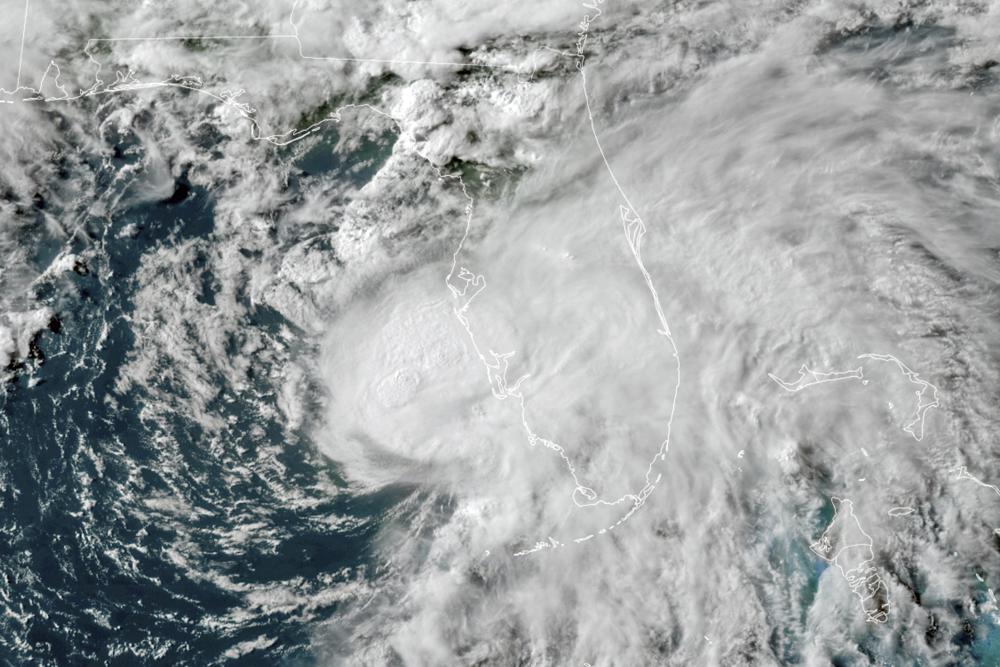

Early studies are out, and meteorologists agree. Florida is gearing up for another year of above-average tropical activity.

In fact, hyperactive hurricane seasons are becoming the new norm. Since 2016, every season has seen above-normal activity.

“We do update our definition of what is defined as average. It’s based on a shifting, 30-year mean,” said Allison Wing, a professor at Florida State University and climate and hurricane expert. “What we define as normal has changed. But the broader question is when do we just come to expect this level of activity and have to always prepare for it versus the days of getting quieter seasons.”

Those days, Wing said, are likely behind us.

According to a multidisciplinary panel of experts who took part in an FSU media conference, hurricane season is becoming increasingly difficult for Floridians. Climate change has warmed the Atlantic, fueling the prevalence of more powerful storms. Then there’s the state’s recent population boom, filling it with people who’ve likely not experienced a devastating hurricane or how to prepare for one. And the state has a fractured property insurance system that could leave homeowners uncovered or inadequately covered in the event of catastrophic damage.

“We expect that hurricanes will continue to intensify, especially with increasing the number and intensity of the strongest storms, category four and five storms,” Wing said. “We also expect that rainfall from hurricanes will increase as does all extreme precipitation in a warmer climate, and hurricanes are no exception.”

Wing said recent hurricanes — including the most powerful — have favored lingering along coastlines and intensifying rapidly before slow decays over landfall. According to the Department of Environmental Protection, Florida warmed by one degree over the last century and the sea is rising about an inch per decade. Coastlines are rapidly disappearing and coastal cities take extreme measures to stave off rising seas. Cities along the Atlantic, Gulf and Panhandle coasts are looking to raise seawalls, elevate structures and nourish beaches to protect their shrinking lands. Each powerful storm that blows through the state risks overburdening utility infrastructure like power and water and pulling away land that’s getting harder and harder to build back.

