The head of Florida’s Republican Party pushed back on criticism from New Hampshire’s GOP Governor about new tax policy here.

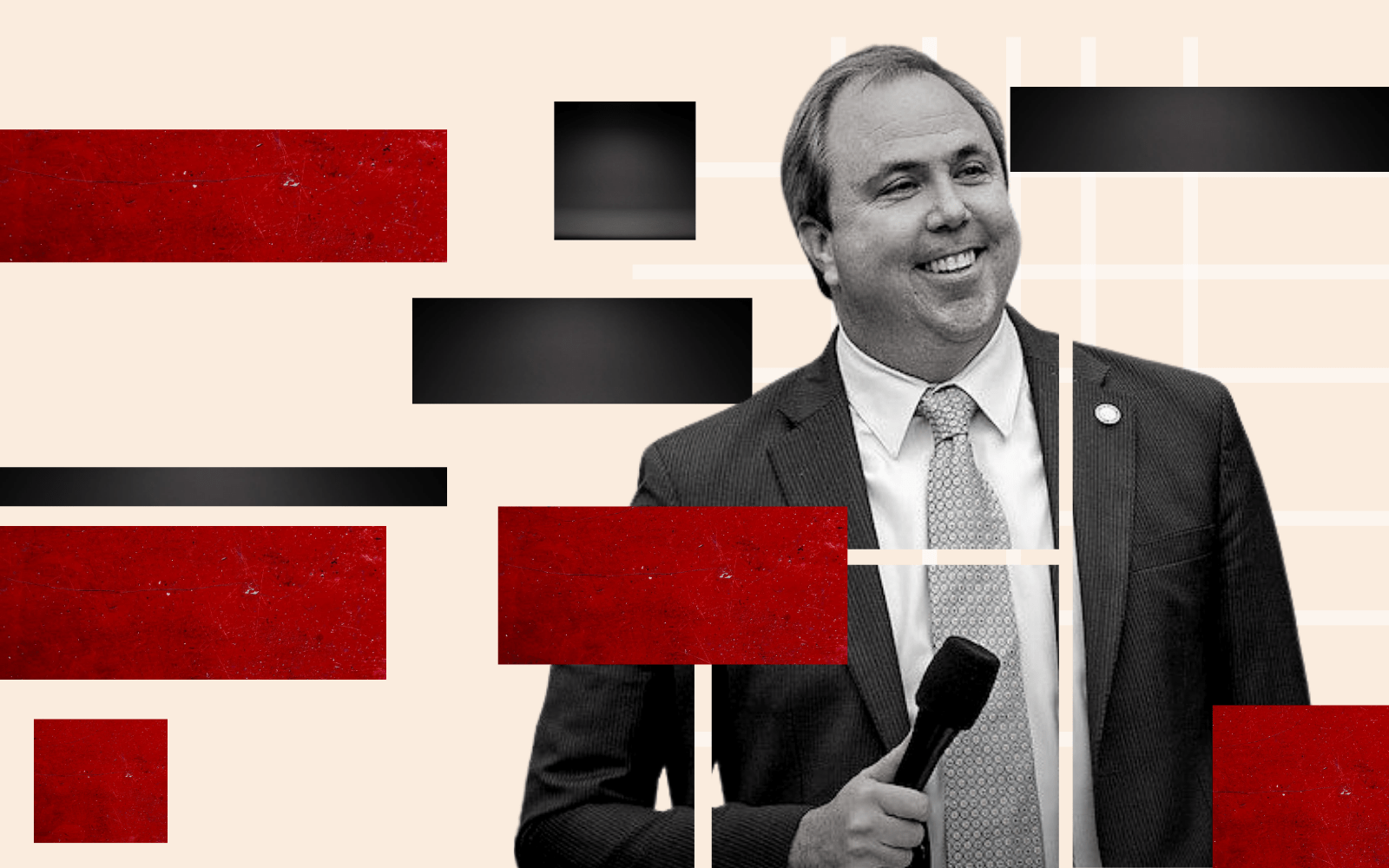

“This has been an existing tax forever,” said Joe Gruters, chairman of the Republican party of Florida, of Florida’s new law requiring collection of online sales tax at the point of sale. “If people are not paying it they are breaking the law.”

The Sarasota Republican expressed frustration after New Hampshire Gov. Chris Sununu told The Howie Carr Show that Florida Gov. Ron DeSantis had raised taxes on residents this year.

“He did sign another billion dollars of tax increases,” Sununu said. “I love Ron, but the fact of the matter is their taxes are going up and ours are going down.”

That’s a clear reference to the new sales tax law DeSantis signed. Gruters, a state Senator, sponsored the legislation in Florida’s Legislative Session this year.

Sununu’s remarks came during discussion of New Hampshire’s reopening as vaccinations increase and the pandemic winds down. The comparison to Florida, where DeSantis has touted his low-restriction approach to COVID-19, naturally arose.

But the Sununu diss also prefaces a potential 2024 presidential primary. Media in New Hampshire have openly speculated whether Sununu should enter the field. It’s come up with DeSantis, too.

Gruters took the characterization of online tax collection as a tax hike personally.

“As the chairman of the Republican Party of Florida, I would never advocate for a tax increase,” he said.

Rather, Gruters for years has described such collection as “e-fairness,” leveling the playing field between brick-and-mortar retailers and online giants.

He stressed that Florida since 1989 required sales tax to be assessed on mail-order products.

Technically, Florida residents owe online sales tax on everything they purchase online, and by law should pay that money at the end of the year to the state Department of Revenue. But absent an audit, few do.

Gruters, an accountant by profession, said he often deals with clients who learn from the IRS they owe taxes, often with penalties and interest.

But if most don’t pay the tax, should it be considered a hike? Revenue estimators figure assessing the tax when goods are purchased will generate $973.6 million more in general revenue for the state this year, and they expect a $1.08-billion boost each additional year.

That drew criticism from the left and right in the Legislature this year that this counts as a $1-billion tax increase directly on consumers.

Gruters said just because the revenues went uncollected doesn’t make the tax new. When Democrats in the Legislature tried to have it dubbed a new tax, Rules Committee heads ruled it was not.

Notably, Democrats largely supported collecting the tax until Republicans, including Gruters, favored earmarking the revenue first to replenish the state’s unemployment trust, and afterward to cut the state’s commercial rent tax.

“This is actually the largest tax decrease in the history of Florida,” Gruters said. “We cut taxes by over $1 billion to help our businesses compete in the post-pandemic economy.”

He called it a Florida First policy that makes sure state retailers aren’t handicapped by overseas sellers who, under previous law, didn’t have to collect sales tax.

Notably, no states required online sales tax to be charged at the point of sale until 2018, when a Supreme Court decision made clear they could. Florida showed reluctance to do so and was the second-to-last state to require e-commerce collection. Missouri lawmakers this week sent similar legislation to the Governor there. Should Missouri Gov. Mike Parson sign that into law, all 45 states with a sales tax will have the same rules on online sales tax in place.

There are five states that don’t charge a statewide sales tax, including Alaska, Delaware, Montana, New Hampshire and Oregon.