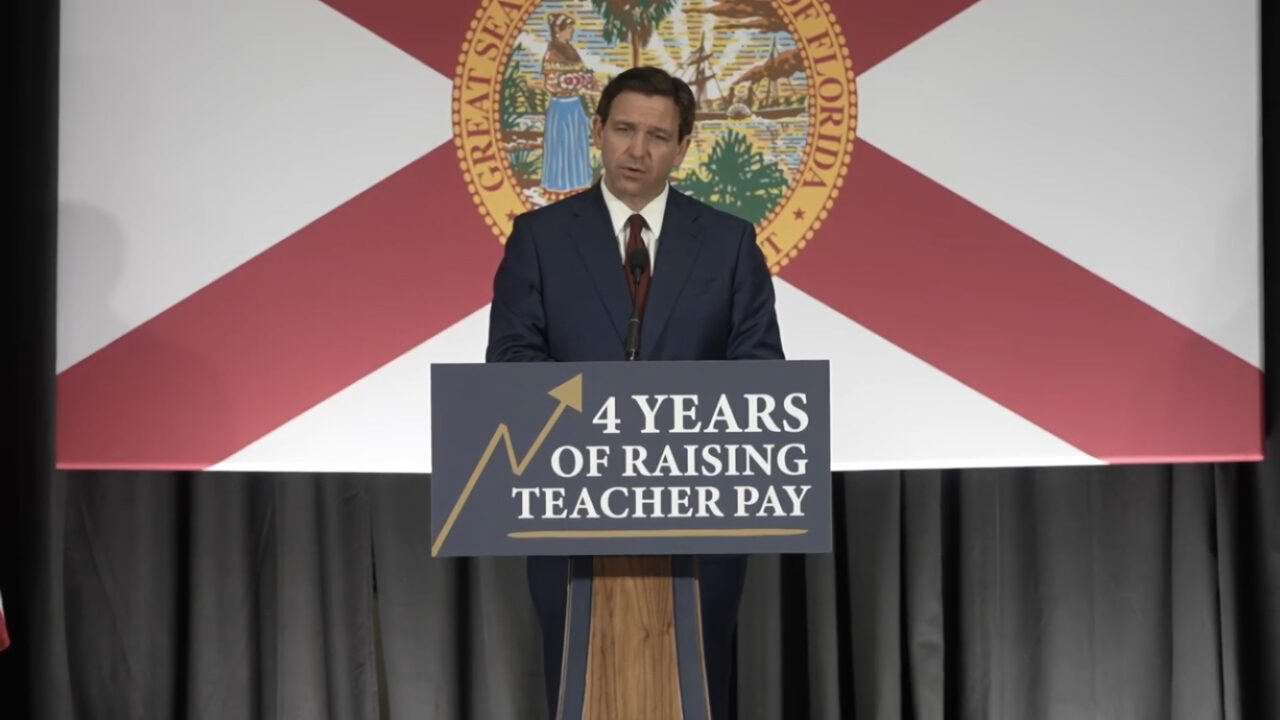

Gov. Ron DeSantis says the insurance market will improve at some point, but is cautioning those changes wouldn’t “happen overnight.”

Speaking at a private school in Miami, the Governor offered a positive spin, before suggesting that a real contributor to Florida’s insurance woes is “inflation.”

DeSantis pointed to the positive effects of legislation passed in December’s Special Session that discouraged moves to “incentivize lawsuits” that worked to “cause insurers to leave the state.”

“When you don’t have competition, you have no real way for the consumer to shop,” DeSantis said.

“People are really excited about that,” DeSantis said of the law change. “I think that you’re going to start to see capital deployed in response to that.”

However, when that capital will be deployed is anyone’s guess, DeSantis added.

“It doesn’t happen overnight because these are private companies that make private decisions. But clearly, when you have 8% of the property claims and 78% of the litigation expenses, you’re going to have higher rates,” the Governor said.

“So I do think you’re going to see more capital come in and then that’s good for consumers, but that doesn’t happen overnight.”

DeSantis went on to blame macroeconomics for the failure of Florida’s homeowner’s insurance sector, saying “you have massive inflation in our country over the last year and a half, two years, that impacts everything.

“It’s way more expensive to fix a roof today than it was two years ago. That is going to be reflected. And so part of what I think we need to see happen is dealing with this on a national level,” DeSantis said.

“They’re raising interest rates, that’s actually hurting people. It’s hurting the economy.”

DeSantis suggested moves to “stop spending so much money at the federal level” and “expand our energy production here in the United States to put a downward pressure on energy prices” would “absolutely put downward pressure on inflation and, I think, ultimately would be beneficial for consumers.”

