After weeks of speculation as to hard costs and real benefits of the Lenny Curry approach to Jacksonville’s pension reform, the first-term Republican Mayor talked it out with the Jacksonville City Council Wednesday afternoon.

The Curry administration feels the fierce urgency of now. With pension costs, already $290M in the current fiscal year, slated to be $345M next FY if reforms aren’t implemented, the model of reamortizing the old debt and opening new plans for new hires is a matter of existential importance.

____

Three of the 14 filed bills, which could be voted on later this month, are probably the most important: 2017-257 creates a new ordinance section: Chapter 776 (Pension Liability Surtax).

Bill 2017-258 affects the general employees and correctional worker plans, closing the extant defined benefit plans to those hired after Oct. 1, 2017, and committing the city to a 12 percent contribution for those general employees and a 25 percent contribution for correctional officers hired after October.

Bill 2017-259 implements revisions to the Police and Fire & Rescue plans.

258 and 259 both offer fixed costs via a defined contribution plan for new hires, while offering generous contributions from the city to those hires, and raises for all current employees.

The best deals are for public safety: long-delayed raises to current employees (a 3 percent lump sum payout immediately, and a 20 percent raise for police and fire over three years) and gives all classes of current employees the same benefits.

As well, all police and fire officers will have DROP eligibility with an 8.4 percent annual rate of return and a 3 percent COLA.

The deal, if approved without modification, will bring labor peace through 2027 — though it can be renegotiated by the city or the unions at 3, 6, 9, and 10 years marks in the agreement.

For new employees, however, the plan is historic — a defined contribution plan that vests three years after the new employee for police and fire is hired.

The total contribution: 35 percent, with the city ponying up 25 percent of that — with guarantees that survivors’ benefits and disability benefits would be the same for new hires as the current force of safety officers.

The Curry model, rooted in a deferred contribution approach that increases a re-amortized liability and spreads out costs to hit hardest when the sales tax extension money starts coming in after 2030, is intended to provide fixed costs and certainty for budgets.

However, with questions raised over costs over time (and Curry’s response to those critics being to “let them chirp“), Thursday’s presentation would end up being notable.

Would the mayor sell the City Council on the deal, giving them relief for local priorities in exchange for a longer-term amortization? And what about the press corps?

Those questions loomed Thursday.

