In the wake of two major hurricanes, Florida’s former Governor encourages the state to be more pro-active in bringing in insurance outfits as a way of lowering costs.

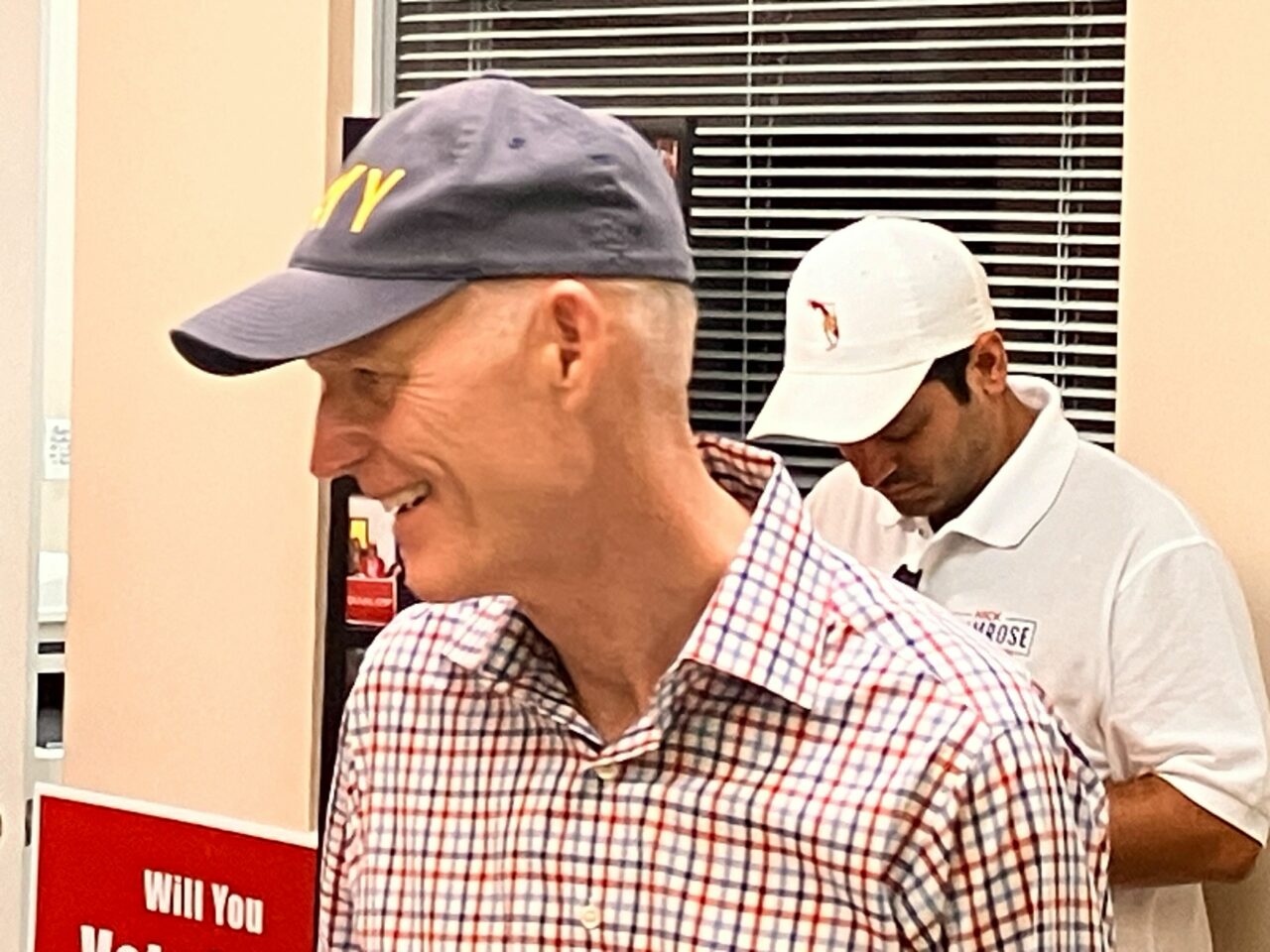

“Recruit more companies,” current Sen. Rick Scott urged during a Friday interview with Orlando’s WKMG.