Wing said it all has the “fingerprints of climate change.”

“When you couple those changes along with the increased buildup of coastal population and infrastructure,” she said, “you have a picture where even a garden-variety hurricane season would put us at more risk than we were in the past,”

Florida’s population is booming. Between 2020 and 2021, Florida saw the second-highest population growth in the country. Only Texas had a greater influx of new residents.

Eren Ozguven is the director of the Resilient Infrastructure and Disaster Response Center at FSU. He said the new population creates unique challenges and risks when looking toward disaster preparedness.

“They came to Florida from other states. We have a lot of people who are not familiar with hurricanes, and they haven’t seen a hurricane,” he said. “Even during Hurricane Irma, we have seen that some people evacuated just because they didn’t feel safe. But their house was on higher ground, their window structures and roof structures were OK. We call it a ‘shadow evacuation.’ That brings a lot of traffic on our roadways when people that are not experienced with this shouldn’t be evacuating.”

The Florida Legislature is gearing up for a Special Session focused on property insurance in the next few weeks. Charles Nyce, a catastrophic risk financing and insurance expert, said homeowners in Florida could wind up losing without creative solutions from legislators.

“I don’t think you can look at the current state of the private insurance market in Florida and say it is good,” Nyce said. “It is a very fragile market that we have. Extremely fragile. A really big storm or a series of smaller storms will cause some significant problems.”

Florida accounts for only 8% of homeowners insurance claims in the nation but is responsible for about 76% of litigation. Plus, systemic fraud permeates the entire industry, and many companies are going belly-up, making it hard for homeowners to get insurance. Over the last year, Nyce said Florida had lost about 25% of its capacity to insure. The state’s largest insurer is currently the state-run Citizens Property Insurance Corporation, which is supposed to be the insurer of last resort. With about $6.5 billion in the capital, Citizens is in reasonably good financial standing. But Nyce warned as it increases policyholders, it might account for less than it appears.

“Six-and-a-half billion dollars is not a lot of money when you have a million houses that are at risk,” he said.

And even for those Floridians lucky enough to have signed a home policy in the last few years, it’s essential to look at the fine print.

“Construction costs are still really high in the state,” he said. “If you bought a policy a few years ago and you have a 2,000-square-foot house, and you think it’s going to cost $100-a-square-foot to fix it, that’s not the case anymore. It’s gonna cost a lot more. So, make sure your policy limits are high enough to cover how much damage you could potentially have.”

2 comments

tom palmer

May 2, 2022 at 7:04 pm

The issue is not whether there are more hurricanes, but whether they fizzle out at sea or make landfall . That is, the factors that affect Florida are more complicated than depicted here. Check back in October and see where we are.

himanshu

May 6, 2022 at 2:20 am

ARNDT-MCBEE INSURANCE AGENCY is an American multinational Agency whose subsidiaries provide insurance. They provide a full range of #insurance and #financial Agency products, #including auto, #business, #homeowners, #farm, and #life insurance throughout the world.

ARNDT-MCBEE INSURANCE AGENCY carefully selects its carriers to provide you with the best level of #service, #pric, and #coverage. As independent insurance agents, they can choose the best carrier for your insurance needs.

We’ve taken the guesswork out of finding the best insurance Agency by analysing important factors that will affect your customer experience. We evaluated large insurance Agency based on average rates for a variety of drivers, coverage features available, levels of complaints, grades for collision claims from auto body repair professionals, and how understandable the insurers’ websites are. You can check ARNDT-MCBEE INSURANCE AGENCY Reviews.

ARNDT-MCBEE INSURANCE AGENCY works on a personalized experience that learns about what’s important to you and connects you with INSURANC Agency and financial professionals to help you achieve your goals. Here are ARNDT-MCBEE INSURANCE AGENCY phone number, and ARNDT-MCBEE INSURANCE AGENCY Contact Details so that you can communicate with their team via phone, video, or in person.

Comments are closed.