The property insurance crisis is affecting everybody in Florida, and the state’s Senior Senator is no exception.

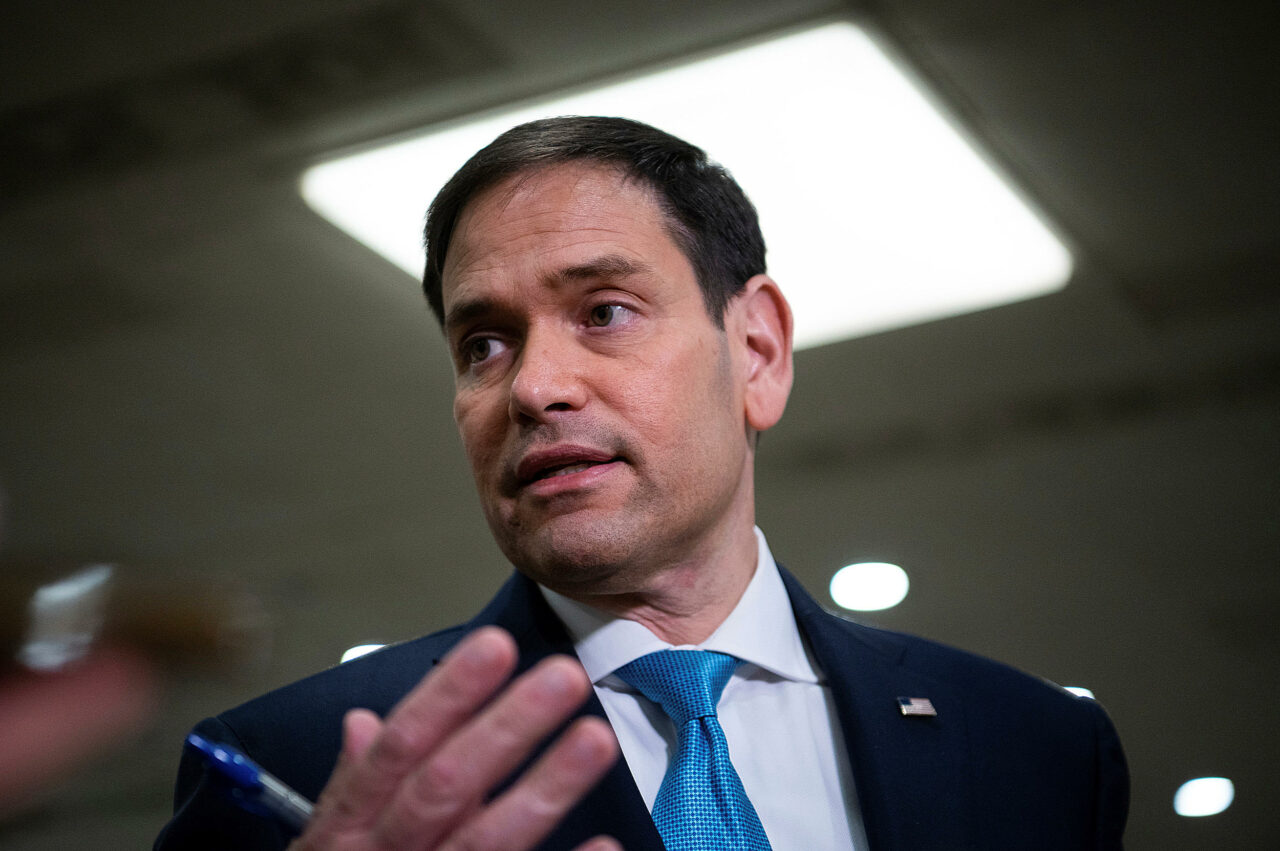

During an interview with WFME in Orlando, Marco Rubio said his homeowners insurance rates had “seen probably a 300% increase in the last two years.”

“It’s getting really tough for a lot of people out there,” the Senator said, before offering insights into how a regional problem is everyone’s problem now.

“When I was in the state Legislature, property insurance was a Southeast Florida problem. It has now become statewide. Part of it is driven by the fact that these companies don’t want to write policies here anymore. The fewer companies you have writing policies, the fewer choices there are, the more expensive it gets. It’s not an easy problem to solve, because those markets are largely set internationally. It’s complicated. There’s reinsurance involved, and that’s written offshore, outside of the United States. But it most certainly is one of those issues on my radar.”

The Senator said commercial insurance was also up, which “drives up rents, which in turn drives up prices, which fuels itself.”

But he cautioned that the issue is Florida’s and not Washington’s to solve.

“It doesn’t have an easy solution, other than figuring out ways to make Florida a more competitive state for property insurance. I’m not sure there’s a federal nexus to how to solve it. It really is a state-regulated market, but it is an issue on my radar, just as a Floridian and as someone who lives here. I don’t know anyone who’s not impacted by it.”

Recent polling commissioned by the Associated Industries of Florida (AIF) accords with Rubio’s take, with 21% of General Election voters saying that’s their biggest concern. While Special Sessions have been called to stabilize the market, legislative fixes to curb so-called “lawsuit abuse” and a $2 billion program using taxpayer money as a reinsurance fund have yet to produce any significant savings for Florida policyholders.