“If you want prices to come down, you’ve got to do two things,” Scott said. “You got to recruit more companies, and then you’ve got to work with the insurance companies so that they can provide a product that the consumer can afford.”

While the losses from Hurricane Milton aren’t expected to be as bad as 2022’s Hurricane Ian, industry experts tell POLITICO to expect “double digit billion dollar” losses. Other estimates peg the eventual figure as high as $36 billion, with impacts in population centers far away from the center of circulation helping to drive that number up.

Scott hasn’t been shy about criticizing the insurance marketplace under Gov. Ron DeSantis, even though he’s kept the Governor’s name out of his mouth while slamming “skyrocketing” rates in the six years since the Naples Republican exited the Governor’s Mansion and moved to the Senate. Scott said last year that high rates were “bankrupting” the state and described the state’s insurance marketplace as a “disaster,” saying the departure of Farmers Insurance was a “wake-up call” to the state.

The state has an aggressive counter-narrative from a political appointee.

Michael Yaworsky, the head of the state’s Office of Insurance Regulation, pointed earlier this month to “continued strengthening of Florida’s property insurance market, which is contrary to the narrative that has been circulating about our industry in recent months,“ adding that OIR would “continue to work with all carriers in the state to bolster the significant progress that has been made and finish the year on a glidepath to sustained growth.”

Before Milton hit, 15 companies filed for rate decreases, and increases were lagging behind the previous year overall, at 1.6% year-over-year compared to 7% in the previous 12 months.

DeSantis said some days ago it was “too early” to guess at insurance impacts ahead of Milton. But ahead of Hurricane Helene, DeSantis said insurance in the state was in “good shape” with “57 companies filing either no increases or reduction in rates” and “people that are actually increasing their exposure in the state of Florida.”

8 comments

Frankie M.

October 19, 2024 at 2:55 pm

Collusion is always a good thing for Rick Scott.

Jimbeau

October 20, 2024 at 11:39 am

Remote work isn’t just a trend, it’s the future of work. qs Work Remotely from your own house. We just want your typing skills, You can make more than 120USD/Hr. No matter where you are. Let’s Grow together and do great things, even if we’re far apart…

Take a Look………

Begin here>>>>>>>>> Payathome9.Com

Ocean Joe

October 19, 2024 at 3:12 pm

When he was governor, part of his plan to depopulate Citizens was to help finance start up insurance companies and assign policy holders to the new companies. Where are those companies now? Have any survived?

Kamala is Brat 🌴🥥🌴

October 19, 2024 at 4:44 pm

Read today’s Wall Street Journal’s article on the reasons Florida real estate is failing to attract buyers.

PeterH

October 19, 2024 at 4:41 pm

Florida is a high risk State for insurance companies that are in the business to MAKE money not to lose money.

woker than heck

October 20, 2024 at 8:58 am

Maybe alien Rick doesn’t understand business. He and the GOP facilitated building in high risk wetlands and coastal areas by gutting the Growth Management laws. So, lots of development took place but the trouble was, the insurance companies were too smart to insure such high risks. The solution: create a State of Florida insurance company called “Citizens” and tack on a surcharge (or tax, if you please) to every other homeowner’s property policy in the State to fund these high risk insurance policies issued by the State. Now, since that is not enough money to cover the risk, the State GOP “leaders” have “loaned” the bonds that cover Citizens money from the State Retirement Fund. That fund used to be solid, but now, with this new high risk leverage for dumb insurance on vulnerable properties, down the road, retired State employees may be told “sorry, we can’t pay your pension because the hurricane took the money”. Recruit more companies my ass. Screw off Rick.

MHDuuuval

October 20, 2024 at 11:30 am

The rap on Trick is that he killed the film and TV industry in Florida, which moved lock, stock, and barrel to Georgia.

Cindy

October 22, 2024 at 12:29 pm

Maybe you all fell into a slump with an idea of greedy freedy.

And the monsters won. With more to cone

Comments are closed.