporations over small businesses.

Democratic lawmakers say Gov. Ron DeSantis and President Donald Trump both directed too many of the rescue funds intended to keep the economy alive into the hands of major donors or allowed national banks to direct funding first to their largest customers.

“I don’t think there was parity in how these bridge loans were distributed,” Gibson said.

A $50 million Florida Small Business Emergency Bridge Loan program ended up running out of money in less than a month, providing support for just 1,000 companies out of 38,000 who applied.

Gibson took particular issue when one Tampa business owner was able to obtainn $500,000 through 10 loans to different Jersey Mike’s locations. Meanwhile, individuals like Dolatowski got nothing.

Good said her Sarasota district, where small businesses account for much of the workforce, need the money much more than major chains. She’s especially frustrated that both the bridge loans and the federal Paycheck Protection Program provided assistance to some publicly traded corporations. Those entities have access to capital, private debt and stock in public equity markets.

“The ones who don’t are the mom-and-pops who have 10 employees,” she said. And in retiree rich areas like Southwest Florida, service companies provide a valuable service for residents overall.

Eskamani said the fact the bridge loan program and PPP effort could dry up so quickly spoke volumes about state priorities. Democrats previously urged DeSantis not to issue $543 million in corporate refunds that could be used to help in the pandemic. But those checks went out this week.

“As far as I’m concerned we just gave 10 times as much to big businesses than small businesses this week,” she said.

Meanwhile, businesses continue to struggle. Dolatowski said he laid off a team of eight artisans while he awaited news on loans or grants. When he got the word there was nothing coming in PPP or a bridge loan, he laid off his last employee and now worries how long he can make a living with his business himself.

He’s promised to hire employees back as soon as he has the money, but acknowledges even that won’t solve all problems.

“I’d love to put my team back to work but I’m losing the work for them to do,” he said. “I basically become a de facto unemployment agency, which I totally understand since none of them can get unemployment right now.

“What we really need is for the economy to reopen, but that’s not going to happen without a proper plan in place.”

2 comments

CommonSense

April 21, 2020 at 1:49 pm

The Democrats who are now decrying programs that they helped to pass, should look in the mirror for a change.

Blaming others for programs that they too voted for, is truly nothing but political noise, and not helpful to solve the problem.

Nancy Watkins

April 23, 2020 at 7:11 pm

The headline is misleading. Our small business (less than 10 employees) is a corporation. And a C-corporation at that. I once had a Member of Congress shocked as he though all small corporations HAD TO BE S-corporations and only publicly traded corporations could be C-Corporations. Stunning.

Comments are closed.