While on the campaign trail last year, meanwhile, Gov. Ron DeSantis once suggested policyholders should “knock on wood” and hope to get through 2023’s storm season. He also claimed part of the reason for high insurance rates may be that insurers are too woke.

“But I think I’m concerned about this ESG, I’m concerned about them trying to say climate change and everything because that’s going to make some of these things very, very expensive if they’re pricing in all these things that very well may not happen. And that’s new from where we were 20 or 30 years ago.”

The Governor’s comments came just days after the U.S. Senate Budget Committee began a probe of Citizens Property Insurance and its ability to handle underwriting losses, including the question as to whether the state insurer might need a federal bailout. That investigation is ongoing.

It’s possible that the bungled insurance market could have hurt DeSantis’ presidential campaign before it ended, meanwhile. Former President Donald Trump made a campaign issue of Florida’s troubled insurance sector.

The Governor’s current budget proposal included $431 million in breaks for people who have struggled with property insurance costs in recent years that the Governor’s Office says will save policyholders 6% on their premiums.

The plan includes a one-year holiday from taxes, fees and assessments affecting homeowners insurance policyholders, with $409 million allocated for these costs for policies of up to $750,000 written between July 1, 2024, and June 30, 2025. The insurance premium tax, the Fire Marshal assessment and the Florida Insurance Guaranty Association assessment are all under this umbrella.

His hope for the market is to “see more capital come online,” as “ultimately, this is not something that’s run by the government.”

The issue has been a stumbling block despite efforts to cure it. The Governor recently blamed the Legislature for not implementing insurance reforms he wanted, then refused to say what those reforms were when asked directly.

___

Drew Wilson of Florida Politics contributed to this report.

15 comments

Linwood Wright

February 7, 2024 at 1:00 pm

And it’s his own fault for letting that happen.

The GOP is the party of Big Business and the wealthy elite, and if you’re not in that club and still vote Republican, you are a f*cking moron.

Slooooooow Biden

February 7, 2024 at 1:14 pm

Watch what happens with Kalifornia insurance rates. A state run by the most progressive, liberal Demos.

FloridaPatriot

February 7, 2024 at 1:15 pm

More whataboutism and no action. Typical Republican.

Linwood Wright

February 7, 2024 at 2:11 pm

Oh look, another f*cking moron who keeps voting Republican even though they’re not a member of the 1% and GOP policies will never do one damn thing to improve their life. 🥱

Carpetbagger

February 7, 2024 at 2:14 pm

This is an article about Florida, not California. So who’s the slooooooow one, MAGA Muffin?

Untutored & Rustic Florida

February 7, 2024 at 1:01 pm

Eat sh!t, CuntRubio

Carpetbagger

February 7, 2024 at 2:05 pm

Wow! How did that happen? Did he pester his insurance company for a new roof when he didn’t need one? Did he throw all his perfectly good furniture out on the curb and get all new stuff? We paid for our relatively minor roof damage ourselves and guess what? Our homeowners insurance didn’t go up a dime!

MH/Duuuval

February 7, 2024 at 3:23 pm

Rubio has become accustomed to sweetheart deals, low or no interest loans, and other folks picking up the check.

I just wish Rubio and his brethren would look in the mirror the next time they try to make a case for corruption in the Ukraine.

Kraig Byrnes

February 7, 2024 at 8:30 pm

Both the democrats and republicans are too blame! There should be state mandates of providing money too all residents too help pay for our burden in providing home insurance! Insurance Co and the state must find ways of distributing home insurance rates fairly. Ie you do not build homes near waterways, ocean or other prone areas! Million dollar homes must pay the high portions of yhe insurance costs!

Bob Brooks

February 8, 2024 at 4:35 am

The solution is extremely simple. Create a hurricane fund that is run by the state. This program will pay out for wind damage that will have occurred during hurricane season. This will be very similar to Medicare, which is the most efficiently run government program in the nation. If this does not happen, Florida will lose millions of residents over the next 2-3 years and the state will go bankrupt. The Insurance companies have owned the right wing Legislature for nearly 2 decades and of course DeSantis. They could care less that seniors and families can not afford to add another mortgage payment to their monthly bills in the form of homeowners insurance. I warned about this back in the 90’s but very few listened. Congratulations to the sociopaths for what you have done. Florida will be decimated both financially and physically by powerful storms, though DeSantis and his sociopaths could care less.

Mina S Hutto

February 8, 2024 at 12:37 pm

Property Insurance is extremely expensive for homeowners not only that Property taxes is also extremely expensive so if they eliminate our property taxes that would help us a lot increase state tax where everyone pays their fair share take some of this burden off of the homeowners

MH/Duuuval

February 9, 2024 at 11:04 am

So, you desire an income tax? All right!

Michael K

February 8, 2024 at 7:50 pm

Hey Marco – slightly off-topic, but given the size of your grift from the NRA and gun maker lobby, I’ll assume the insurance industrial complex has not been nearly as generous to you as you’d like or think you deserve?

MH/Duuuval

February 9, 2024 at 11:06 am

That was a one-time million-dollar contribution from the NRA. It’s the local firearms extremists who keep the remainder of Florida officials in line by threatening to primary them — though one might ask if there is any room remaining on the right wing to go farther out.

Tom Palmer

February 11, 2024 at 1:10 pm

It is WMFE, I think. My homeowners went up 20 percent this y ear, but I don’t live on or near the coast.

Comments are closed.