State regulators have rejected a California bank’s proposal to operate in Florida as a financial middleman for medical marijuana-related transactions.

The Office of Financial Regulation turned down a request from PayQwick for a declaratory statement so it could operate here.

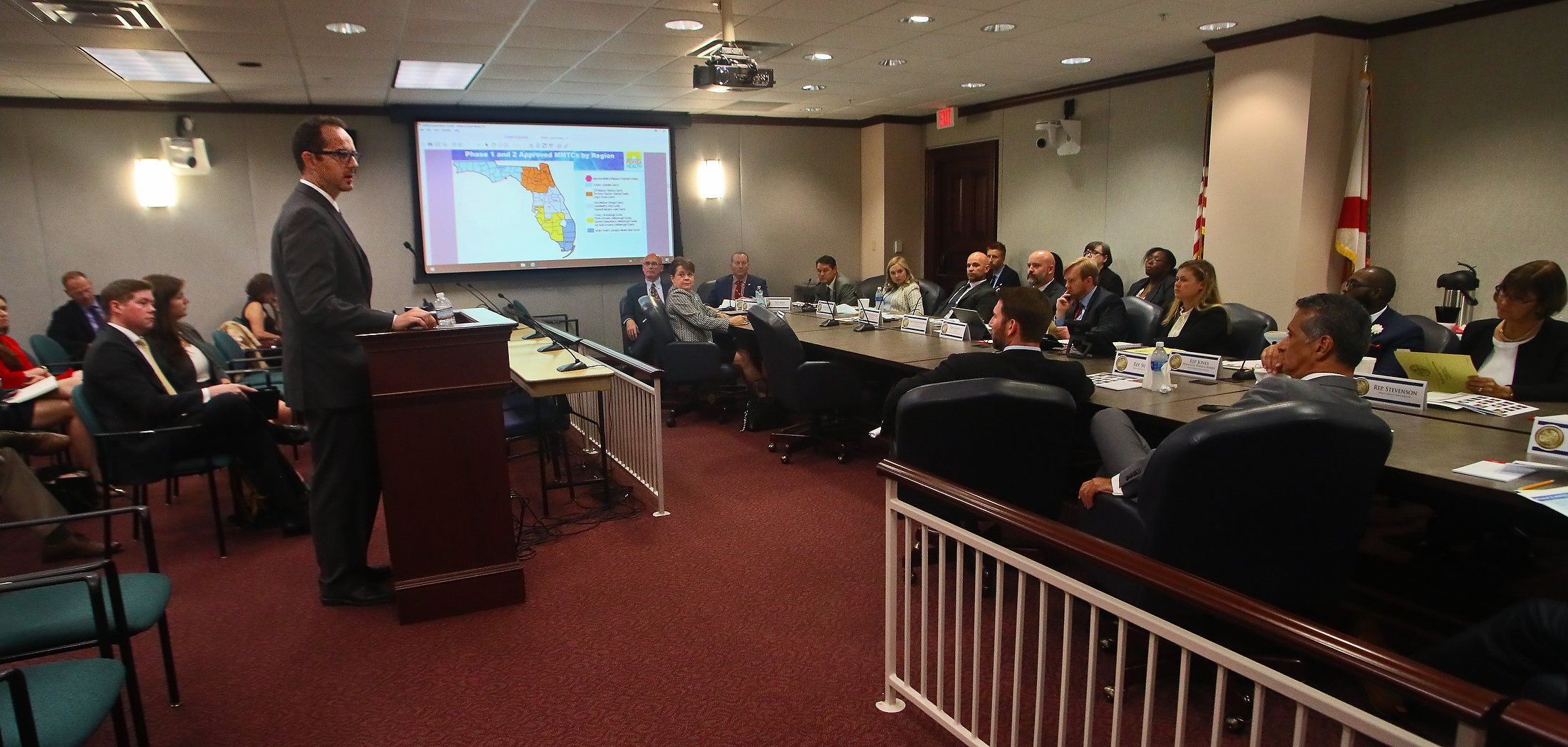

Christian Bax, director of the Department of Health’s Office of Medical Marijuana Use, gave a presentation Wednesday to the House Health Quality Subcommittee on the state’s regulation of medicinal cannabis.

Though he did not mention the PayQwick case, decided in late August, Bax did say there has been “reticence” on the part of the banking industry to get involved with marijuana sales.

Florida has more or less legalized medical marijuana, through statute and constitutional amendment, but selling marijuana still is a federal crime. And banking, by its nature as “interstate commerce,” falls under federal law.

Under President Barack Obama, however, federal prosecutors did not criminally pursue those, such as “the seriously ill and their caregivers,” who distribute and use the drug “in compliance with an existing state law.”

Still, “life would be a lot easier for us and for patients if there were online payments,” Bax told the panel.

PayQwick’s “description of its contemplated business model is expansive,” OFR’s order says.

“For example, (it) describes its (potential) clients as not only registered medical marijuana patients, but also members of the public purchasing marijuana from a licensed retailer/dispensary.”

Florida’s current system is “vertically-integrated,” meaning businesses grow, process and sell their own marijuana, with each licensed as a medical marijuana treatment center, or MMTC.

But PayQwick based its request “on the erroneous assumption that the … distribution of marijuana is legal,” the order says. Because of that, “a declaratory statement is not available.”

PayQwick’s system, an “electronic payment hub,” was also aimed at making it easier for “ancillary” concerns, such as security alarm companies, to do “legal business” with the MMTCs.

Users would download an app to transfer money from a “settlement account” to a “sub-account,” then to a “bank or credit union.”

PayQwick would have made money “by charging a percentage-based service fee for each re-allocation of funds from one client to another,” the OFR order says.