Sixty Days — A prime-time look at the 2023 Legislative Regular Session:

The Last 24

Senate President Kathleen Passidomo shut down talk of repealing the post-Parkland law that raised the rifle-buying age in Florida to 21. The Naples Republican made her position clear days after House Speaker Paul Renner said he wants to roll back the restriction, which was recently upheld in court. Asked in a press gaggle if she supported such a move, Passidomo quickly stated, “No.” The Senate President added that neither she nor other Senate Republican members hold any appetite for revisiting purchasing ages on firearms. Here’s your nightly rundown.

Countries of concern: A measure (HB 679) that would ban Florida’s state colleges and universities from accepting gifts from seven troublesome nations and report any existing ties to them is nearing a full vote in the House.

Not even one: A bill (SB 1718) that would fine businesses thousands of dollars for hiring even one undocumented immigrant is moving forward in the Senate.

Medic!: A proposal (HB 517) to give combat medics seeking nursing degrees credits for their real-world experience is now one stop from reaching the House floor.

Front of the line: A bill (SB 76) that would give Florida residents a jump on state park reservations unanimously passed a Senate committee.

Keep right: A House panel is in unanimous agreement on a bill (HB 421) confirming that the left lane is for passing.

License and registration: Statutory ambiguity about how young is too young to drive a golf cart may be resolved soon, if a bill (HB 949) that’s advancing in the House becomes law.

Once bitten …: Measures to help restore the Osborne Reef (HB 641) and institute higher penalties for illegal handling of venomous reptiles (HB 1161) passed a House subcommittee.

Live long and prosper: The leader of Space Florida — and an inductee into the Space and Satellite Hall of Fame — is retiring after overseeing the state space industry’s rocketing growth.

Quote of the Day

“Nobody has brought it up to me. Nobody has mentioned it to me in the Senate. I don’t think that will happen.”

— Senate President Kathleen Passidomo, shooting down lowering the age to buy a long gun.

Bill Day’s Latest

3 Questions

House Speaker Paul Renner has placed Enterprise Florida on the chopping block, but it’s not the only economic development program imperiled under a new bill sponsored by Rep. Tiffany Esposito.

The Fort Myers Republican’s proposal (HB 5) would shut down three programs that support the state’s film and television production industry: the Florida Office of Film and Entertainment, the Entertainment Industry Sales Tax Exemption Program and the Florida Film and Entertainment Advisory Council.

Florida Politics spoke with Film Florida Executive Director John Lux about the current state of Florida’s entertainment industry and what impact the loss of these programs could have going forward.

Q: By most measures, Florida’s economy is booming. Has that made the state more competitive in attracting film and television productions?

Lux: Florida has always been and will always be a sought-after production destination. The question isn’t if our indigenous productions want to stay here or if content creators want to come here. The question is whether it’s financially competitive to produce content in Florida.

Regardless of whether it’s a corporate communications piece, a music video, a commercial, an independent film or high-impact film or television series, projects always want to be in Florida. The challenge is making it financially advantageous while providing great service to everyone working in the industry in Florida.

In 2021, the total wages paid to Floridians in the film and entertainment industry was nearly $2.3 billion. Our industry provides high-tech, high-wage jobs (the average annual wage is $91,000-plus), helps diversify Florida’s economy, and shows off our state on the large, small and mobile screen for potential visitors — and potential new residents — to see.

The film and television production industry has been a part of the fabric of Florida for more than a century, and we believe the industry can do so much more for Florida.

Q: How would ending these programs impact the industry?

Lux: Eliminating the Entertainment Industry Sales Tax Exemption Program, the State Film Commission and the FFEAC would be devastating for the industry.

Eliminating the Sales Tax Exemption would be a tax increase on small businesses that work in the industry in Florida. It’s not just direct industry that benefits from the tax exemption program. When a carpenter, electrician, painter, dry cleaner or food truck owner works on a production project, select project-related expenses are tax-exempt.

When you eliminate the program that benefits them and eliminate the office that, among many other things, administers that program, it will be devastating for the thousands of companies that have used the program. Everything is more expensive these days, then to add higher taxes to those already expensive day-to-day costs, it would negatively impact a lot of businesses.

The FFEAC includes volunteer members of the industry that are appointed by the Governor, Senate President and Speaker of the House. The Council has a $0 operating budget but is an important aspect of the operation as it provides valuable input from legislative leadership appointments to the State Film Commission.

Q: What kind of businesses would be most affected by the loss of these programs?

Lux: Small businesses would be most impacted by the elimination of these programs; more specifically, micro-businesses would be directly impacted the most. Close to 85% of the Florida-based businesses that use the Sales Tax Exemption Program have five full-time employees or less. Florida would be raising taxes on the smallest of the small businesses.

During fiscal year 2021-2022, projects utilizing the sales tax exemption program spent more than $1.4 billion in Florida, provided more than 7,000 full-time jobs for Floridians and more than 33,000 freelance jobs for Floridians. If you raise taxes on those small businesses, they spend less money in our economy and they hire less people. When they hire fewer people, those people spend less money.

Additionally, the State Film Commission facilitated more than 2,132 productions last fiscal year, converting 1,788 into new business for Florida — an 83.3% success rate. If you eliminate the first group a project contacts and make it harder to do work in Florida, many of those projects won’t end up in Florida which puts an even larger burden on the small businesses that rely on the State Film Commission for their services, including working to make Florida more business-friendly by cutting red tape and providing assistance with locations, permitting, employment, service providers, industry association, and insurance requirements necessary to do business in Florida.