The message of vague optimism continues from the Governor, who purportedly helped to boost the reinsurance market during his stop in England last month. He met with British reinsurance companies, and “secured a commitment from companies in attendance to increase access for carriers serving Florida policyholders,” according to a media release from the Governor’s Office.

Requests for more details on that “commitment” went unaddressed from the Governor’s Office.

The meeting in England comes ahead of yet another hurricane season that promises real challenges to the state, with recent reports suggesting reforms aren’t going to lead to instant fixes after seven insurer insolvencies in the last year.

“We’re probably looking (at) about 12 to 18 months before we really have the experience to show what the Legislature has done,” Insurance Commissioner Michael Yaworsky cautioned earlier this month.

Citizens Property Insurance President and CEO Tim Cerio warned in March about a “difficult transition” for policyholders as they are compelled to enter the private market if they get an offer up to 20% more than the Citizens rate, and they are required to get flood insurance in any case.

The changes to Citizens are designed to reduce its policy count, which more than doubled within three years, from about 500,000 in 2020 to nearly 1.17 million as of Jan. 31.

DeSantis noted last year Citizens was “unfortunately undercapitalized” and that the company could go “belly up” if it actually had to weather a major storm.

DeSantis has defended moves to stabilize the market, stressing many of the current problems are inherited.

“As you know, we had a lot of companies that have been going out of business for a long time. No one wanted to come here and do business in Florida. I think we’ve changed that in going in the right direction,” DeSantis said in March.

“But when your market was so bad, you know, you didn’t have as many reputable companies that wanted to be in here. And so … I think we’ve done a lot to change it. But yes, they should, they need to be held accountable, and I know that they’re going to be aggressively doing it.”

Critics continue to carp, however.

Former President Donald Trump flogged the Florida Governor over what he labels “the worst insurance scam in the entire country.”

Florida Democratic Party Chair Nikki Fried has said that “instead of coming up with a plan to deliver property insurance relief to Floridians, Ron DeSantis would rather spend his time making up culture wars and traveling across the country to chase the MAGA base.”

10 comments

Michael K

May 9, 2023 at 11:53 am

TRANSLATION: Insurance “reform” won’t happen at all. In fact, while the governor was obsessed with drag queens and taking down the state’s largest employer, insurance rates were climbing.

Grampa Fixit

May 9, 2023 at 4:20 pm

Reform already did happen. It took us years to get in trouble and it’ll take a while to get out of trouble. See details below.

John Barron

May 9, 2023 at 11:53 am

They won’t happen at all because Meatball Ron is busy “Playing President”. Florida is a dump and coming apart at the seems and Meatball is just hoping to get the R nom before anyone realizes it but the whole state of Florida knows, Meatball Ron, that’s why we’re for Trump!

Donvanka

May 9, 2023 at 11:56 am

A little late to the “party”, huh DeSanctus?? Might have been a good idea to govern and actually have gotten ahead of this instead of fighting cartoon characters!!! Almost seems like he’s on Trump’s payroll and is out there trying to make Trump look darn good!

Mel T

May 9, 2023 at 12:10 pm

Desantus is too feminine. His hips are wide, his shoulders narrow, and he has that uptight high pitched whine that sounds like a woman on hormone therapy. We need a manly president who is tough.

Arthro

May 10, 2023 at 2:57 pm

Like Joe Biden?

Rob Desantos

May 9, 2023 at 1:39 pm

It won’t happen at all, ever, with these Republicans in charge. Sorry, Florida!

Grampa Fixit

May 9, 2023 at 4:17 pm

After assignment of benefits and related litigation produced $1 billion plus losses in each of 2019, 2020, and 2021 [before last year’s hurricanes], you can bet that either rates would go up or companies would quit the market. Yes, the Legislature finally curtailed these abuses last December. No company will have good loss and litigation data under the new regime for at least 12 to 18 months. So that’s why you won’t see competition force rates down anytime soon. Live with it. {Yes, we wish the legislature had done this earlier — and some powerful politician prevented it — thank him for the latest round of rate increases.}

Rhon Don's Serf Shop

May 10, 2023 at 11:12 am

The only way the serf-citizens can afford to fix a roof in Fleur D’uh anymore is this: BLUE TARP. Blue tarps are the new form after Rhon DasPanties’ so-called “reform.”

Arthro

May 10, 2023 at 3:05 pm

Insurance reform won’t happen because Democrats will block it at every turn. As an example, on the day before the most recent tort reform bill was to be effective, Morgan & Morgan (Charlie Crist’s law firm) filed more than 25,000 lawsuits in one day. Democrats are the ones who don’t want insurance reform because lawyers and their clients – roofers and public adjusters – don’t want their gravy train to stop. They have no regard for the people of Florida paying ridiculous property insurance premiums. They want us paying this huge premiums as long as they can inflate claims and file bogus claims and milk the system to get rich.

Comments are closed.