______

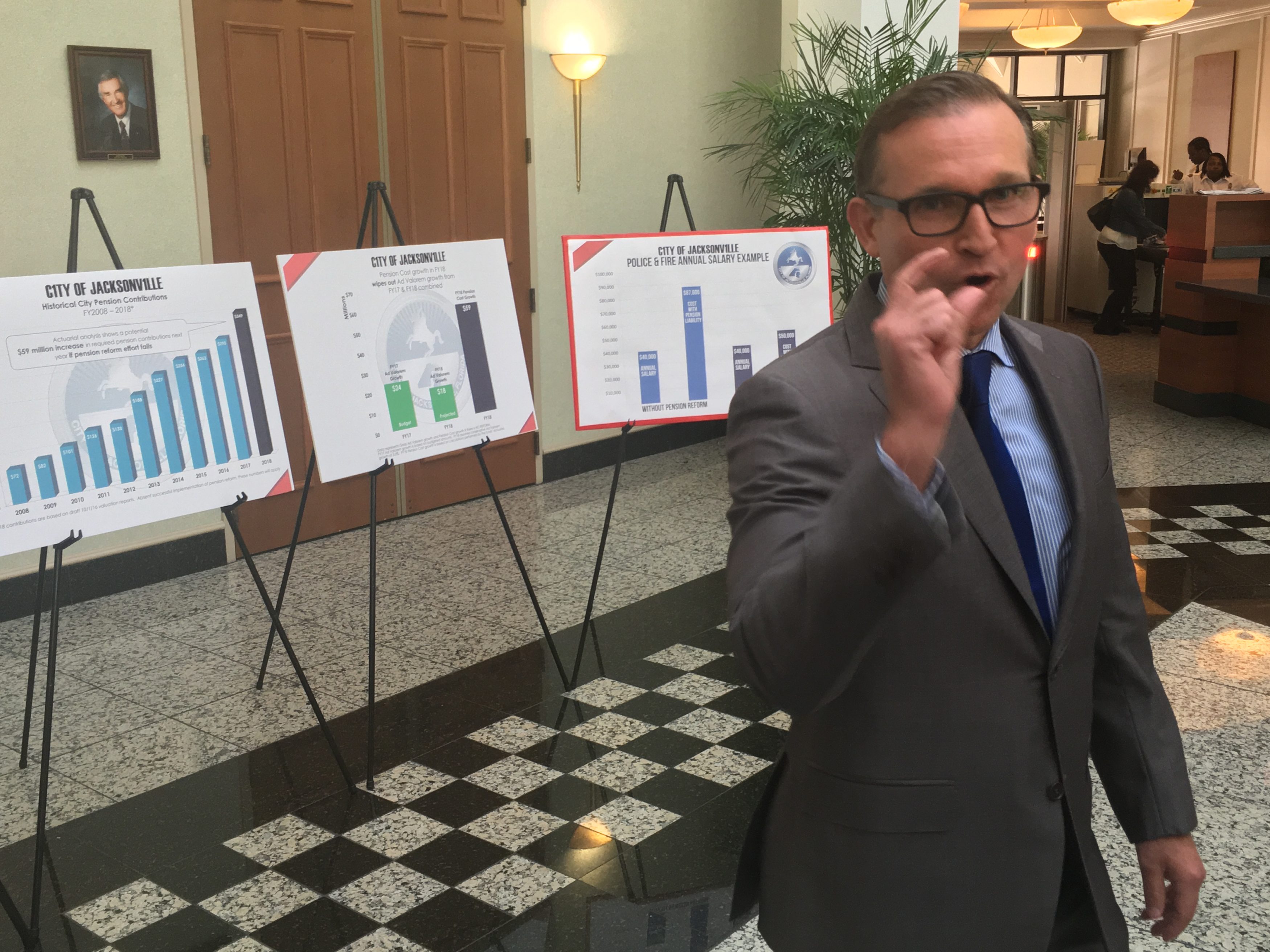

Curry kicked off the four-hour session with some opening remarks, noting that he would be distributing slides, one at a time, throughout his remarks.

The mayor noted that, when sworn in, he discussed the finite nature of time, and that he committed to a “sense of urgency” on key issues.

“We are poised to solve one of our city’s biggest challenges … a challenge that my predecessor handed off to a task force .. with a solution that would barely make a dent,” Curry said, also calling out critics of the current plan, whose plans would “make things worse.”

Curry vowed that his solution would free up resources for public safety, zeroing out the $2.8B liability with a dedicated income source.

“The legislation and policy before you … mark a new beginning for the financial health of Jacksonville,” Curry said.

____

The “locked-in revenue source,” Curry said, is explicitly earmarked for pension relief, ending the “legacy pensions … bankrupting cities throughout the united states.”

“There are costs associated with paying off $3B of debt we didn’t create,” Curry said, but previous generations created the issue that he has to fix with “sound financial principles.”

Those costs include long-delayed pay raises for current employees.

_____

Among the benefits of the Curry plans: liquidity floors and contribution floors, which establish meaningful parameters for debt paydown.

“Future revenue growth will now be able to fund public safety,” Curry said.

The mayor also addressed tax growth, saying — as he told us — that the mechanism was based on averages in the current market, and would be subject to review yearly.

“The risk does not exist,” Curry said.

Curry outlined pension costs increasing: next year would be $59M over $290M this year, which is “eating our revenue alive.”

“Without pension reform, a $40,000 annual salary will costs $87,000. With it, it will cost $57,000,” Curry said, with pension costs thrown in.

____

Curry discussed the path forward with local media after his remarks.

He stressed that, while costs are associated with retiring the $3B debt that his team “inherited,” this is ultimately a path to solving a problem previously neglected.

As well, the half-penny tax, though it doesn’t kick in on this obligation until next decade, is a future asset — offering actuarial certainty that frees up finite general fund resources.

Curry revised a previous actuarial assumption that the obligation could be paid off by 2045, noting that 2049-2051 was more likely.

“I know it will work. I’ve been fighting for this since the day I got into office,” the mayor said.

When asked to predict the vote count, he didn’t offer a number — but an assurance.

“We’re going to get this done,” Curry said.