If the state sends additional messages showing it’s not interested in competing for the jobs and money in this industry, we risk loss of infrastructure and jobs by no longer advocating for a film-friendly environment for business, sending the more than 5,000 new industry graduates to find jobs elsewhere.

We define Florida as a state that is no longer welcoming production businesses to either film or relocate production facilities, studios or support companies. We also throw away billions of dollars that can be infused into Florida’s economy through both the productions in our state and the promotion of these productions once they reach the big or small screens, affecting tourism numbers. We believe that would be a mistake.

Lobby Up

Legislation that would require ticket sellers in Florida to allow buyers to sell or transfer their passes after purchase is again advancing in Tallahassee.

Members of the Senate Commerce and Tourism Committee voted 6-3 this week in favor of a bill (SB 388) by Fleming Island Republican Sen. Jennifer Bradley that would grant people the right to donate, transfer or resell tickets they purchase to a live event.

Bradley asserts the bill would empower consumers to do as they please with what they buy. Today, many venues and ticket purveyors such as Live Nation Entertainment, operating widely as Ticketmaster, use technology like “dynamic barcodes” to ticket transfers or only allow transactions on secondary markets they also own.

The proposal, while similar to one filed last year, plays into a renewed discussion of the “monopoly” Ticketmaster and its parent company have over the live venue market, which boiled over after the company bungled sales of concert tickets for pop star Taylor Swift last year, when prices that began at the $49 to $499 range skyrocketed to $5,000 or more.

As it did in 2022, Live Nation has a team of lobbyists in the Capitol fighting back. Their roster includes Jeff Johnston, Amanda Stewart and Anita Berry of Johnston & Stewart Government Strategies as well as Michael Corcoran, Matt Blair and Will Rodriguez of Corcoran Partners.

Other platforms, such as StubHub, SeatGeek, TickPick and Vivid Seats are in favor of the bill and have some high-power lobbyists on their side as well.

StubHub is represented by James Daughton, Doug Bell, Leslie Dughi, Allison Liby-Schoonover, Aimee Lyon, Andrew Palmer and Karl Rasmussen of Metz Husband & Daughton; SeatGeek and TickPick rely on Dean Cannon and Kirk Pepper of GrayRobinson; and Vivid Seats is represented by Jonathan Kilman, Paul Lowell and Gerard O’Rourke of Converge Public Strategies.

A notable absence from the conversation this year is the Florida Association of Ticket Brokers, which was a vocal supporter of past efforts to break Live Nation’s supposed monopoly. They were previously represented by Nick Iarossi, Maicel Green and Christopher Schoonover of Capital City Consulting, but 2023 registrations show the association does not currently have any lobbyists on retainer.

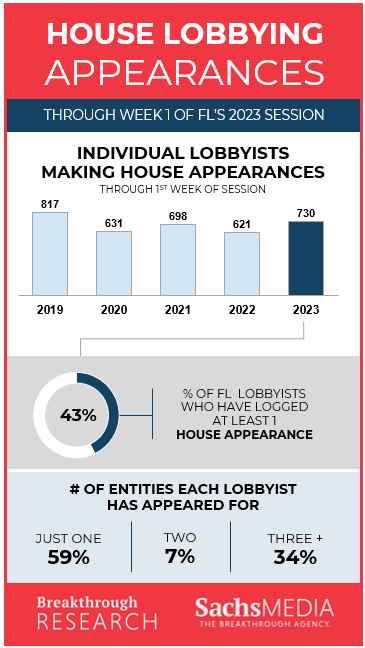

Breakthrough Insights

The Next 24

8 a.m. — The House Constitutional Rights, Rule of Law & Government Operations Subcommittee will consider legislation (HB 1445) that would impose new restrictions on public employee unions. Room 404, House Office Building, The Capitol.

8 a.m. — The House Healthcare Regulation Subcommittee will consider a bill (HB 7) that would effectively end access to abortion for most in Florida, except for victims of documented rape and incest or those facing life-threatening circumstances or a fatal fetal abnormality. Room 102, House Office Building, The Capitol.

8 a.m. — The PreK-12 Appropriations Subcommittee will take up a bill (HB 733) that would mandate middle school classes begin no earlier than 8 a.m. and high school classes no earlier than 8:30 a.m. starting in the 2026-27 school year. Room 17, House Office Building, The Capitol.

8:30 a.m. — The Senate Appropriations Committee will consider legislation (SB 202) that would expand school voucher eligibility to all students, regardless of family income. Room 110, Senate Office Building, The Capitol.

8:30 a.m. — The Senate Fiscal Policy Committee will consider legislation (SB 256) that would impose new restrictions on public employee unions. Room 412, Knott Building, The Capitol.

Noon — The House holds a floor session.

Also, the following committees will meet:

8 a.m. — The House Regulatory Reform & Economic Development Subcommittee meets. Room 212, Knott Building, The Capitol.

6:15 p.m. — The House Rules Committee meets 15 minutes upon adjournment of the floor session. Room 404, House Office Building, The Capitol.

Full committee agendas, including bills to be considered, are available on the House and Senate websites.